As a seasoned crypto investor with battle scars from previous market volatility wars, I find myself both elated and cautious about FARTCOIN‘s recent surge. On one hand, I’ve learned to embrace the thrill of watching my investments moon, so the 27% gain in a week is certainly music to my digital wallet. However, as the wise old saying goes, “What goes up must come down,” and the spike in FARTCOIN’s volatility has me concerned about potential corrections.

BeInCrypto’s analysis confirms my fears. The altcoin trading above its upper Bollinger Band suggests overbought conditions, and the all-time high ATR reading is a clear sign of heightened market volatility. It’s like riding a rollercoaster with no brakes – exhilarating but nerve-wracking at the same time!

That being said, I remain optimistic about FARTCOIN’s potential. If bullish pressure persists, we might just witness another leg up in this meme coin’s price journey. But if selling activity gains momentum, well, I’ve learned to expect the unexpected in this wild crypto world.

Lastly, let me share a joke to lighten the mood: They say investing is like watching paint dry or grass grow – if it were easy, everyone would do it. Well, at least with FARTCOIN, I get to watch my money turn into poop emojis!

Over the last seven days, the price of meme coin FARTCOIN has surged by an impressive 27%. The peak of this upward trend was reached on January 2, when the token hit a record high of $1.47 during its daily trade.

On the other hand, this rise in value has not been without consequence: increased market turbulence now poses a risk to any additional growth for the meme coin.

FARTCOIN’s Gains at Risk Amid Surging Volatility

According to BeInCrypto’s analysis, the FARTCOIN/USD daily chart indicates that the altcoin has moved above the top boundary of its Bollinger Bands.

As a crypto investor, I utilize an essential tool that gauges the volatility of an asset’s price and pinpoints overbought or oversold situations. This versatile indicator is composed of three elements:

1. A median line, which is a simple moving average, serving as the central point of reference.

2. An upper band, representing a standard deviation above the median line, acting as a resistance level.

3. A lower band, mirroring a standard deviation below the median line, functioning as support.

By keeping tabs on these bands, I can make informed decisions about when to buy or sell my crypto assets.

If an asset’s price surpasses its upper limit, it often signals a rise in market turbulence since the current worth is substantially deviating from its typical value. This situation can imply that the asset might have been excessively purchased, suggesting a potential need for a price adjustment.

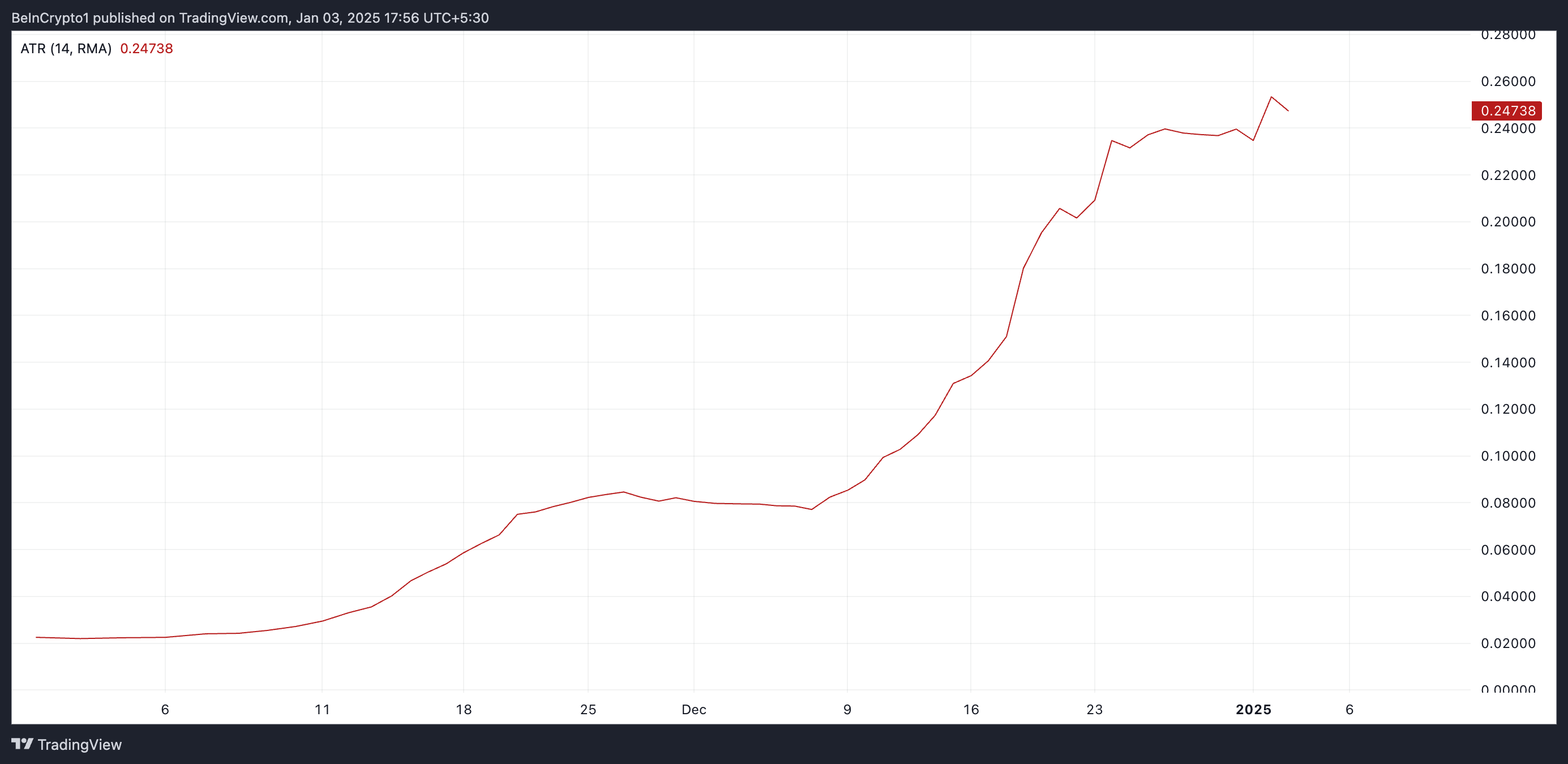

Furthermore, it’s worth noting that FARTCOIN’s Average True Range (ATR) reached a record peak of 0.25 on January 2, indicating increased market turbulence. Currently, the ATR is measured at 0.24.

The Average True Range (ATR) is a tool used to gauge the volatility of an asset by calculating the average difference between its high and low prices over a chosen time frame. When it spikes up in this manner, it suggests a rapid change in price fluctuations, indicating that the market’s volatility has increased significantly.

FARTCOIN Price Prediction: Key Levels to Watch

As a seasoned investor with years of experience navigating volatile markets, I can confidently say that heightened market volatility often leads to significant price movements, pushing assets towards either a steep ascent or descent. In my personal investment journey, I’ve witnessed numerous instances where an asset’s price would break out in one direction or the other due to persistent bullish pressure.

Given the current momentum surrounding FARTCOIN and its potential for growth, I believe that this digital asset may follow a similar trajectory. If the positive sentiment continues, it could potentially surge past its all-time high of $1.47 and even rally further. As always, however, it’s crucial to remember that investing carries inherent risks, and it’s essential to do thorough research and make informed decisions based on your financial goals and risk tolerance.

Conversely, should trading activity pick up speed, the meme coin’s value might burst downwards within a trend and potentially drop to $0.53.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-01-04 03:52