Ah, the day of reckoning is almost upon us. As the Federal Reserve gears up for its grand performance, traders on prediction markets are practically winking at the crowd, convinced that a quarter-point rate cut is in the cards. It seems Jerome Powell and his merry band of economic wizards might just hand the markets the double shot of espresso they’ve been clamoring for-especially if this cut isn’t the last. With crypto and U.S. equities poised for a raucous good time, the stage is set for a spectacular display of liquidity in 2025. ☕️💰

Markets Bet Big on Fed Rate Cut

It’s a tale as old as time-markets full of hope, traders with their fingers crossed, and the Federal Reserve, like a rather large, influential magician, about to make interest rates… disappear. The consensus on this fine Tuesday? A rate cut in 2025 seems inevitable, and it’s about time, too! Investors are already imagining dollar bills (or should we say crypto coins?) raining down on them as fresh liquidity dances its way through Wall Street, causing both crypto and equities to boogie along in unison. 💃🕺

At 12 p.m. Eastern time on Tuesday, Polymarket traders are all but throwing confetti in the air, pricing a 25 basis point (bps) rate cut at a dazzling 98%. This bet has already pulled in a grand $191.3 million, with the long shots-no change or a dramatic 50-bps chop-limping along at an almost comical 1%. 🎉

Kalshi traders, not to be outdone, are also pegging a 25-bps cut at 98% odds, after their wagers topped a cool $25.8 million. Seems like no one’s betting against Powell and his scissors this time. Thomas Perfumo, Kraken’s global economist, was caught in a rather jovial mood, noting that the crypto market’s wild swings are largely dictated by the big-picture economic backdrop. Because who doesn’t love a bit of macroeconomic drama, right? 🎭

Perfumo cheekily pointed out:

“A 25bps cut at this week’s FOMC meeting appears highly probable and the market is pricing in one additional cut at the Fed’s December meeting. Nonetheless, the October 10 sell-off underscored that crypto and broader risk assets remain exposed to exogenous shocks.”

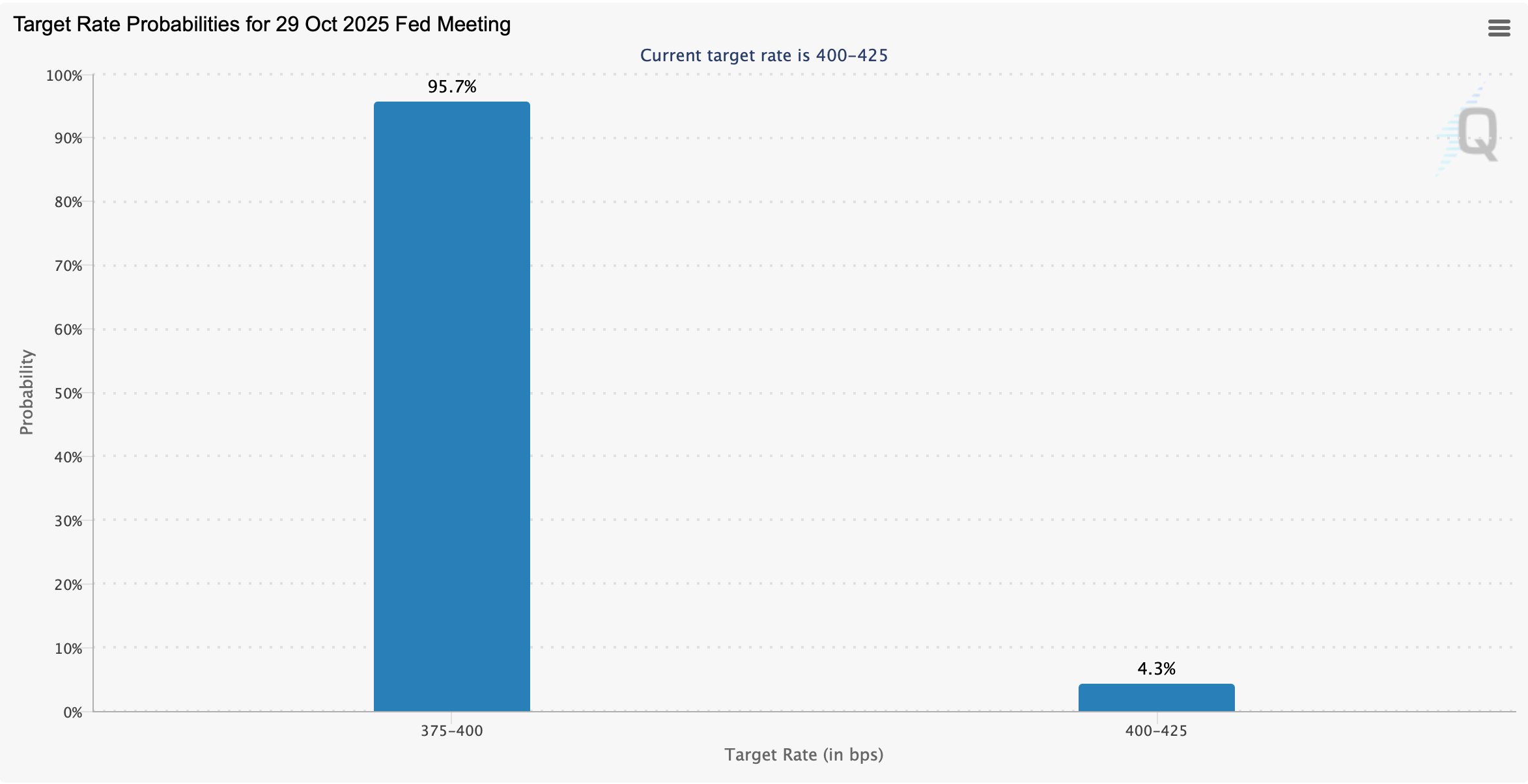

As if to chime in, CME’s Fedwatch tool jumped on the bandwagon, pegging the odds of a quarter-point trim at 95.7% as of 12:30 p.m. Eastern time on Oct. 28. The tool, a delightful bit of number-crunching wizardry, reveals that nearly everyone is betting on a smooth, understated trim, rather than some shocking revelation. Though, there’s still a paltry 4.3% chance that the Fed will choose to hold steady. Could we possibly be in for a plot twist? Stay tuned. 📉✨

At this point, Powell might as well bring his own scissors to the meeting-he’s practically cutting ribbons with how much confidence traders have in this rate move. With billions in bets riding on a 25-bps trim, it’s safe to say crypto and equities are already pre-celebrating. Whether this marks the calm before the next rally or yet another teaser, one thing’s for sure-Wall Street is ready to pop the champagne for what’s about to come: cheaper money and a splash of drama. 🥂🍾

FAQ 💬

- What are prediction markets saying about the Fed meeting?

Prediction markets like Polymarket and Kalshi are giving a 98% chance of a 25-basis-point rate cut. Oh, and they’re positively giddy about it. 😏 - How much money has been wagered on the Fed rate decision?

Over $191 million in bets have been placed across major prediction platforms. Not a bad way to spend your lunch money. 💸 - What does CME’s FedWatch tool indicate?

CME’s FedWatch tool shows a 95.7% probability of a quarter-point cut and a 4.3% chance of no change. Either way, it’s going to be a show. 🎬 - How could a Fed rate cut affect crypto and stocks?

Analysts expect lower rates to boost liquidity, potentially lifting both bitcoin and U.S. equities. Get your party hats ready. 🎉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Netflix Co-CEO Ted Sarandos Urges DC to Expand TV Projects Like ‘The Penguin’ After Warner Bros. Acquisition

2025-10-28 20:40