Ah, Ethereum (ETH), the financial equivalent of that one relative who always shows up to parties slightly late, flustered, and yet somehow still manages to steal the spotlight at $4,470 a pop, after taking a 5.3% stumble this week. Meanwhile, the traders are leveraging and hedging as if their lives depend on it-or at least their coffee budgets do. 🤹♂️

Ethereum’s Week: Price Takes a Tumble, Leverage Sits Tight, Dealers Play Musical Chairs

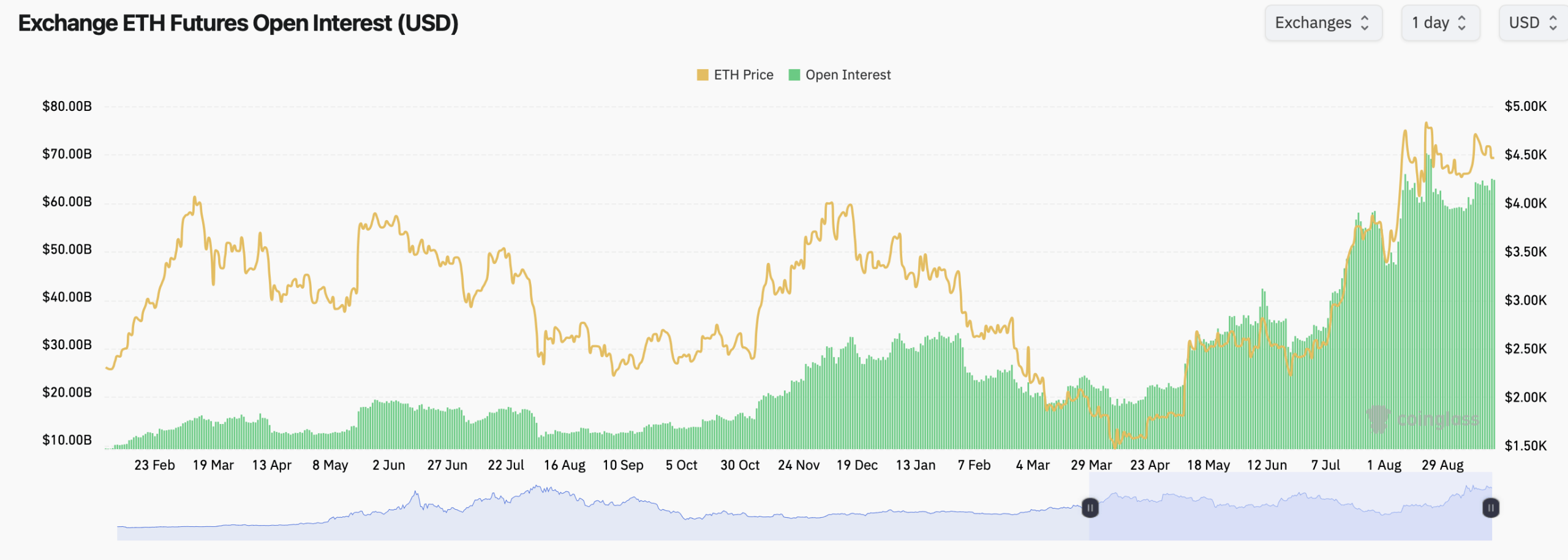

According to those mysterious gods of finance known as exchanges (ethereum, if you’re one to trust names), futures open interest (OI) is strutting around $64.57 billion-roughly 14.43 million ETH-like a cat convinced it owns the place, all courtesy of Coinglass. Markets have been chopping about September as if trying to figure out where the last slice of pizza went.

Binance is still the alpha dog, wagging its tail at around $12.26 billion OI (18.98%), with CME, the stodgy elder, dragging $9.63 billion (14.91%) along like a reluctant donkey. OKX isn’t far behind, about $4.12 billion (6.37%), while Bybit and Gate duke it out in the mid-$5 billion sandbox. It’s like the grand game of “Who’s got the biggest pile of pretend money?”

But momentum, dear reader, is the financial equivalent of your socks disappearing in the laundry. Bybit’s OI popped 6.28% in 24 hours, while Binance sneezed and slipped 0.33%, and CME barely moved-like a Victorian butler unsure if it’s on the clock. Meanwhile, Kucoin and Bitget added a cheeky 2.7% to 4.6%, and BingX just vanished double-digits, proving that sometimes the market behaves like a cat thrown in a fountain. The weekend? Hedge fund managers nervously rearranged their chairs rather than their exit routes. 🚪💺

On the options side (which is like betting on whether the duck race will take a nap mid-race), the crowd leans bullish, but only just enough to keep things interesting. Calls outnumber puts 61.11% to 38.89%, a delicate waltz of optimism holding a rather soggy umbrella of caution. The last 24 hours’ volume was split 54.53% in calls and 45.47% in puts-roughly 118,475 ETH to 98,789 ETH. Essentially, it’s like watching a penguin consider flying but deciding a swim was more their speed.

Open interest ranks chuck a chunky chalk outline around the $4,000 strike price: the single largest gathering is a Deribit 26SEP25 $4,000 put with 120,550 ETH, followed by December calls at $6,000 (92,667) and $4,000 (74,481). There are also some starry-eyed bets at $7,000 and $5,000 for December, plus September calls nestled between $3,600 and $4,700-you know, all the usual suspects in a financial soap opera. Dealers will feel those magnets pulling like a fridge full of “I should eat this” leftovers.

Max pain, the oddly named villain of this story, lounges somewhere in the mid-$4,000s until late September, then dips to around ~$3,600 before rebounding like a caffeinated kangaroo into Q4. December’s bumps wobble lower, which means ethereum bears are still getting their grumpy face on for the late-year party. If the price hovers near $4,450-$4,550 during the roll, call sellers will be popping confetti-though, sad trombone, not the good kind. 🎉🥲

Futures open interest has been climbing alongside a choppy price recovery since early summer. The green bars push toward cycle highs just as spot prices decide to take a breather, indicating that basis traders are probably on very strong coffee while directional traders wait for the next exciting plot twist. In the meantime, dealers likely prefer to fade impulsive moves-because why leap when you can cautiously shuffle?

Bottom line: Ethereum’s recent tumble didn’t scare off the leverage-hungry crowd; it just got them to rearrange their piles. Binance’s heap of OI and CME’s refined presence, coupled with a slight call-heavy options skew and max-pain pounding in the mid-$4,000s, spell out a grinding range filled with traps more twisted than a conspiracy theorist’s twist tie. The sensible strategy? Trade the levels, not the drama. Because the floor is lava, but also slightly sticky. 🔥🕺

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-20 19:08