As a seasoned analyst with over a decade of experience in the volatile and ever-evolving world of cryptocurrency markets, I have witnessed countless cycles of euphoria and despair. Having closely monitored Solana (SOL) throughout its rapid rise and recent correction, I find myself cautiously optimistic about its future prospects.

The 21% decline over the past 30 days has been a stark reminder of the unpredictable nature of this space, but SOL’s resilience is evident in its continued position as the sixth-largest cryptocurrency by market capitalization. The technical indicators suggest that while the downtrend persists, its strength has diminished, and the price is consolidating, hinting at a potential turning point.

The BBTrend indicator’s neutral stance and the weakening trend strength indicated by the Solana DMI chart suggest that the current market conditions are uncertain. However, I believe that the key to understanding SOL’s future direction lies in closely monitoring support and resistance levels and shifts in market momentum.

In my experience, short-term price movements can be misleading, and it is essential to maintain a long-term perspective when analyzing digital assets like Solana. As such, I will continue to keep a close eye on SOL’s performance and make adjustments to my investment strategy accordingly.

One thing’s for certain – the world of cryptocurrency never ceases to surprise us! In this space, you might as well expect the unexpected. So, who knows? Maybe Solana will soon prove its mettle once more and surprise us all with a bullish run!

Just remember: In crypto, even if it looks like a duck, swims like a duck, and quacks like a duck, it might just be a bitcoin wearing a duck costume to throw us off the trail. Keep your eyes peeled, and don’t forget to have fun while navigating this rollercoaster ride!

The value of Solana (SOL) has encountered substantial hurdles in recent times, falling by around 21% over the past month. Yet, despite this decrease, SOL still maintains its position as the sixth most significant cryptocurrency, boasting a market capitalization worth approximately $90.8 billion.

The technical indicators like BBTrend, DMI, and EMA lines show that although the downward trend remains, it’s losing intensity, and at present, the price is stabilizing. If the price of SOL follows a bearish path further or begins to recover will depend on crucial support and resistance levels, as well as shifts in market dynamics and momentum.

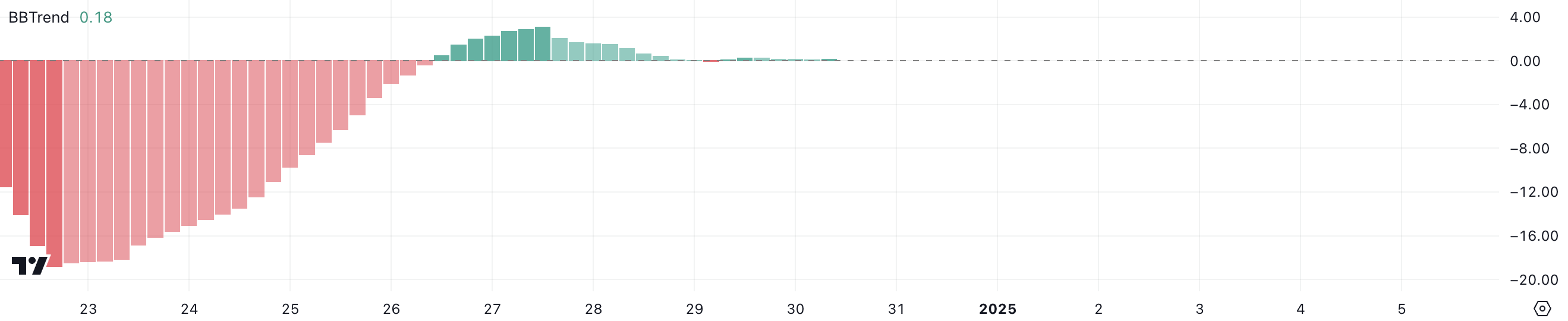

SOL BBTrend Is Nearing Zero

Right now, the SOL BBTrend stands at 0.18, suggesting a balanced position as it recovers from significantly negative readings that started on December 23.

As someone who has spent several years studying financial markets and analyzing various indicators, I have learned that short-term fluctuations can often be misleading. On December 27, I noticed that the indicator briefly spiked to a positive value of 3.09, which initially seemed like a bullish sign to me. However, my years of experience have taught me that it’s important not to jump to conclusions based on a single data point. Since then, the indicator has declined and stabilized around 0.18, indicating that there is currently no strong directional bias in the price action. This reminds me of a time when I made an impulsive investment decision based solely on a positive indicator reading, only to realize later that it was just a short-lived bullish trend. Now, I always try to look at multiple indicators and consider other factors before making any decisions about my investments.

The BBTrend is a technical tool that’s based on Bollinger Bands and helps determine the intensity and direction of price movements. A BBTrend value greater than zero usually signals an uptrend, while a value less than zero points to a downtrend. When the BBTrend is close to zero, like it is for SOL right now, it indicates a market that’s neither strongly trending upwards nor downwards, suggesting a sideways or range-bound movement instead.

