They call it biotech. I call it a high-stakes crapshoot. And Exelixis (EXEL 1.13%)? Well, they’ve been quietly stacking the deck, delivering results while the rest of these so-called innovators are chasing unicorns and burning through venture capital like it’s going out of style. Five years. Five YEARS of steady gains in a sector built on hype and heartbreak. It’s… unsettling. And that, my friends, is precisely why we need to pay attention. Forget the blue-chip safety nets. We’re here for the pulse, the raw energy, the potential for a REALLY good run… or a spectacular implosion. Either way, it won’t be boring.

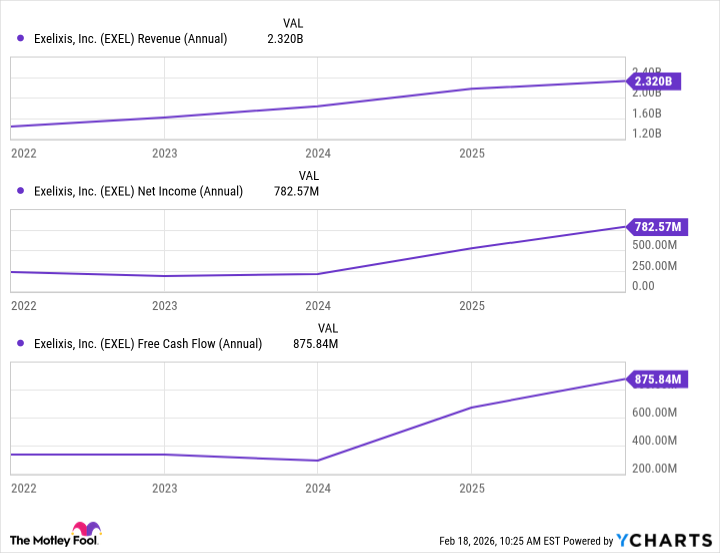

Let’s get down to brass tacks. Exelixis isn’t reinventing the wheel, they’re refining it. Cabometyx, their flagship drug, is a cancer treatment. Sounds mundane, doesn’t it? But this isn’t about saving the world; it’s about capturing market share in a brutal, unforgiving landscape. They’ve carved out a niche in renal cell carcinoma, and they’re not afraid to expand. They’re playing the combo game, partnering with the big boys like Bristol Myers Squibb and their Opdivo franchise. Smart. Cynical. Effective. Revenue, earnings, free cash flow – all trending UP. The S&P 500? They’ve nudged past it. It’s not a rocket launch, but it’s a sustained climb. And in this business, sustained is everything.

The Clock is Ticking

Okay, let’s address the elephant in the room. Cabometyx isn’t immortal. Generics are coming. The patent cliff looms. The vultures are circling. They’re whispering about competition, about lost revenue, about the inevitable decline. They’re right, of course. Everything ends. But Exelixis isn’t sitting around waiting for the apocalypse. They’re preparing. In March of 2025, Cabometyx got a green light for neuroendocrine tumors. A new market. A lifeline. It’s not a miracle cure, but it buys them time. And in this game, time is money. Lots of it.

But here’s where things get interesting. They’re not putting all their eggs in one basket. They’ve got zanzalintinib in the pipeline, a potential game-changer for metastatic colorectal cancer. CRC. The second-leading cause of cancer death in the world. A grim statistic, but a massive opportunity. Phase 3 trials completed. Regulatory approval requested. They’re playing the long game, diversifying their portfolio, building a fortress against the inevitable onslaught of generic competition. They’re not just treating cancer; they’re building a franchise. And that, my friends, is what separates the players from the pretenders.

They’ve got other candidates in the pipeline, too. Early-stage stuff, risky bets, but that’s where the real upside lies. They’re not afraid to fail. They’re not afraid to take chances. They’re willing to push the boundaries, to challenge the status quo. And that’s exactly what we want to see. Exelixis isn’t a safe haven. It’s a calculated gamble. A high-risk, high-reward proposition. But if they can navigate the treacherous waters ahead, if they can execute their strategy, if they can continue to innovate, they could be sitting on a goldmine.

So, is Exelixis worth a closer look? ABSOLUTELY. It’s a company that understands the rules of the game, a company that’s willing to play dirty, a company that’s determined to win. It’s a long shot, yes. But in this world of fleeting fortunes and broken promises, sometimes the biggest rewards go to those who are willing to take the biggest risks. And I, for one, am ready to roll the dice.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Banks & Shadows: A 2026 Outlook

- QuantumScape: A Speculative Venture

- HSR Fate/stay night — best team comps and bond synergies

- Crypto Chaos: Is Your Portfolio Doomed? 😱

2026-02-20 23:54