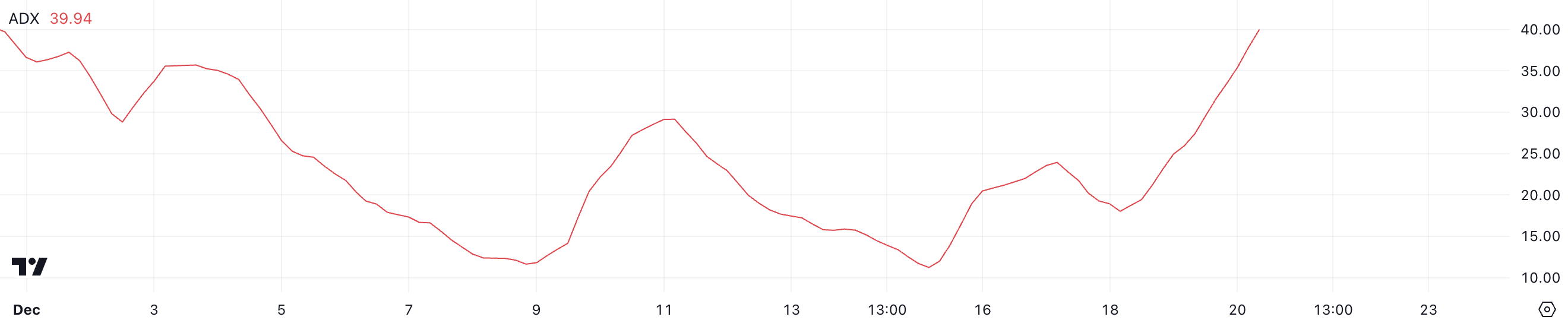

As a seasoned researcher with a background in financial markets and blockchain technologies, I have witnessed numerous bull and bear cycles, and I must say that the current downtrend of Fantom (FTM) is showing remarkable resilience. The surge in the Average Directional Index (ADX) to 39.94 indicates a significant strengthening of the bearish momentum, which could potentially lead to further declines in the near term.

The cost of Fantom (FTM) has dropped more than 12% within the past 24 hours as the platform shifts to its latest token, Sonic. This significant drop has accentuated FTM’s persistent price decrease, with technical markers such as the ADX underscoring increasing bearish trends.

