Bitcoin sits there like a stubborn mule, refusing to budge above $107,000. Call it a “supply overhang” or just plain old Wall Street foot-dragging—fact is, she’s going nowhere fast. 🚧

All eyes (and two or three glass eyes from last cycle’s traders) squint toward the US Federal Open Market Committee’s upcoming shindig on June 17 and 18. Folks are hoping they’ll either drop the rates or let us know what the heck’s coming next. Hope springs eternal for gamblers and crypto degens alike.

Waiting for the Fed: Bitcoin Just Takes a Nap Under $107,000

Tomorrow’s FOMC decision looms larger than an elephant at a tea party, especially after May’s inflation numbers poked their nose up for the first time since February. BeInCrypto, probably sipping sweet tea, reported the uptick like it was spotting Haley’s Comet.

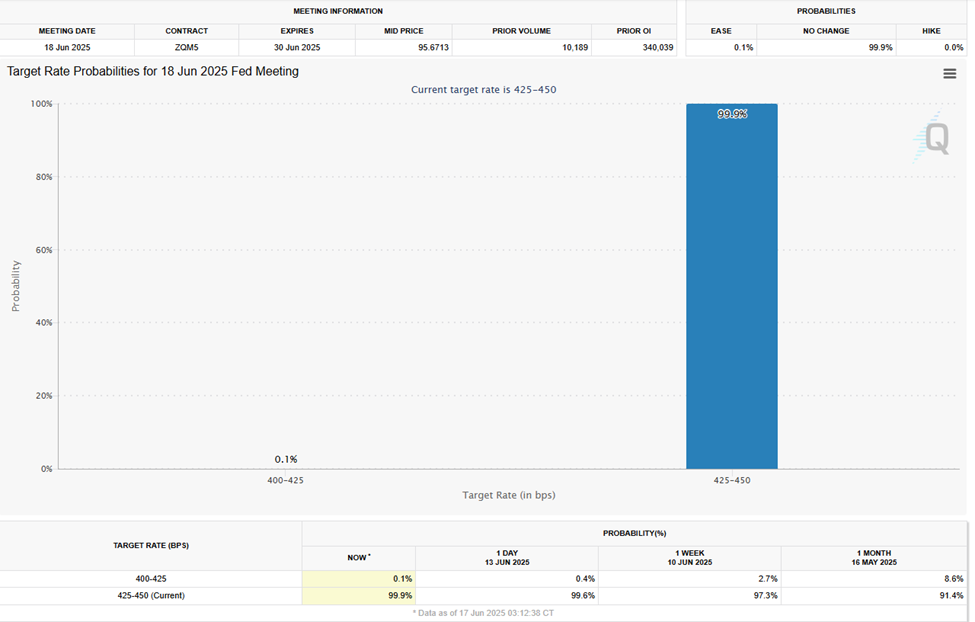

The CME FedWatch Tool’s flashing its lights and hollerin’ that “no interest rate cut is coming.” Betting odds show more certainty than grandma’s biscuit recipe.

With rates set like old habits, folks are whispering about the Supplementary Leverage Ratio (SLR) instead—a real crowd-pleaser if you like your regulation dry as prairie dust.

“Bitcoin tried jumping this $108K fence and landed flat on its rear. No clean break above, so keep your hats on and your horses hitched. Still stuck in the same range, partner,” reported Daan Crypto Trades, who probably talks to his charts more than people.

Odds say the Fed’s rate will stand still, as firm as a Missouri mule: 98% chance for June, 84% for July. But some sharp-eyed analysts are poking around in what isn’t being hollered from the rooftops.

“No rate cut this week—sure, sure. But everyone’s missing the SLR parade; that’s where the juice is,” quipped Quinten, probably while buying beans and ammo.

The SLR—sounds fancier than it is—just keeps banks from acting like riverboats loaded with too much cargo. If they loosen it, banks can gobble up more debt, spitting fresh liquidity into the markets without all the hullabaloo of Quantitative Easing. In other words: more money sloshing around (maybe enough to float your cousin’s altcoin, maybe not).

