As a seasoned researcher with over a decade of experience in the cryptocurrency market, I’ve seen countless rallies and corrections. The current surge in FARTCOIN has certainly caught my attention, but it also raises some red flags that I believe are worth considering.

The double-digit rally combined with plummeting trading volume is a classic scenario that often precedes a correction. It’s like watching a fireworks display without the expected thunderous applause – it’s beautiful, but something seems amiss. The negative Chaikin Money Flow further emphasizes this concern, as selling activity already appears to be underway.

In my experience, when the market is not convinced by a rally, it can quickly turn sour. I remember a time when a particular coin was dubbed “Dogecoin on steroids” – that didn’t end well. So, while FARTCOIN may be poised for a new peak, investors should tread cautiously.

Now, let me share a little joke to lighten the mood: You know what they call a bull market in cryptocurrency? A bear market that ended yesterday! Always remember, even in the world of digital coins, nothing is as certain as uncertainty itself.

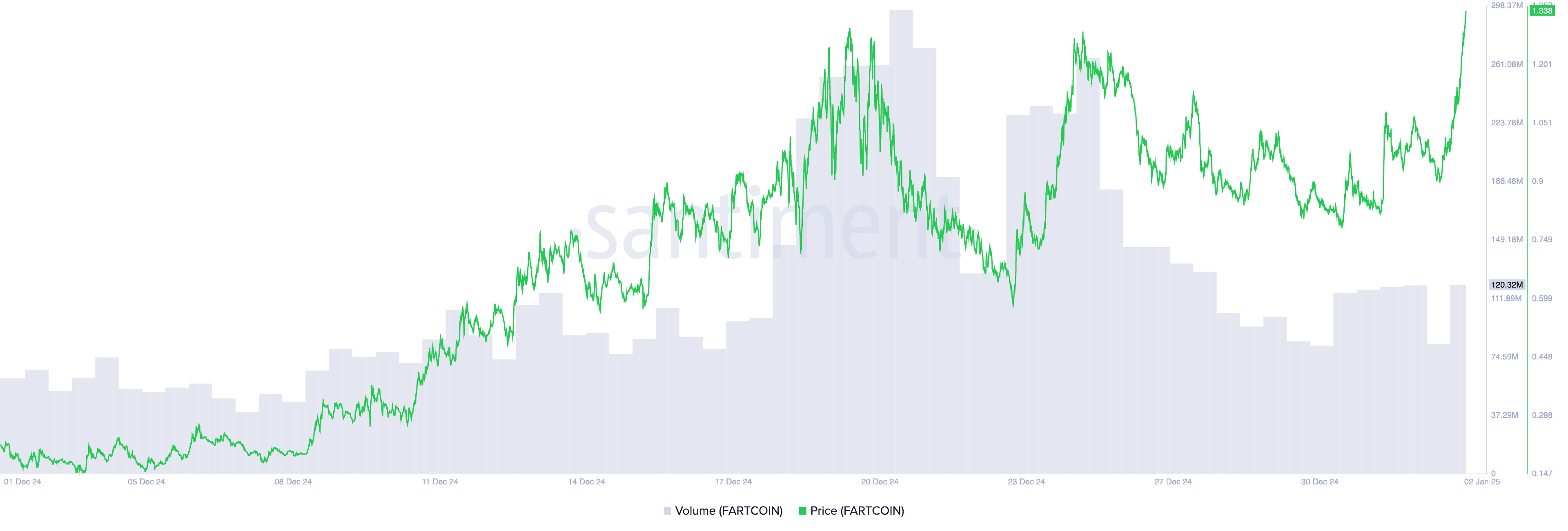

FARTCOIN experienced a 27% jump over the last 24 hours, hitting an unprecedented peak of $1.36. This spike in value has incited more sellers, as investors are cashing in on their recent profits.

As someone who has been following the cryptocurrency market for several years now, I have seen many digital currencies rise and fall, some more dramatically than others. From my perspective, FARTCOIN’s previous peak is a formidable hurdle that could potentially hinder its progress.

Based on my observations, selling pressure often accumulates when the price of a coin reaches a certain level, causing a significant number of investors to cash out their profits. This phenomenon can create a self-reinforcing downward trend in the market, making it difficult for the price to break through previous highs.

In the case of FARTCOIN, if selling pressure builds up due to profit-taking or other factors, it could prevent the price from surpassing its previous peak. This analysis is based on my experiences in the market and the general patterns I’ve observed over time, but it’s essential to keep in mind that past performance is not always indicative of future results.

FARTCOIN’s Double-Digit Rally Faces Risk

Over the last 24 hours, the cost of FARTCOIN has surged by double digits, but surprisingly, its trading activity has significantly decreased, leading to a discrepancy between the price and trading volume, which is often seen as a bearish sign.

When an asset’s price goes up but there are fewer trades being made, it suggests that not many traders are involved, which could raise doubts about the rally’s longevity since low trading activity can suggest weaker market confidence. This situation might make FARTCOIN’s price rise vulnerable to a reversal if selling pressure arises due to the lack of substantial buying action.

