The electrification of the automotive sector represents a significant, if predictably disruptive, shift in global transportation. While established manufacturers and nascent technology firms alike pursue various strategies within this evolving landscape, investment opportunities are not uniformly distributed. This assessment focuses on QuantumScape and Ferrari, two entities approaching the electric vehicle transition from markedly different positions, and evaluates their respective prospects for long-term value creation.

QuantumScape: Technological Promise & Execution Risk

QuantumScape (QS) is predicated on the development and commercialization of solid-state lithium-metal battery technology. Should the company succeed in achieving scalable production of this technology, it could address several limitations inherent in current lithium-ion batteries – notably, energy density, charging speed, and safety. However, translating laboratory advancements into commercially viable products at scale remains a substantial undertaking, fraught with engineering challenges and capital requirements.

Recent milestones, including the shipment of B1 samples and progress with the Cobra production process, are encouraging, but do not eliminate the inherent risk. The company’s reliance on a joint venture with Volkswagen Group’s PowerCo represents both a potential avenue for monetization and a point of dependency. The agreement, granting PowerCo a license for approximately one million vehicles annually, is contingent upon successful technology validation and mass production capabilities. Failure to meet these criteria could jeopardize the partnership and significantly impact QuantumScape’s financial outlook.

- Technological Risk: Solid-state battery technology, while promising, faces significant hurdles in achieving scalability and cost-effectiveness.

- Execution Risk: Transitioning from research and development to mass production requires substantial capital investment and operational expertise.

- Dependency Risk: Reliance on the Volkswagen Group partnership introduces external dependencies and potential constraints on strategic decision-making.

Ferrari: Electrification as a Complement, Not a Replacement

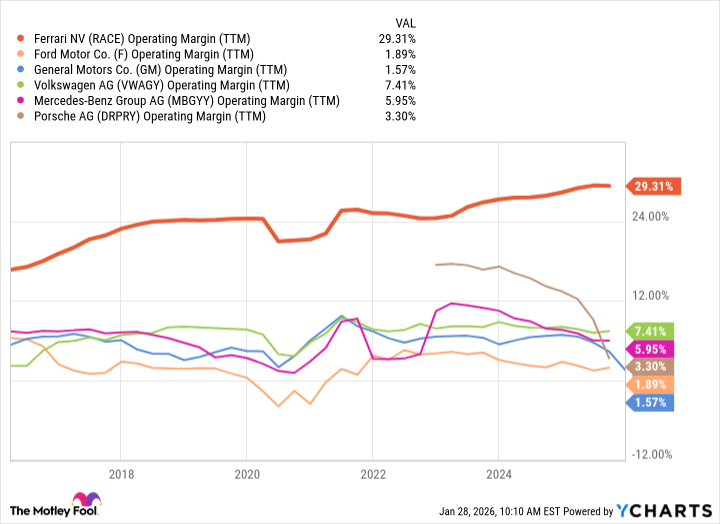

Ferrari (RACE) presents a contrasting approach to the electric vehicle transition. Unlike many manufacturers aggressively pursuing full electrification, Ferrari has adopted a more measured strategy, focusing on hybrid technology as a bridge to future fully electric models. This approach appears, thus far, to be strategically sound. The company has demonstrated an ability to maintain pricing power and robust operating margins, even as it integrates hybrid powertrains into its vehicle lineup.

The fact that hybrids now constitute a substantial portion of Ferrari’s shipments – approximately 43% in the most recent quarter – highlights the company’s ability to cater to evolving consumer preferences without compromising its brand identity or financial performance. This is not merely a matter of technological preference; it is a reflection of Ferrari’s unique market position and the inherent demand for its vehicles. The company’s ability to command premium pricing mitigates some of the profitability concerns that plague other EV manufacturers.

Comparative Assessment & Investment Considerations

QuantumScape and Ferrari represent divergent investment profiles within the electric vehicle ecosystem. QuantumScape offers a high-risk, high-reward proposition, predicated on the successful commercialization of disruptive technology. The company’s valuation reflects this inherent uncertainty, and investors should carefully consider the technological, execution, and dependency risks outlined above.

Ferrari, conversely, offers a more stable and predictable investment opportunity. The company’s strong brand equity, pricing power, and demonstrated ability to navigate the electric vehicle transition mitigate some of the risks associated with other EV manufacturers. While Ferrari is not immune to the challenges of the evolving automotive landscape, its unique market position and financial performance suggest a degree of resilience.

Ultimately, the suitability of either investment depends on an investor’s risk tolerance and investment horizon. QuantumScape may appeal to those seeking exposure to potentially disruptive technology, while Ferrari may be more attractive to those prioritizing stability and long-term value creation. A thorough assessment of the respective risks and opportunities is paramount before allocating capital to either entity.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 🎁 AGF 2025 Coupon

2026-02-01 23:22