Markets

What to know: (Because Ignorance is Bliss, But We’re Here Anyway)

- Ether decided to do a dramatic dive, leading the CoinDesk 20 Index’s nosedive because Trump’s tariffs are apparently the new crypto villain. 🦹♂️

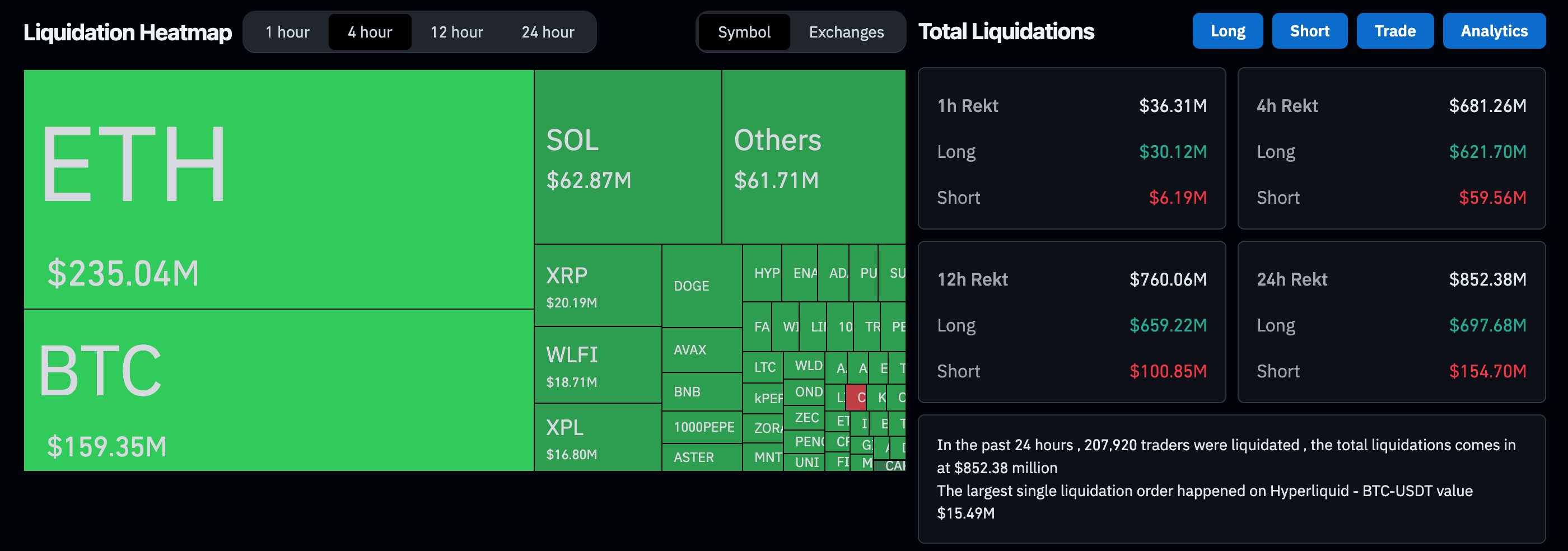

- Over $600 million in leveraged positions got liquidated. That’s right, $600 million. Someone’s yacht fund just took a hit. 🚤💔

- ETH broke through support levels like a bull in a china shop, but hey, there’s *potential* support at $4,100. Buyers, where you at? 🛟

Friday was basically a horror movie for crypto markets, thanks to U.S.-China trade tensions. Trump’s tariff threats were the jump scare no one saw coming. 🎃

Ether took the crown for Most Dramatic Performance, plunging 7% and hitting its lowest since late September. Bitcoin’s 3.5% drop? Cute. The CoinDesk 20 Index’s 5% plunge? Amateur hour. 🏆

The whole thing turned into a liquidation party, with $600 million in leveraged positions saying “bye, felicia.” CoinGlass data doesn’t lie, folks. 🥂💸

ETH led the liquidation parade with $235 million in long positions getting wiped out. Longs? More like *wrongs*. 😬

Technical Breakdown (Or: When Charts Attack)

Behind this mess? ETH’s dramatic breakdown of critical support levels. CoinDesk Research’s technical analysis model is basically the therapist we all need right now. 🛋️

• Selling pressure hit at 14:00 UTC with 372,211 units. That’s almost double the 24-hour average. Someone pressed panic mode. 🚨

• Volume-based resistance at $4,287? More like *resist-a-lot*. 💪

• Primary resistance at $4,141 during a failed recovery attempt. Spoiler: It didn’t recover. 🤡

• Potential support at $4,100? Buyers, if you’re out there, now’s your moment to shine. Or not. 🤷♀️

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2025-10-10 22:40