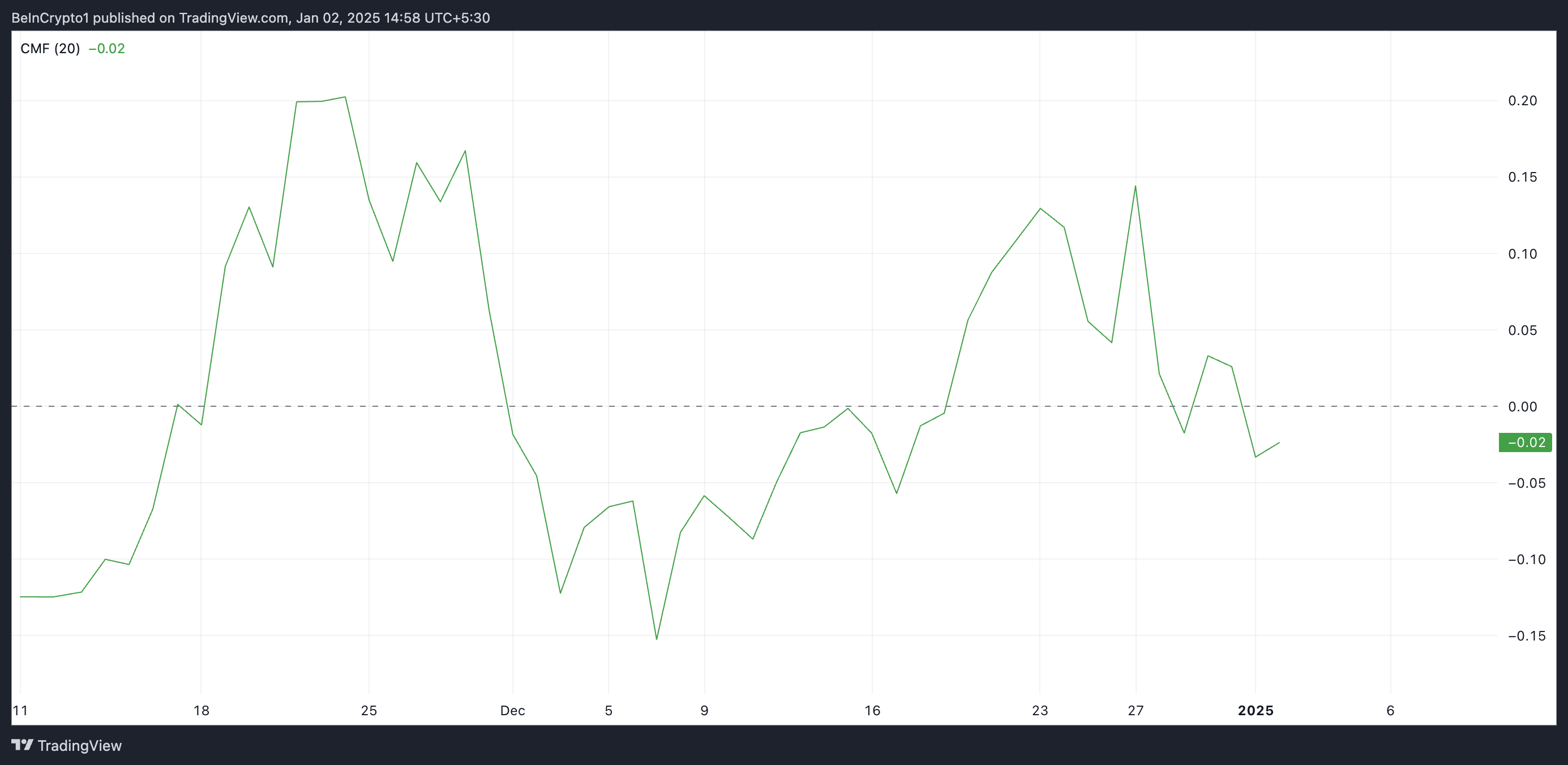

Significantly, the downward trend in the Chaikin Money Flow (CMF) for the meme coin indicates that selling is occurring, with traders capitalizing on the recent price increase. Currently, the CMF stands at -0.02, suggesting this activity.

The CMF (Commodity Channel Index) tracks the inflow and outflow of funds related to an asset. If its value is negative while an asset’s price is rising, it forms a bearish discrepancy.

Based on my years of trading experience, I have noticed that when a market shows a divergence with rising prices but strong selling pressure, it suggests a lack of conviction among investors. This is often a sign of weakness in the rally and can indicate that the market may soon reverse course. In my career, I’ve seen many instances where a negative Cumulative Money Flow (CMF) persists for an extended period, leading to a price reversal. It’s important to keep an eye on these trends because strong inflows of capital may not be enough to sustain the rally in such situations. As a trader, I always make sure to pay close attention to market divergences and the CMF when making investment decisions.

FARTCOIN Price Prediction: Is the Meme Coin Poised for a New Peak?

As someone who has followed the cryptocurrency market for several years now, I have learned that no coin is immune to market fluctuations, not even meme coins like FARTCOIN. Recently, it has seen some impressive gains, but if selling pressure continues to build, it may struggle to maintain these levels. In such a scenario, I believe we could witness a pullback towards the $0.56 mark. My advice would be to stay informed and make decisions based on a well-researched strategy rather than emotions. Cryptocurrency trading can be exciting, but it’s important to remember that it involves risk and requires careful analysis of market trends and factors influencing price movements.

If the support level doesn’t keep the price stable, FARTCOIN might drop down to approximately $0.44. Conversely, if the upward trend continues, the value of a FARTCOIN token could potentially reach a new high point.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-02 17:11