Ah, the grand theater of finance! ETHZilla, that peculiar beast of the Ethereum treasury world, has flung $40 million worth of precious ETH into the abyss of the market-all in service of that most sacred of modern rituals: the share buyback. As if clutching at straws while drowning in the murky waters of stock price and net asset value disparity, the company seeks salvation through arithmetic. How very… predictable. 😏

- ETHZilla pawned $40 million in ETH-because nothing says “confidence” like selling your golden goose.

- 600,000 shares swallowed back into the corporate maw for a mere $12 million. A bargain? Or a sign of deeper tremors? 🤷♂️

- Shares leapt 14% on Monday, proving once again that markets are ruled by the whims of panicked lemmings.

The Nasdaq-listed leviathan, ever the opportunist, snatched up these shares late last week-right after dumping ETH like a man fleeing a burning house with his pockets full of kindling. An Oct. 27 press release solemnly declared this maneuver, as though announcing the birth of a new messiah rather than a desperate attempt to plug a sinking ship.

Net Asset Value-NAV, for those who adore acronyms-is the holy grail of crypto treasury firms. It whispers sweet nothings about whether a stock is overpriced or criminally undervalued. ETHZilla, clutching its Ethereum reserves like a miser with his last coin, dreams of narrowing the chasm between its share price and NAV by reducing the number of shares in circulation. A classic case of “if we can’t make the pie bigger, let’s just give fewer people forks.” 🍰

McAndrew Rudisill, ETHZilla’s Chairman and CEO (a man whose name sounds like it was generated by a corporate title bot), proclaimed with all the gravitas of a man selling snake oil: “By opportunistically repurchasing shares while our stock is trading below NAV, we plan to reduce the number of shares that are available for stock loan/borrow activity, while increasing the NAV per share of the Company.” Ah yes, “opportunistically.” A word that, in the world of finance, often means “we have no better ideas.”

The remaining funds from the ETH fire sale? Oh, they’re earmarked for more buybacks, because nothing says “long-term strategy” like doubling down on a short-term fix. ETHZilla vows to keep repurchasing shares until the discount to NAV is “normalized”-a term as nebulous as a politician’s promise. Meanwhile, the company still clutches $400 million worth of ETH in its treasury, presumably for the next emergency. Or the next yacht. 🛥️

ETHZilla shareholders: The peanut gallery demands blood

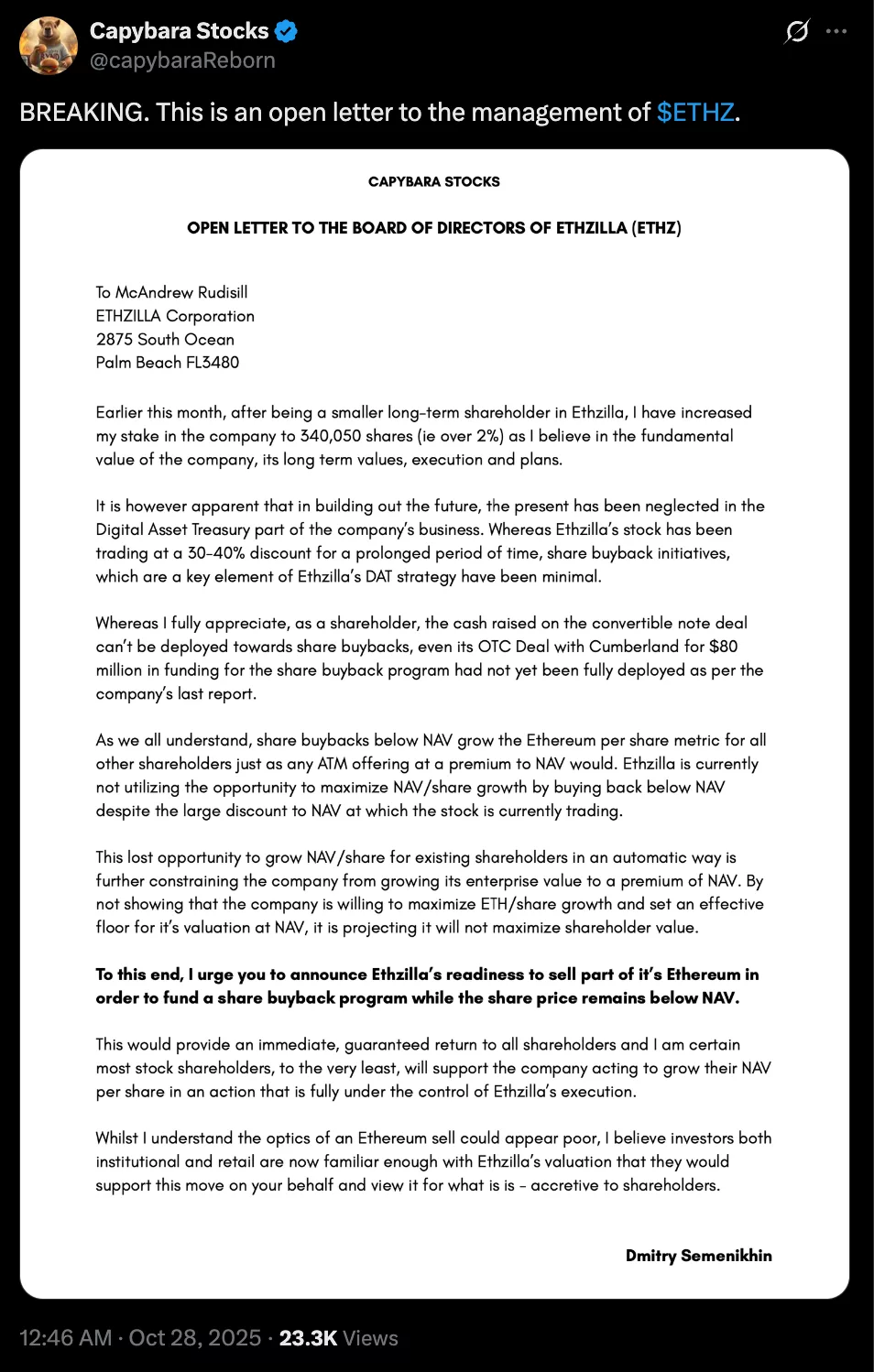

Enter Dimitri Semenikhin, activist investor and professional thorn-in-the-side, who recently acquired a 2.2% stake in ETHZilla-just enough to make noise but not enough to actually do anything. His open letter, dripping with the passive-aggressive charm of a man who knows he’s right, urged management to deploy Ethereum holdings for buybacks. Because, of course, the solution to every problem is throwing money at it until it goes away. See below.

ETHZilla shares, after a month-long existential crisis, suddenly remembered they were supposed to go up-rising 14.5% on Monday to $20.65, then another 14% after hours. Because nothing fuels market enthusiasm like a company frantically buying its own stock while simultaneously investing $15 million in something called “Satschel, Inc.” (Yes, that’s a real name. No, we don’t know what it does either.)

The $250 million buyback program: Because why stop now?

Back in August, ETHZilla’s board-presumably after a long lunch-approved a $250 million share repurchase plan. Because if $40 million won’t fix the problem, surely a quarter-billion will! The latest purchase follows September’s acquisition of 6 million shares, because nothing says “we believe in our future” like buying back our own past.

The repurchase program is set to run until June 30, 2026-because in finance, deadlines are like New Year’s resolutions: made to be broken. Shares will be bought on the open market or through “privately negotiated transactions,” which is corporate-speak for “we’ll whisper sweet deals to our friends when no one’s looking.”

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-28 10:31