A nervousness has settled over Wall Street, not as a tempest but as a fog that clings to the collar and refuses to loosen. The S&P 500, that gaunt figure in a pinstripe suit, loiters near the edge of a precipice, its gait heavy with the weight of a few swollen stocks. The air hums with the dissonant chords of inflated valuations and the distant, arrhythmic thud of history repeating itself-2018’s tremor, 2022’s collapse, now shadowed by the specter of 2026.

The midterm election year looms like a bureaucratic form with missing fields. Political tides, inflationary whispers, and interest rates-these are the inkblots in a ledger that no one dares interpret. Yet the pattern persists: a rise in prices, a tightening of monetary noose, and the markets’ inevitable unraveling. The Federal Reserve, that inscrutable entity with a thousand doors and no windows, has long been the custodian of this paradox. But now, as its stewardship teeters on the edge of a calendar page, the system begins to creak.

Jerome Powell’s Term Is Up in May

Jerome Powell, that enigmatic figure whose name is etched into the annals of economic policy, will soon depart from his post. His tenure-a decade of turbulence, pandemics, and inflationary spikes-has been a study in bureaucratic endurance. Renominated by two administrations, he has navigated the labyrinth of political pressure with a quiet resolve, as though the Fed were a cathedral and he its custodian, sweeping dust from the pews while the congregation argues over the stained glass.

Yet even the most steadfast custodians are not immune to the caprices of power. President Trump, that relentless petitioner at the gates of economic orthodoxy, has long viewed Powell as a recalcitrant clerk in a department he did not establish. In 2018, when the Fed tightened its grip on interest rates, Trump’s frustration bubbled like a kettle on a stove. “I’m not even a little bit happy,” he declared, a phrase that now hangs in the air like a bureaucratic memo no one dares to file.

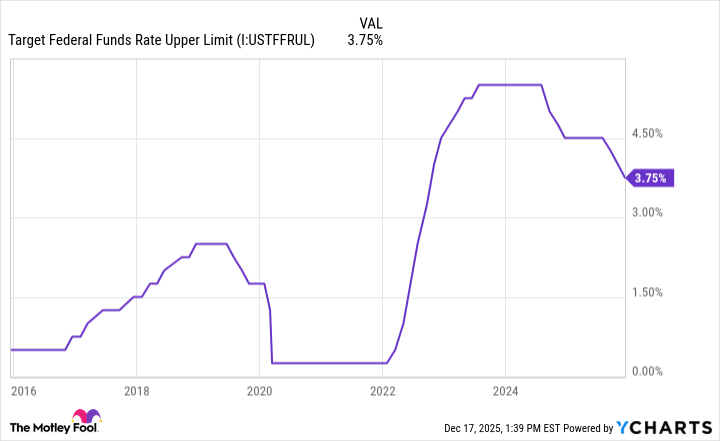

The 2022 inflationary surge, that tempest in a teacup, saw the Fed raise rates with the urgency of a clockwork mechanism. But when the dust settled, the system reset itself, and the markets, ever the obedient automata, resumed their dance. Now, with Powell’s term expiring in May 2026, the machinery of succession begins to whirr. And the question is no longer whether the Fed will act, but who will pull the levers-and to what end.

Trump’s demands for rate cuts, delivered with the fervor of a man shouting into a void, have already begun to unsettle the delicate equilibrium. Last week’s quarter-point reduction to 3.75% was met with a shrug from the markets, as if they had expected nothing less. But Trump, that relentless reviser of economic scripture, insists the cuts should have been “at least doubled.” His words, like ink spilled on parchment, leave no room for interpretation.

Why the Fed Chair’s Independence Matters

If the new Fed Chair is to be a mere echo of the President’s whims, the system will begin to fray. History offers a cautionary tale: in the 1960s and 1970s, Presidents Johnson and Nixon pressed their central bankers to keep rates low, a policy that sowed the seeds of inflationary chaos. The result was a bear market so prolonged it became a monument to folly-a testament to the dangers of conflating political ambition with economic prudence.

The 1970s, that decade of creeping inflation and market paralysis, was not a failure of policy but a failure of independence. The Fed, reduced to a bureaucratic puppet, allowed the economy to spiral into a state of perpetual unease. Now, as the calendar turns toward 2026, the same specter looms-a Fed Chair who may prioritize political harmony over economic rigor, and the markets, like a clock with its gears misaligned, will suffer the consequences.

Who Will Trump Appoint? And Will They Be Independent?

Two names circulate in the corridors of power: Kevin Warsh and Kevin Hassett. Both are figures of bureaucratic pedigree, yet their allegiances hang in the balance like documents awaiting signatures. Hassett, currently ensconced in the White House, has already demonstrated a proclivity for aligning his rhetoric with the Administration’s drumbeat. When asked if the President’s influence would sway Fed decisions, Hassett offered a reply as hollow as a bureaucratic form: “No, he would have no weight… unless it’s based on data.” A mantra, perhaps, but one that rings with the dissonance of a system in denial.

What to Watch for in 2026

Investors, those unwitting participants in this bureaucratic farce, must now observe the Fed with the vigilance of a prisoner watching the warden’s key turn in the lock. The new Chair’s press conferences will be rituals of obfuscation, their words dissected for clues in a code that no one truly understands. But the true test will come when the data arrives-when inflation stubbornly clings to the 2% target and the Fed’s Open Market Committee chooses to ignore it. At that moment, the system will reveal its true nature: a machine that, once set in motion, cannot be stopped.

And so the markets await, like a man standing before a door that may or may not open. The future is written in the ink of policy, but the hand that holds the pen is trembling. 👻

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-12-19 14:08