Fantom’s (FTM) performance is presenting a mixed picture as it endeavors to bounce back from recent setbacks. Despite a 3% increase in the last day, the token is still almost 20% lower compared to the previous week, suggesting persistent difficulties in countering bearish trends.

The challenges faced by FTM are further complicated by wider market instability and a decrease in significant investor actions. As the price hovers close to crucial resistance points, its future trend will significantly depend on whether buyers can reassert control and trigger a prolonged upward momentum.

FTM Current Downtrend Is Still Strong

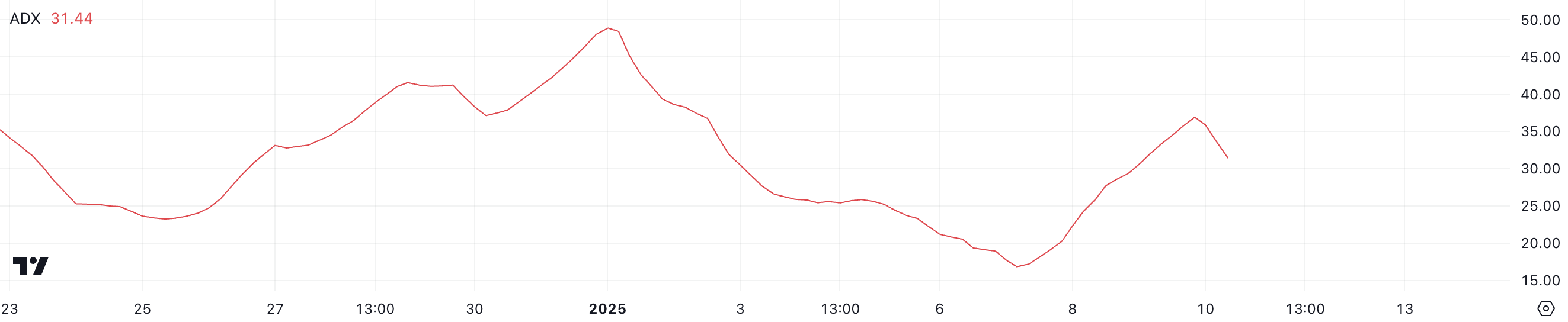

The Technical Indicator known as Average Directional Index (ADX) for Fantom has dropped to 31.4 today, compared to 36.9 the day before. ADX ranks trends from 0 to 100, with higher values indicating stronger trends, whether bullish or bearish. An ADX above 25 signifies a strong trend, while an ADX below 20 hints at weak or non-existent momentum.

The drop in FTM’s Average Directional Index (ADX) suggests that the strong downward trend may be weakening, implying a possible shift towards a period of stability instead of further bearish movement following a 20% price correction for FTM within the last week.

Currently, the ADX indicates that while the downward momentum is weakening in Fantom (FTM), it hasn’t clearly shown signs of a significant directional shift yet. This change could lead to decreased market volatility and potentially provide an opportunity for price stabilization. If Fantom continues on this trend, it may suggest the onset of recovery or a period of sideways trading.

If purchase activity doesn’t pick up or the trend doesn’t strengthen, the price might persist in a period of stability, waiting for additional triggers to determine its future movement.

FTM Whales Exit Their Positions

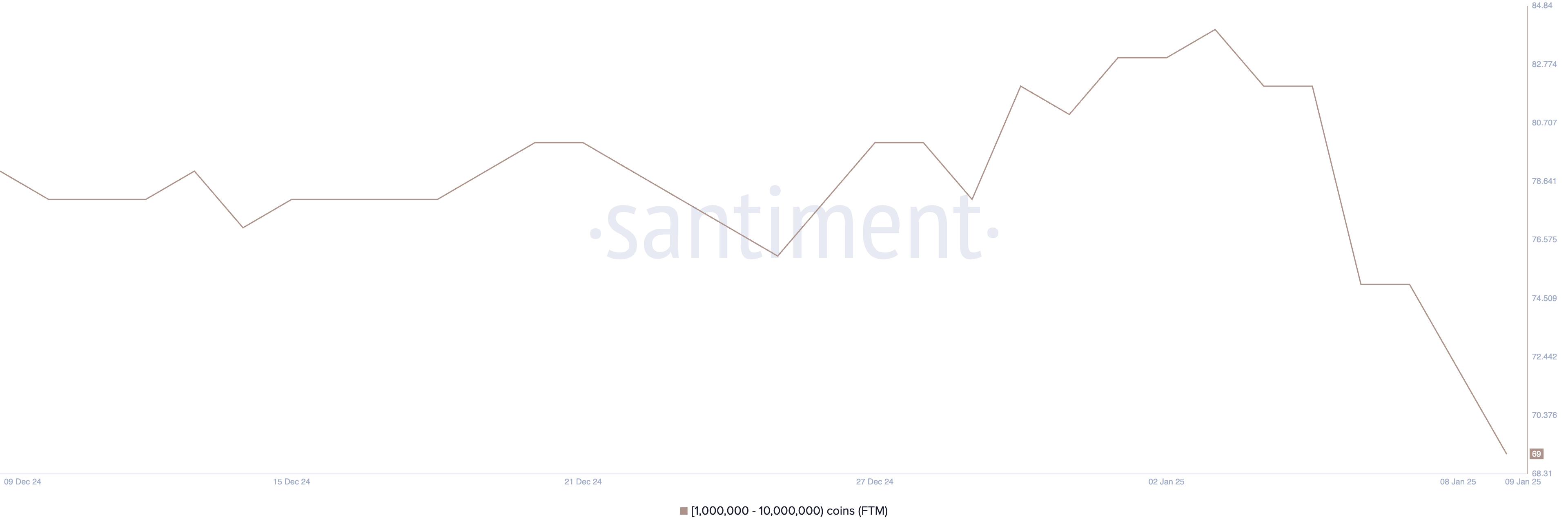

The count of wallets containing between one million and ten million FTM has noticeably decreased, going from 84 to just 69 since peaking on January 3. Keeping an eye on these ‘whales’, whose substantial holdings can significantly impact market opinions and fluidity, is essential.

When large numbers of investors amass a particular asset, it could show their trust in its value, leading to a decrease in supply and possibly causing prices to rise. On the flip side, a decrease in these big investors might suggest they are cashing out, losing confidence, or liquidating, which may lead to a drop in price.

In just a single week, the drastic decrease in whale population has reached its lowest point since November 2024. This rapid decline hints at significant investors unloading their shares, which seems to be intensifying the sell-off on the price of FTM.

If the behavior of whales (large investors) doesn’t shift towards holding more FTM (Fantom), or if they continue selling, it might weaken the attempts to raise the FTM price, making it susceptible to additional drops or extended periods of stagnation.

Fantom Price Prediction: Can FTM Go Back to $1 In January?

If Fantom’s price continues falling in its current trend, it could reach the significant support point at approximately $0.618. Dropping beneath this support might escalate selling activity, possibly causing the Fantom price to dip lower, potentially down to around $0.60 or even as low as $0.50.

Instead of continuing on a downward trajectory, a shift in direction might pave a path towards recovery. The FTM price is targeting the resistance at $0.879. If it manages to surpass this barrier, it could rekindle bullish energy, enabling the price to rise above $1 for the first time since late December.

As a researcher observing market trends, if this rally persists, it seems that the Future Token Market (FTM) could potentially reach the $1.05 mark. This bullish movement might indicate a revival of investor trust and a return to an upward trajectory for FTM.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2025-01-11 05:31