Who Cares About Rates? SLR’s the Mystery Sauce Nobody Tastes

Turn the SLR screw and banks might just start acting a little less like morticians and a little more like poker players, throwing chips (liquidity) back onto the table without printing more funny money.

Meanwhile, nobody can agree if rates should be up, down, or gently swaying in the breeze. Powell, with the calm of a fellow resisting Aunt Polly’s lemonade recipe suggestions, is keeping his lips zipped tighter than a cowpoke’s coin purse—despite President Trump’s hollering from the White House porch.

“The US’ll be late with rate cuts. But the minute they start hacking ‘em down, crypto’s gonna blast off like a roman candle,” said Mister Crypto, whose optimism is only matched by his collection of velvet Elvis paintings.

Chamath Palihapitiya, never one to let an opportunity for a good podcast slip by, reminds us it’s all politics, not numbers. If rate cuts were as sensible as shoes at a river crossing, we’d already have ‘em.

“If the math’s there, and it helps the country, and everyone wins—even the gophers—why ain’t you doing it? Because: politics. Simple as a fly in the buttermilk,” Chamath said, tugging at invisible suspenders.

Trump, never missing a shot at turning things up to eleven, reckons the Fed should cut by a full point. That’d drop the nation’s debt load by $300 billion, spark up the GDP, and make everyone happier—unless you enjoy inflation, in which case, congrats!

Donald J. Trump Truth Social 06.11.25 09:54 AM EST

CPI JUST OUT. GREAT NUMBERS! FED SHOULD LOWER ONE FULL POINT. WOULD PAY MUCH LESS INTEREST ON DEBT COMING DUE. SO IMPORTANT!!!

— Commentary Donald J. Trump Posts From Truth Social (@TrumpDailyPosts) June 11, 2025

The Fed meeting? Probably more scripted than a Punch and Judy show, but don’t sleep through Powell’s press conference—that’s when markets might actually dance or just trip over their own boots. A word from Jerome and the whole thing could go stampede or slumber party.

“The real kicker ain’t just the rate cut or no cut. It’s Powell’s performance after, like waiting to see if the town mayor’s been dipping in the jam jar. If Middle East drama moves quick before the Fed meeting, maybe they offer a hint, QE ends, rates could fall, bulls run. If not—well, markets might just slide into the mud,” wrote Cipher X, sounding like someone who enjoys watching trainwrecks in slow motion.

Marty Party, who either analyzes markets or runs a bluegrass band on weekends, thinks the GENIUS Act plus the FOMC decision means Bitcoin could break out any minute—if you squint, cross your fingers, and ignore the laws of gravity.

“Wyckoff accumulation almost done—about to enter markup phase. GENIUS Act or FOMC will be the spark,” Marty Party muttered, stacking beans for winter.

Wyckoff’s cycle is simple: accumulate, markup, get rich, buy a boat, lose it all, reminisce. If the stars—plus two pieces of regulation—line up, Bitcoin could rocket like Huck Finn escaping Aunt Sally’s Sunday service. 🚀

This is the time when prices stretch their legs, buying pressure builds, and everyone but your dentist tries to call the next top.

Bitcoin Price: Waiting on the Fed Like a Cat at the Screen Doorn

As of writing, Bitcoin’s doing the Texas two-step at $106,700. There’s a juicy demand zone between $101,461 and $105,923—a good spot for buyers to jump in unless they’ve all gone fishing. Volume profiles show the greenhorns are ready to pounce if prices drop a lick farther.

Bullish cross-your-fingers scenario: we retest $109,242–$111,634, and if Bitcoin closes above $110,478 on the daily, it could set new records, bring on champagne, and clog Twitter for weeks.

But—and there’s always one of those—if price trips and drops below $103,529, support might fall through like a screen door after a tornado, and red nodes (the bears)’ll be waiting to pounce (or gloat).

In short, with macro fears and technical jitters mounting, traders are huddled up, staring at the Fed and SLR, hoping the next round of news won’t make them look like they misplaced their fishing poles again. 😅

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-06-17 14:07