Now, dear reader, gather close and listen: for the week in Bitcoin spot ETFs has wobbled more than Ivan Ivanovich’s mustache during a sneeze. Incomes, outgoes, more drama than a provincial theater—thank the financial gods for easily panicked investors! 🪙💼

It all seemed lost—macroeconomic omens, Fed meetings looming, and financiers clutching their hats in terror. But lo! Just as Nikolai Petrovich might reconsider that third cabbage roll, the US Federal Reserve elected to do precisely nothing—left interest rates as unmoved as Aunt Praskovya during a family quarrel. Instantly, the market was swept up by a new gust of optimism, as if a cold samovar suddenly started boiling unbidden.

Bitcoin ETFs Flip Like Blini on Monday Morning

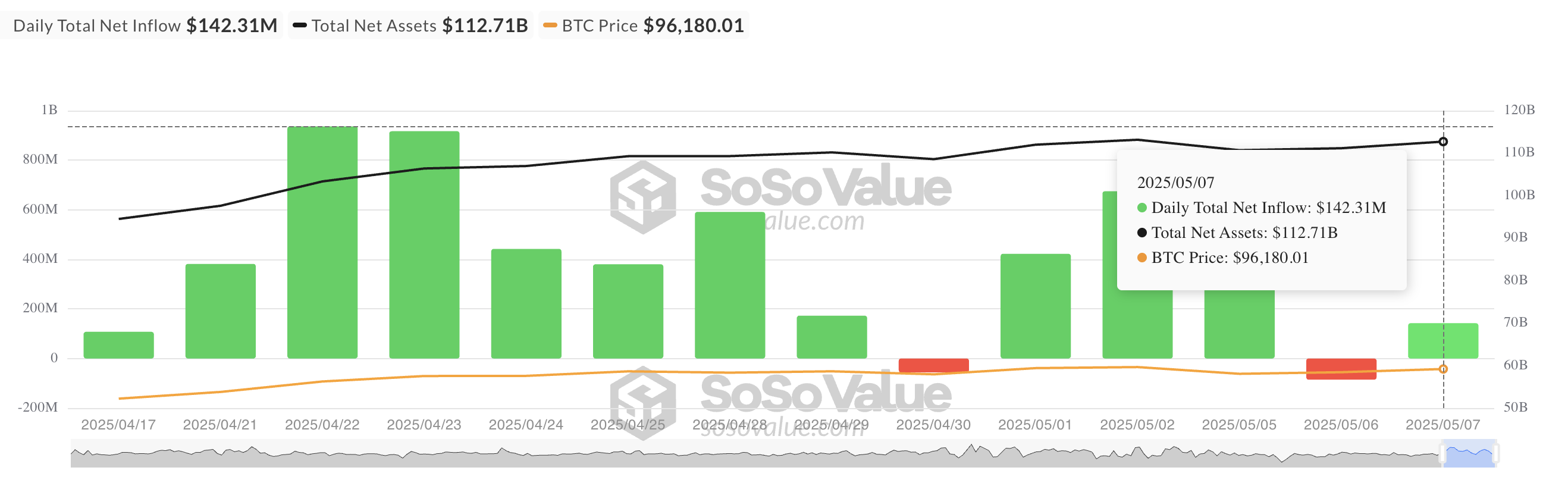

The week began with as much gusto and clamor as a wedding feast: On Monday, investors threw $425.45 million into Bitcoin spot ETFs. But on Tuesday, smelling the sour borscht of uncertainty ahead of the infamous FOMC meeting, those same investors rushed for the exit, snatching away $85.64 million, presumably to buy more fashionable boots or perhaps—heaven forbid—government bonds.

Came Wednesday, and ah! The Fed lovingly cradled interest rates as if they were the last pierogi at supper. Investors, relieved that the sky hadn’t fallen (this time), came stampeding back, bringing $142.31 million to the crypto banquet. What a sight! If only Gogol’s townsfolk had such lively coffers.

On the seventh of May, Ark Invest and 21Shares’ ARKB performed a solo on the financial balalaika, notching a single-day inflow of $57.73 million—enough to make even a state auditor dizzy, and pushing its total inflows to a majestic $2.68 billion. Fidelity’s FBTC, ever the competitive cousin, slid onto the scene with $39.92 million, licking its historical net inflows at a vulgar $11.64 billion.

One could almost imagine a municipal clerk leaning in to whisper: Not a single fund recorded an outflow on Wednesday, according to the mysterious SosoValue (whose name, no doubt, inspires as much confidence as Dr. Zinoviev’s Miracle Liniment).

