Oh, dear Ethereum! After a jolly little bounce back in December, our beloved crypto is inching up like a tortoise on a lazy afternoon. But lo and behold, it has stumbled upon a rather hefty roadblock in the form of a multi-month resistance cluster around the $3.3-$3.5K mark. Quite the pickle, isn’t it?

Now, don’t be too quick to boo-hoo! The price structure looks as promising as a chocolate cake at a kid’s birthday party, and the on-chain activity is popping up like toast from a toaster! But here’s the kicker-ETH is dancing right beneath that pesky resistance. The next few days will serve as the grand finale: will we see a glorious breakout or will we just get another slap back into the range? 🎭

Ethereum Price Analysis: The Daily Chart

In the magical land of daily charts, ETH has bounced up more cheerfully than a puppy chasing its tail from the green demand zone at $2.7K, pushing into the key supply area at $3.3-$3.5K. This delightful zone is cozying up with the 100-day moving average, while the 200-day is perched even higher, waiting to rain on our parade with some dynamic resistance.

As long as the price stays above the marvelous $3K area, the structure remains a series of higher lows-like a rollercoaster that just keeps climbing! If we can close above $3.5K, we might just unlock the mystical door to the psychological $4K level. But beware! If it tumbles below $3K, we could find ourselves back at the $2.7K support block, whimpering like a lost kitten.

ETH/USDT 4-Hour Chart

On the enchanted 4-hour chart, ETH has been frolicking inside a symmetrical triangle, creating a whimsical dance of higher lows and lower highs. But wait a tick! It has recently burst through the pattern like a jack-in-the-box, now testing the blue resistance band around $3.3-$3.4K. That last leap was accompanied by an overcooked RSI signal, leading to a bit of a sideways shimmy and pullback. Talk about drama! 🎪

In the short term, keep your peepers peeled for the local support near the $3K zone and the rising trendline lurking just below at the $2.9K level. If those hold their ground, buyers might just summon another breakout attempt above $3.4K. But if we see a clean break below the lower trendline, watch out! Sellers will come marching in, and the $2.5K zone may reappear like an unwanted guest at a tea party.

On-Chain Analysis

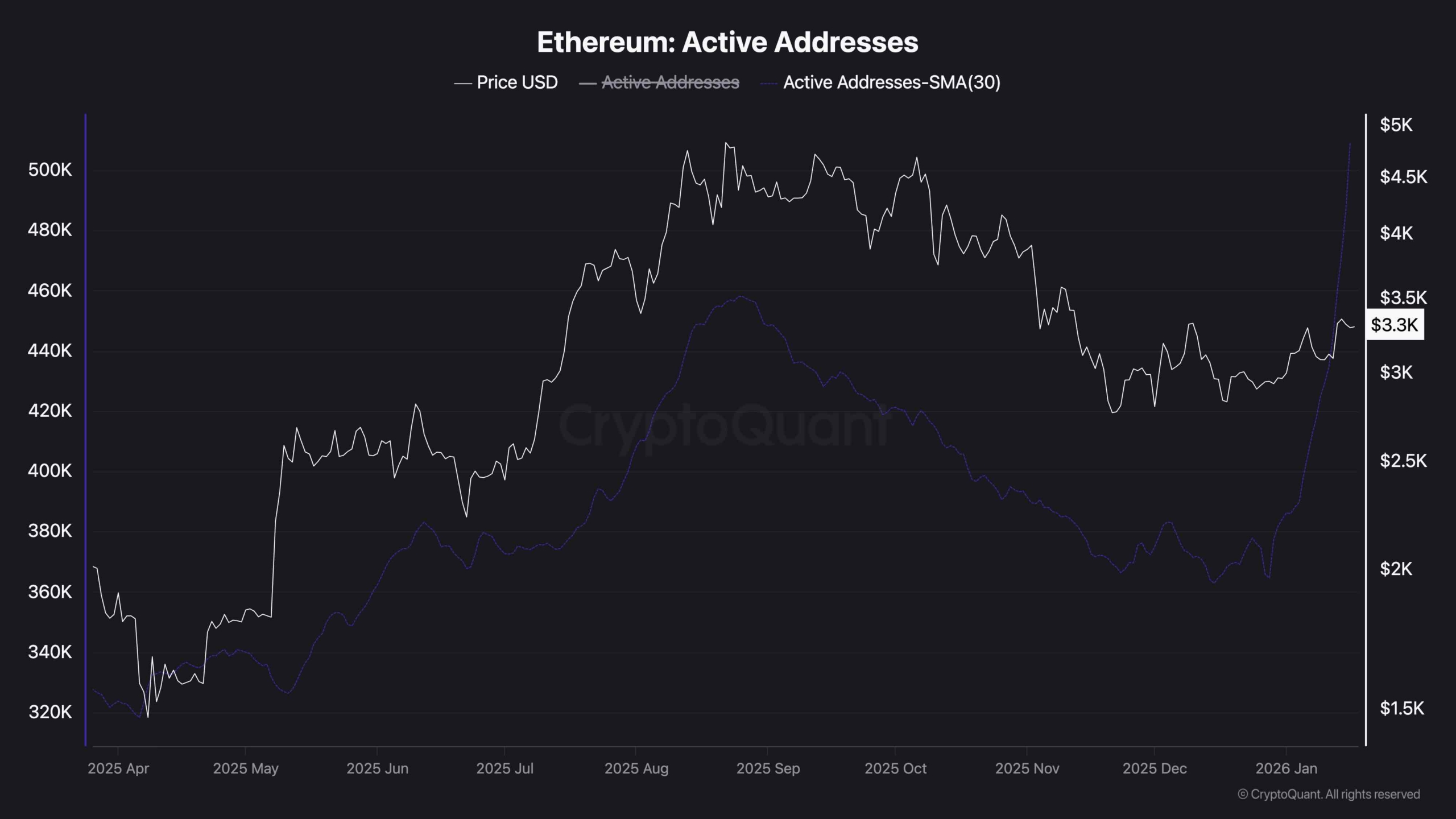

The 30-day moving average of Ethereum active addresses has been trending up like a hot air balloon since the start of this year, soaring above last year’s highs while the price still plays hide-and-seek with its prior peaks. Quite the dramatic twist!

This enormous surge in active addresses usually signals an improving organic usage and network demand-much like discovering an extra cookie in the jar after you thought it was empty! But beware, dear reader! Spikes in activity just under resistance have been known to coincide with local tops when the price decides to play hard to get.

If active addresses continue to rise while ETH finally breaks free past $3.5K, we’re in for quite the joyride! But if activity starts to wane while prices stall, we might just be headed for a deeper cool-off back into the lower support zones-oh, what a rollercoaster! 🎢

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2026-01-17 19:02