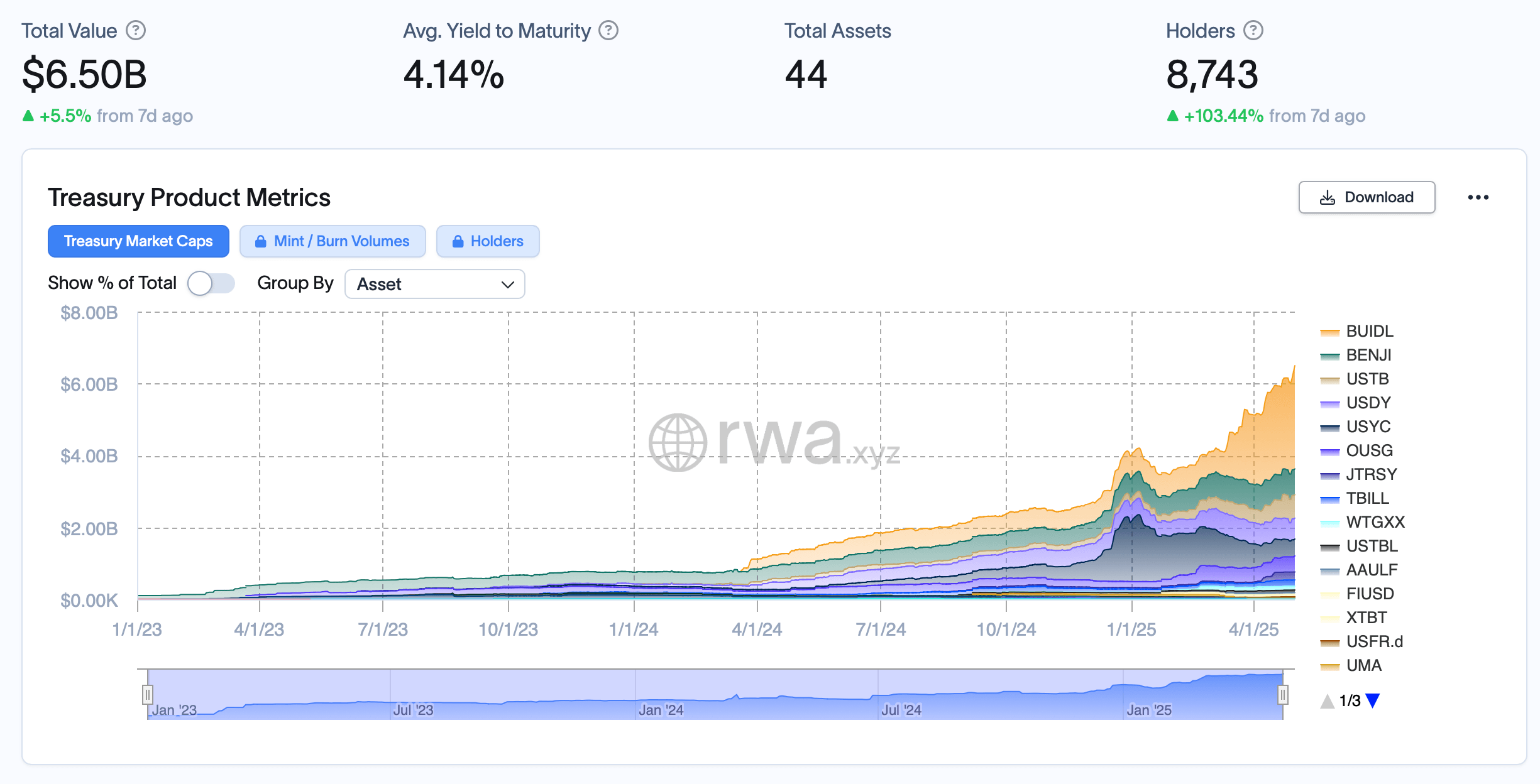

Fifteen days slipped by, quietly and inexorably—as days are wont to do—and yet, by May 2, 2025, the tokenized Treasury market, perhaps breaking out in triumphant laughter somewhere in cyberspace, had encased within itself another bewildering $560 million. Its total, now, stands at $6.5 billion. A sum substantial enough to make even a Russian landowner wake from his afternoon nap, if only to mumble about “progress.” 😏