For a while, the Solana BBTrend reading of 0.18 might indicate a period of possible price stabilization. This could mean that the market activity may become less erratic as we await the development of a more distinct trend pattern.

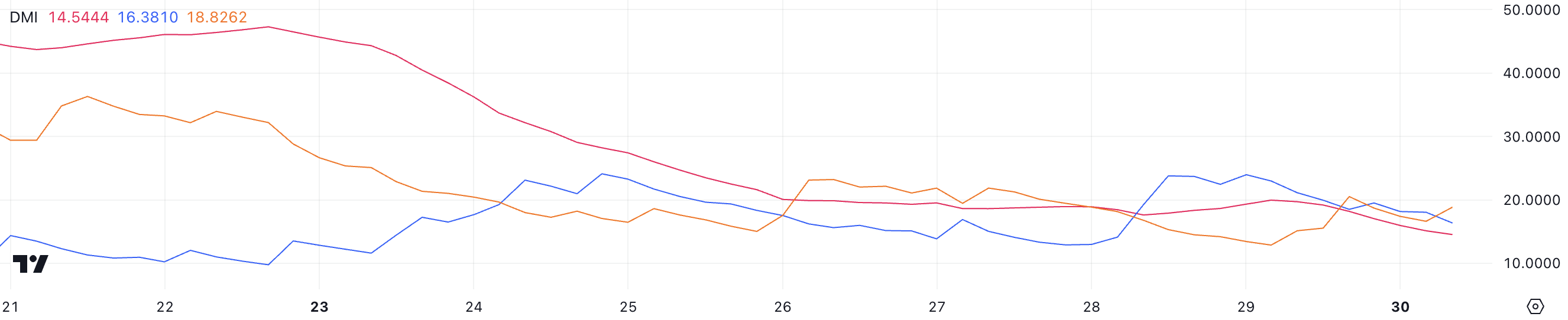

Solana Bears Are Still Here

The Solana DMI chart indicates that its ADX has decreased from around 20 to 14.5 within a day’s time. This decrease suggests a lessening of trend strength, hinting that the current market momentum may be starting to slow down.

As an analyst, I’m observing a situation where the Directional Indicator (DI) shows the +DI at 16.2 and the -DI at 19.7. This implies that bearish pressure is slightly prevailing as the -DI is higher than the +DI. This pattern indicates that the Solana price continues to face challenges in fully reversing its downward trend.

The Average Directional Index (ADX) assesses a trend’s intensity, regardless of its direction, ranging from 0 to 100. Values over 25 signify a robust trend, whereas readings below 20, such as the current SOL reading of 14.5, suggest weak or non-existent trend strength. When the +DI is beneath the -DI, it implies that the downward trend persists, but the decreasing ADX hints at a lack of substantial momentum in this trend.

Based on my years of trading experience, I have found that the short-term behavior of the SOL (Symbol) can often be somewhat unpredictable and require a keen eye to spot potential shifts in momentum. For instance, if the SOL continues to consolidate or move sideways for an extended period without any significant changes, it’s a sign that caution should be exercised. However, if there is a noticeable increase in the +DI (Positive Directional Indicator) moving above the -DI (Negative Directional Indicator), accompanied by a steadily rising ADX (Average Directional Movement Index) value, it usually indicates a stronger trend developing. This scenario typically suggests that it may be a good time to consider entering or increasing positions in the SOL, as the trend appears to be gaining strength. Nonetheless, it’s essential always to remember that trading involves risk and should never invest more than you can afford to lose.

SOL Price Prediction: Will the Downtrend Persist?

The arrangement of Solana’s Exponential Moving Averages (EMA) suggests a bearish trend, since the shorter-term averages stay beneath the longer-term ones. This pattern indicates persisting downward pressure without any clear indication of an upcoming bullish shift at this time.

In simpler terms, the bearish Exponential Moving Average (EMA) setup indicates that selling forces may continue dominating, particularly as the price nears the next significant support point at $182. If this support level breaks, the bearish trend might strengthen, possibly causing Solana’s price to drop towards $176.

From my perspective as an analyst, should the price of SOL shift its present downward trajectory and instead form an uptrend, it may challenge the resistance at $201. If it successfully surpasses this barrier, it would suggest a strengthening bullish energy and potentially set the stage for additional upswings.

For a transition like this to take place, the Exponential Moving Averages (EMA) should start coming together and ultimately reverse into a bullish configuration, where the shorter-term EMAs rise above the longer-term ones. Until this happens, the current bearish EMA arrangement remains a warning for short-term investors to exercise caution.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Honkai: Star Rail – Hyacine build and ascension guide

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- In Conversation With The Weeknd and Jenna Ortega

2024-12-30 19:51