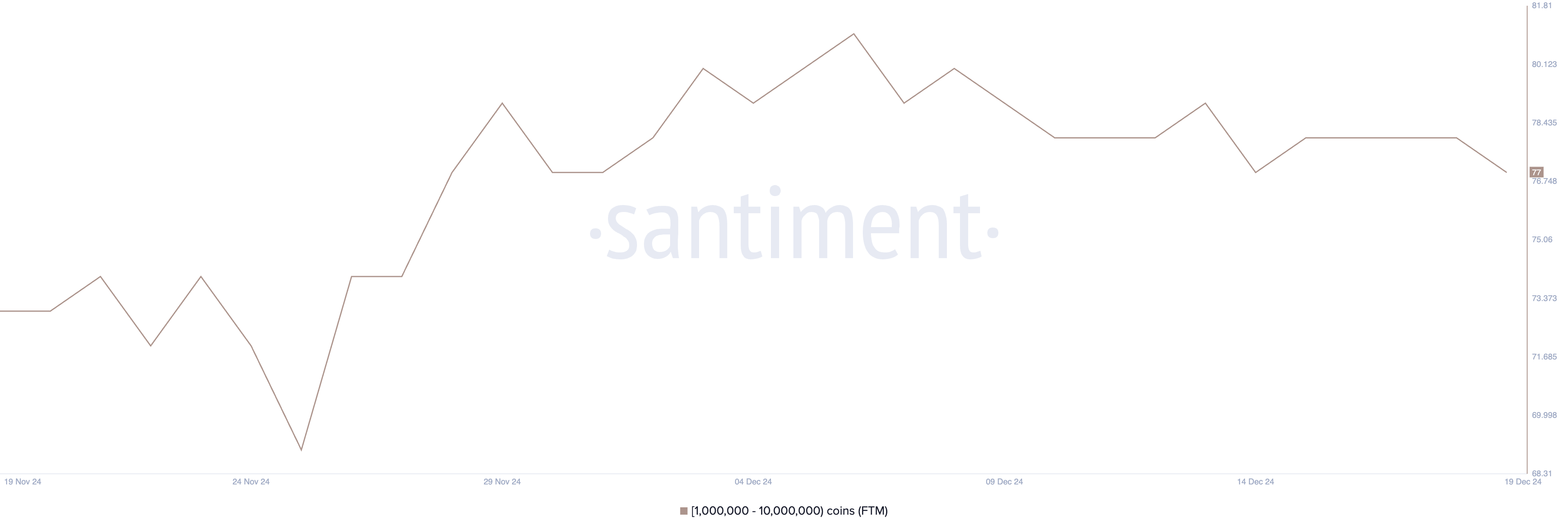

Currently, there’s been a gradual decrease in the number of whale wallets holding between 1 million and 10 million FTM, suggesting less confidence among large investors. As FTM hovers close to crucial support at $0.84, traders are on high alert for either a potential drop towards $0.64 or an upturn aiming for resistance levels of $1.13 and higher.

Fantom’s Current Downtrend Is Showing Its Strength

The ADX (Average Directional Index) for FTM is currently at 39.94, a sharp increase from below 20 just two days ago. This surge indicates that the strength of the current trend has grown significantly in a short period.

Given that the Fast Moving Trade (FTM) price is presently on a downward trend, the increased Average Directional Index (ADX) indicates that the bearish force is growing stronger, suggesting that the price may encounter continued downward pressure over the short term.

The ADX (Average Directional Movement Index) assesses the strength of a market trend, whether it’s ascending or descending, ranging from 0 to 100. A value below 20 indicates a feeble or indecisive trend, while values between 20 and 40 hint at a moderately strong trend, and scores above 40 showcase a robust trend.

As FTM’s ADX inches close to 40, it suggests a robust downward trend, indicating persistent selling activity. For now, if substantial buying demand doesn’t materialize soon, the FTM price might keep dropping. Traders are keeping a close eye on support levels in case they signal any potential price stabilization.

Whales Are Not Accumulating FTM

The count of cryptocurrency wallets containing between 1 million and 10 million FTM has decreased to 77, reaching a new low since last December. These wallets are commonly known as “whales” because their holdings represent a substantial amount of tokens, which can have a major impact on the market due to the volume they control. Monitoring these whale wallets is essential as their actions can significantly affect FTM’s price trends.

As a crypto investor, I’ve noticed that fluctuations in the number of wallets holding a particular cryptocurrency can sometimes signal shifts in the sentiment among significant investors. Such changes might precede significant price swings.

On December 6th, the count of whales peaked at an all-time monthly high of 81, though it’s been gradually decreasing ever since. No significant drops or “token dumps,” as you put it, have been detected during this period.

Over time, this gradual reduction seems to show less active trading by aggressive sellers. However, it may also point towards diminished confidence among major investors. Temporarily, this pattern could hint at vulnerability in Fantom, since dwindling whale involvement frequently correlates with reduced buying interest and possible price stability or additional drops.

Fantom Price Prediction: Can FTM Correct By 33% Next?

At the moment, Fantom’s price is moving between approximately $0.84 (as its lower limit or support) and $1 (its upper limit or resistance).

Should the $0.84 level not withstand, there might be a substantial decrease in the price. The following crucial support lies at $0.64, signifying a possible 33% adjustment from the present prices.

Conversely, should the FTM price successfully surge beyond its current $1 barrier, it might indicate a change in investor attitude, potentially paving the way for an increase towards $1.13.

If bullish momentum continues, it’s possible that Fantom’s price may challenge the next resistance at around $1.32, signifying a robust recovery. The likelihood of breaking above the $1 mark and maintaining an upward trend largely hinges on growing buying demand and a shift in the current powerful downtrend.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-21 00:33