As a researcher with years of experience following the cryptocurrency market, I find myself consistently drawn to the insights of Chris Burniske, a seasoned analyst who has navigated multiple bull markets. His recent warning about the potential $10 trillion crypto market cap is particularly noteworthy.

On the other hand, Chris Burniske, previously an analyst at ARK Invest and now a partner at Placeholder, is advocating for prudence in investment decisions. He warns investors against being carried away by the excitement about a possible $10 trillion worth of cryptocurrency market capitalization.

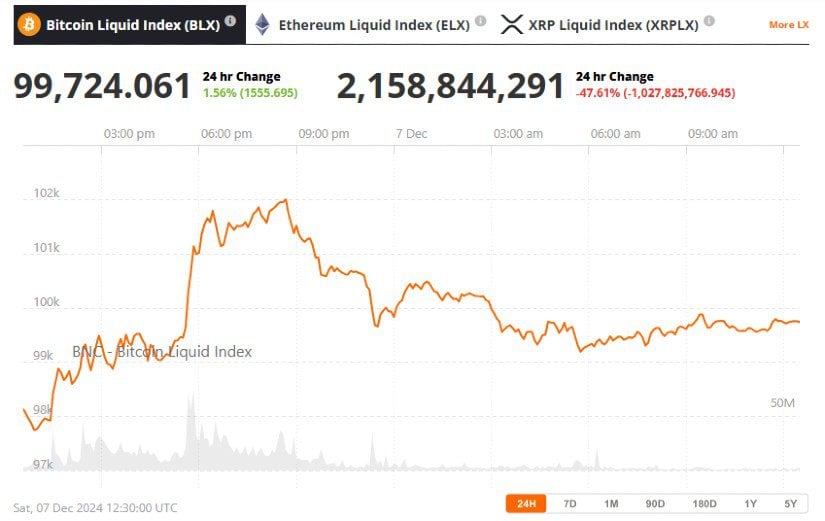

The recent spike in Bitcoin‘s value has sparked renewed debates about the potential direction of the cryptocurrency sector, with certain experts suggesting that Bitcoin might attain unprecedentedly high price levels. Nevertheless, Chris Burniske cautions that although a $10 trillion market cap could be “generally accurate” for the long-term outlook, it’s not likely that the market will achieve such heights during this specific cycle.

Burniske shared, despite the enthusiasm, that it’s possible we may not reach our $10T goal in the current economic phase. He emphasized the importance of maintaining a realistic perspective when investing.

Burniske’s warning is rooted in lessons he learned during previous bull markets, such as the 2021 rally. During this time, predictions of Bitcoin reaching $100,000 and Ethereum touching $10,000 were commonplace. However, Bitcoin’s price only reached about $70,000, while Ethereum peaked near $5,000. These unmet targets demonstrate how excessive enthusiasm can lead to overly optimistic forecasts that ultimately result in disillusionment.

Strategic Profit-Taking Amid Market Frenzy

As Bitcoin’s price neared record levels, Burniske underscored the value of tactical profit-making. For those who joined the crypto market when its total value was less than $1 trillion, he suggests that it could be prudent to begin cashing out profits as the market approaches the $3 trillion to $10 trillion threshold. Burniske noted that “there’s no such thing as losing money by taking profits,” encouraging investors to strike a balance between their long-term ambitions and the volatility of short-term market trends.

Burniske recommends maintaining some investments for long-term involvement while also cashing out during market hype, as he put it, “Hold onto some assets as a long-term investment, but don’t forget to cash out during manias and enjoy your life. Time is more valuable than any cryptocurrency like Bitcoin,” he emphasized, warning investors that constantly trying to find the ideal market move might cause them to miss other opportunities.

Volatility Concerns and Liquidity Gaps

As a crypto investor, I’ve seen the thrilling surge of Bitcoin crossing the $100,000 barrier, but it’s hard not to feel some apprehension about possible market corrections and volatility. Key analysts are focusing on significant zones like the $39,000-$40,000 range, which has served as a strategic investment hub for many. Interestingly, blockchain analytics firm Glassnode highlights this sector as a vital support level if Bitcoin’s price should happen to drop.

Over the last few months, the price range between $62,000 and $64,000 has become a significant area of high demand, contributing to Bitcoin’s surge to its current value. Yet, as Bitcoin’s price continues to be unpredictable, analysts are expressing worry about potential liquidity shortages. Glassnode highlights that Bitcoin might not have robust support below $96,000, potentially leading to increased volatility if the market falls towards $88,000 or even lower prices.

Market Sentiment: A Mixed Picture

As a financial analyst, I find myself caught between enthusiasm and wariness as Bitcoin’s unprecedented price surge echoes through the crypto sphere. Having navigated the rollercoaster ride of its volatile past, early adopters like myself are taking a moment to reminisce about our experiences. On the other hand, newcomers to the market are expressing concerns over the increasing institutional involvement and whether this shift might dilute Bitcoin’s fundamental principles.

Notable personalities like Anthony Pompliano have commended Bitcoin investors for their tenacity, yet there’s lingering doubt about the longevity of the current surge. Concerns such as regulatory ambiguity and insufficient trading volume are often brought up by critics, who wonder if the market will continue its upward trend.

As Bitcoin continues to rise, Burniske’s advice stands as a reminder to investors that while the future of cryptocurrency may hold great promise, short-term volatility and inflated expectations could derail potential gains. His message encourages a balanced approach to investment, combining long-term holding strategies with prudent profit-taking to weather the ups and downs of the market. While Bitcoin’s recent highs are undeniably significant, Burniske’s caution serves as a timely reminder of the unpredictable nature of cryptocurrency markets.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-07 17:00