As a seasoned researcher with years of experience in financial regulation and digital assets, I have to admit that I find myself both intrigued and disheartened by the ongoing issue of illegal cryptocurrency advertisements in the United Kingdom. Having closely followed the Financial Conduct Authority’s (FCA) efforts to regulate the crypto industry, it seems that the battle against illicit promotions is proving to be a challenging one.

Having witnessed the FCA take decisive steps to protect consumers from potentially harmful investments, I am disappointed to see that only half of the alerts issued by the authority have led to the removal of illegal crypto ads. It’s like playing a game of whack-a-mole where new ads pop up as soon as the old ones are taken down.

However, I must acknowledge the FCA’s determination in addressing this issue and their commitment to taking robust action against noncompliant parties. The potential penalties for violating the rules are severe, ranging from fines to imprisonment, which should serve as a deterrent to those who continue to flout the regulations.

In my view, the FCA’s approach seems to be a balancing act between protecting consumers and fostering innovation in the crypto industry. It’s a delicate task, but one that is essential for maintaining trust and confidence in the digital asset space.

To lighten the mood, let me end with a little humor: I can’t help but think of the classic game of cat-and-mouse between regulators and unscrupulous actors in the crypto world as a modern-day version of “Whack-a-Mole” – only instead of cute cartoon animals popping up, it’s illegal ads for cryptocurrencies. But rest assured that I am ready to keep whacking away at this issue until we can ensure a safe and secure environment for UK consumers in the crypto space!

Cryptocurrency ads that are deemed illegal persistently pop up within the UK borders, despite the Financial Conduct Authority’s (FCA) instruction for such crypto initiatives to take down their marketing campaigns.

In June 2023, the Financial Conduct Authority introduced fresh regulations for crypto advertising due to the inherent risks present within the cryptocurrency market.

FCA’s Crypto Ad Takedown Requests Go Unanswered

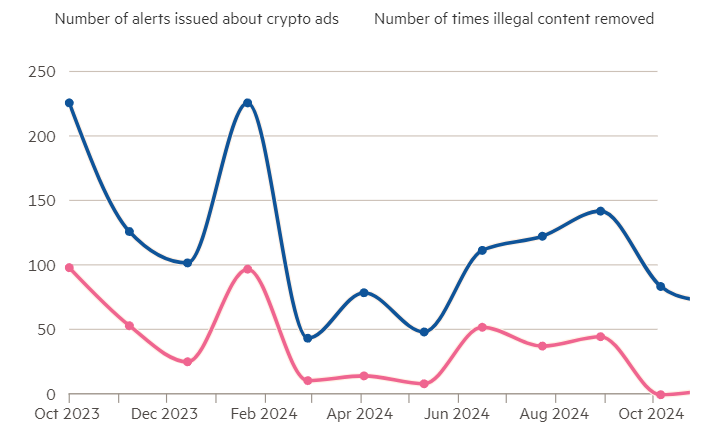

Based on a Financial Times report, out of the 1,702 warnings given by the FCA between October 2023 and October 2024 regarding illegal cryptocurrency ads, only about 54% resulted in these ads being taken down. The rest of these promotions continue to be active.

In 2023, the regulatory body of Britain made it clear that non-compliant crypto companies may encounter penalties. These penalties could encompass terms of up to two years in prison, hefty fines without a cap, or even a combination of both.

The Financial Conduct Authority (FCA) has declared they will vigorously address individuals who break laws by marketing to UK consumers unlawfully. This could involve listing firms on a warning list, taking measures to eliminate or prevent any illegal financial promotions across websites, social media platforms, and apps, as well as enforcing penalties.

Moreover, only FCA-authorised crypto promotions are allowed to be published in the UK.

The regulatory body aims to ensure that investors understand the risks associated with different cryptoassets and protect them from investing in ones that don’t align with their risk tolerance level,” clarified the authority.

Nevertheless, it appears that even though the Financial Conduct Authority has asked for their removal, approximately half of these advertisements continue to persist consistently.

Moreover, it’s worth noting that, despite issuing warnings, the Financial Conduct Authority (FCA) has not yet imposed penalties on businesses or organizations found breaking its regulations. Previously, the chair of FCA, Charles Randell, underlined the importance of imposing penalties on companies that fail to take down content as a key step in addressing the “extremely aggravating” level of non-compliance.

According to the Financial Conduct Authority (FCA), they aim to conclude the regulation of cryptocurrencies in the United Kingdom by the first quarter of 2026, as announced in November. Key aspects that will receive attention include preventing market manipulation, overseeing trading platforms, managing lending practices related to crypto, and ensuring the proper functioning of stablecoins.

Lately, Pump.fun by Solana limited access for UK users due to cautions from the Financial Conduct Authority (FCA) in the United Kingdom. In December 2024, the FCA declared that the platform was not authorized to serve UK users, making it inaccessible within the country now. Similarly, Binance halted the registration of new users in 2023 after withdrawing their FCA registration.

The regulatory body has stated that this company is no longer offering regulated services or goods. However, it had been previously approved by both the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

As a researcher studying the regulatory landscape of cryptocurrencies in the UK, I’ve observed that the Financial Conduct Authority (FCA) has been making concerted efforts to oversee the crypto sector. However, the outcomes thus far have fallen short of expectations. It remains intriguing to anticipate whether the regulator will implement significant adjustments to its strategy following the less-than-impressive results in 2024, or if it will choose to intensify its enforcement actions against the industry instead.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-01 23:38