BUIDL and USTB: Heroes or Merely Lucky? 98% of Growth in Just a Fortnight

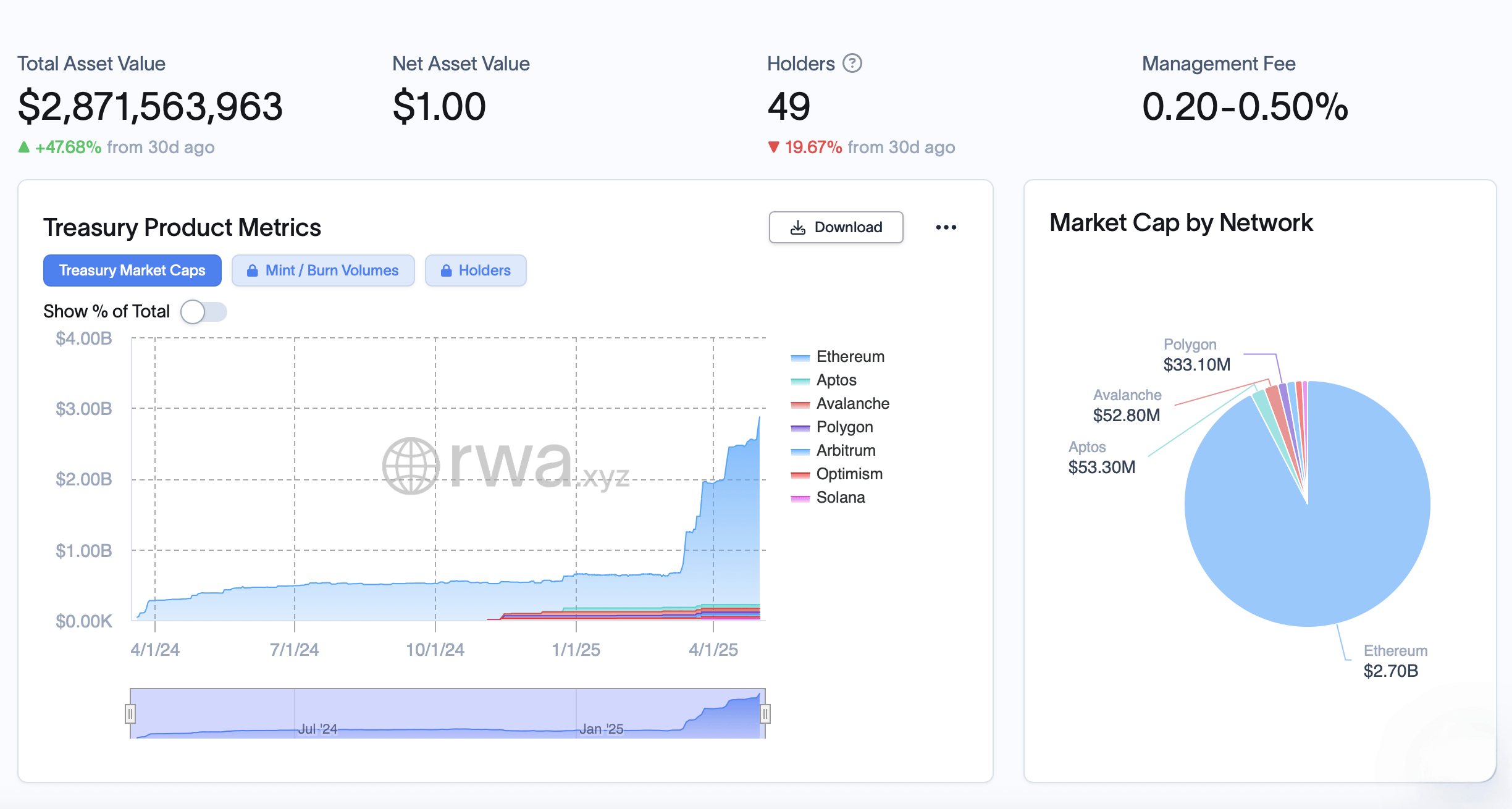

The Blackrock USD Institutional Digital Liquidity Fund (BUIDL)—that ponderous acronym—swooped down, commandeering the market’s attention and $402 million of fresh capital, swelling its coffers in a manner reminiscent of some old general seizing surplus grain from the peasants. Rwa.xyz metrics suggest that in a brief quantum of time (precisely 15 days, but who’s counting?), BUIDL rose from $2.469 billion to an almost conceited $2.871 billion. The numbers, one suspects, are beginning to feel rather pleased with themselves. 😂

Meanwhile, lest BUIDL stroll off with all the applause and the samovar, Franklin Templeton’s Onchain U.S. Government Money Fund (BENJI) experienced a modest, yet respectable, leap—from $702 million to $716.84 million. Not a jump so much as an aristocrat’s elegantly executed hop. The battle for third—ah!—took on the air of a Dostoevskian chess match: Ondo’s USDY, until recently the proud third, ceded its station to Superstate’s Short Duration U.S. Government Securities Fund (USTB), whose name alone is long enough to require a decent cup of tea to finish reading. 🫖

Superstate’s USTB, not content to remain a minor character, bounded up from $502.30 million to $651.51 million—a surge so substantial, one can practically hear the rubles clattering in a forgotten dacha trunk somewhere. Together, BUIDL and USTB account for $551.21 million—two titans, holding 98% of the total $560 million sectoral growth since April 17, while poor Ondo’s USDY was left sighing in the fourth place breezes after almost $5 million vanished into the digital ether. 🥲

Not wishing to be left entirely out of this theater of numbers, Circle’s USYC clung gamely to a top-five seat with $468.68 million, although one might note it lost a touch of its former luster, retreating from its earlier $525.17 million—enough to make a financier pine quietly into his vodka. Across a bewildering forty-four tokenized Treasury bond offerings, the mean yield to maturity fluttered gracefully down to 4.14%, per rwa.xyz stats. And lo, in the past week, the number of cryptocurrency holders in this saga leaped by 103.44%, reaching 8,743. Even in Turgenev’s wildest reveries, he would not have foreseen so many participants in the ballet of speculative finance. 💃🏽🕺🏽

Read More

2025-05-02 19:32