Options and Futures: The Market’s Masquerade Ball

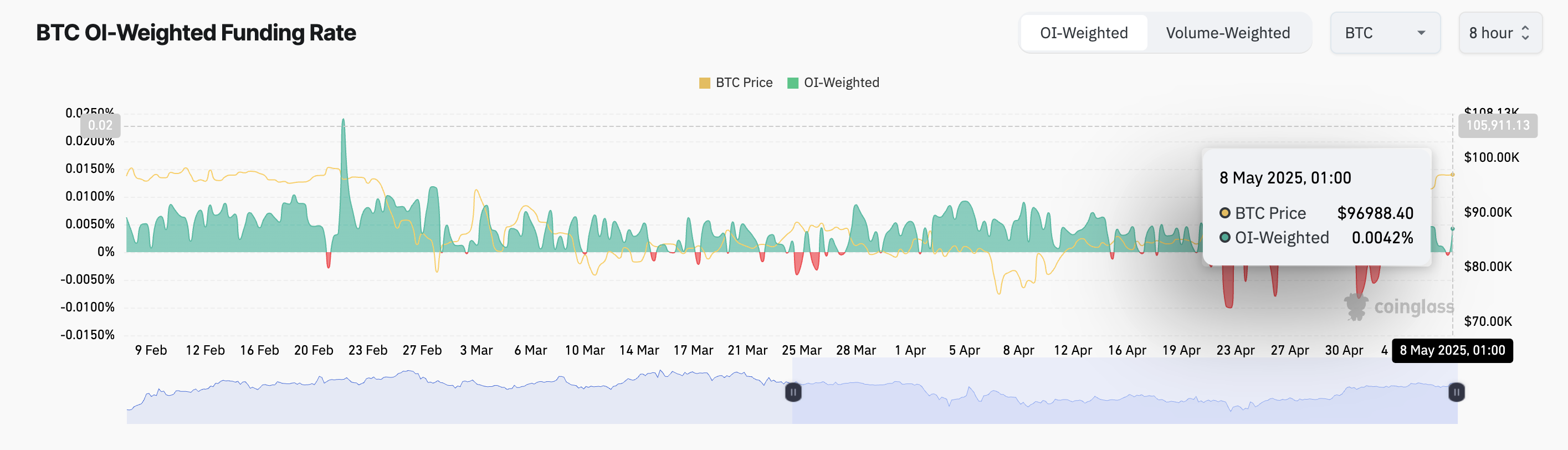

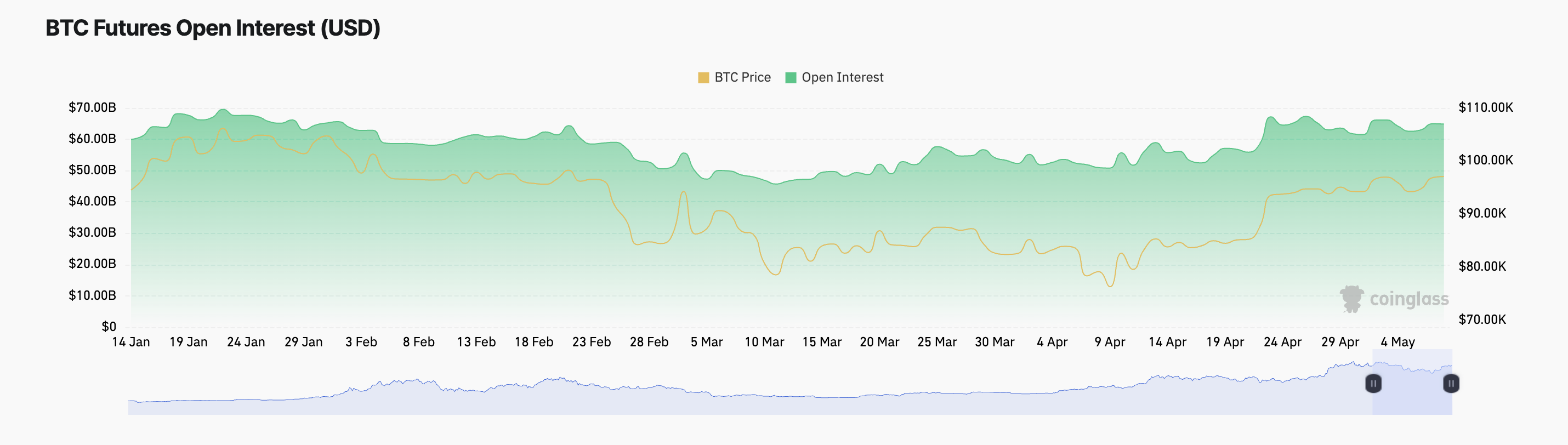

The fever of optimism leapt straight into the options and futures salons. Bitcoin, saucy as ever, sashayed up by 2% in the last 24 hours, now swapping hands at a vainglorious $98,888—just the sort of price to make a penny-pinching landowner faint on the chaise. Long positions abound, funding rates gleam positivist at 0.0042%, and the market is as bullish as a herd of provincial cows let loose by the river in May. 🐄

Funding rate, you ask? Why, it’s the ritualistic tax the longs pay the shorts to keep prices aligned with the earthly reality—an elegant ballet of fees and egos. And again, let us not pretend: while exuberance rages, the open interest in BTC futures slipped by a meager 0.18%. Some traders, perhaps fearing their luck would turn to turnips, quietly closed shop and pocketed their gains. 🍠

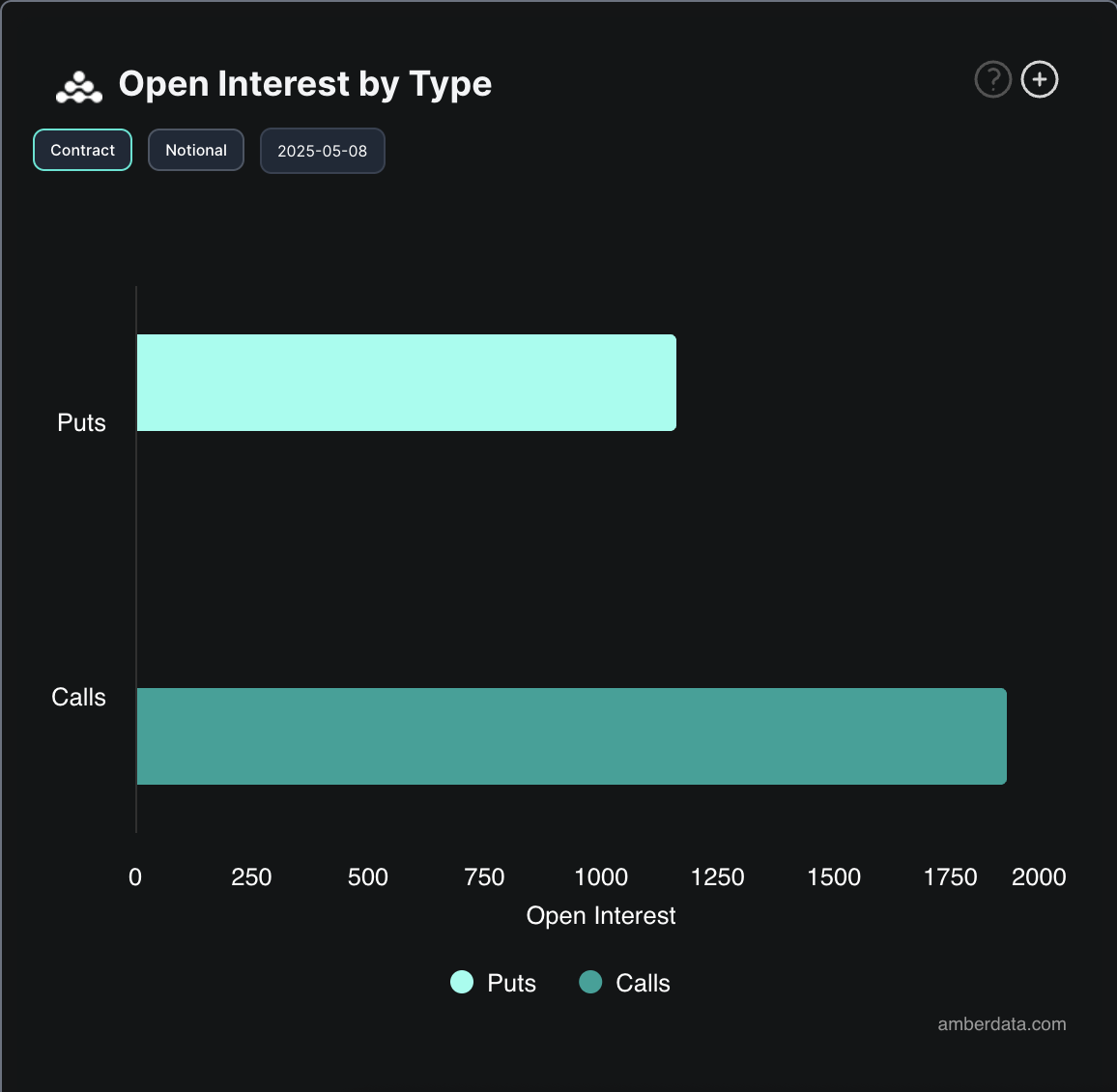

Options traders, meanwhile, have caught the bullish disease—the kind that makes one crave call options with the tenderness of a lovesick bureaucrat. Demand for calls now dwarfs puts, with traders lining up for the next miraculous Bitcoin ascension. It’s a contagion of optimism, spreading faster than rumors in a government office.

So, dear reader, as the players scurry about with their options and futures—watch, be amused, and, if so inclined, toast the ponderous inaction of the Federal Reserve, which has managed (by doing nothing at all!) to set this whole grand comedy in motion. 🥂

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-05-08 11:33