Alright folks, gather ’round! Ethereum is like that overachieving kid in class-everyone’s watching, nobody’s sure if it’ll ace the test or accidentally blow up the lunchroom. With exchange outflows climbing like your Aunt Edna’s blood pressure and stablecoin circulation doing backflips, Ethereum’s the star of the crypto soap opera this week!

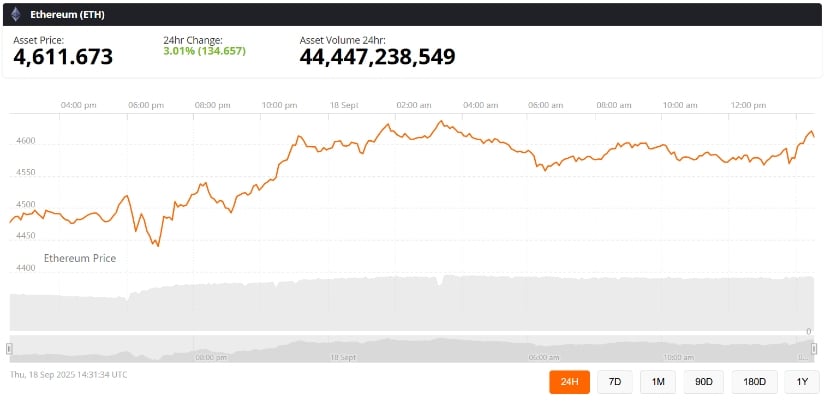

Ethereum Price Today and Market Context

Picture this: Ethereum struts around $4,605 like it owns the place, but it’s politely knocking under the $4,638-$4,665 velvet ropes of resistance. The buyers? Oh, they’re playing security guard around $4,520-$4,547, backed by some fancy exponential moving averages (EMAs)-or as I like to call them, “EMA-nently crucial support.” Despite the U.S. Federal Reserve’s looming decisions (which are spookier than a horror flick), Ethereum’s trend says, “I’m still in the game, baby!”

Now, here’s the kicker: the Fed might cut interest rates by 25 basis points this week. Historically, that’s like throwing a bone to ETH, which tends to gain an average 12% after such moves. So put on your party hats! 🥳

Analysts Eye $5,500 Target

Our dear market sage @crypto_goos shared on X (because who goes to Twitter anymore?) that Ethereum just busted out of a descending triangle pattern. That’s crypto speak for “things are looking up, and fast.” He’s betting on Eth to hit $5,500, a price higher than your hopes after three cups of coffee.

Meanwhile, @LaCryptoMonkey-the trader who probably talks to bananas for tips-reminded us that $4,770 is the magic number for support, courtesy of August’s low swings. Waiting for this zone to confirm is like waiting for the perfect joke setup-timing is everything!

Basically, the charts and on-chain whispers agree: buy, hold, or forget your popcorn ’cause volatility might just give us a show.

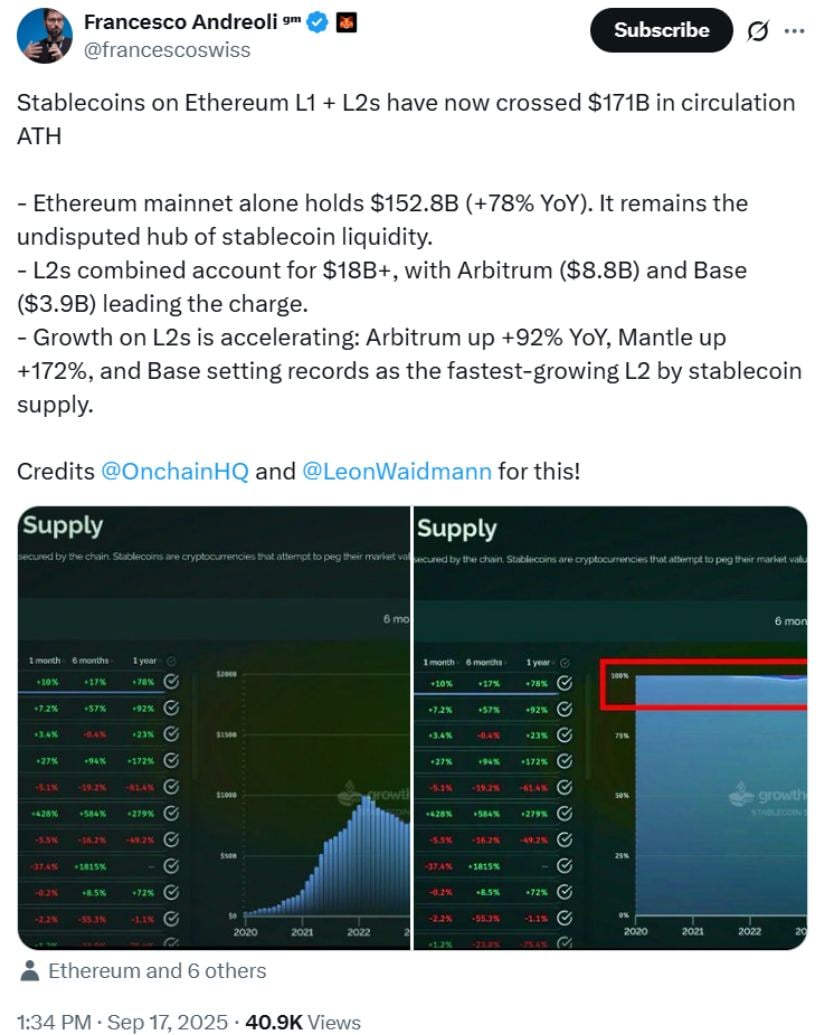

Stablecoin Liquidity Surges to $171B

Ethereum’s DeFi game? It’s not just good, it’s Batman-level serious. Francesco Andreoli reports stablecoins on Ethereum’s Layer 1 and Layer 2 networks have ballooned to a jaw-dropping $171 billion. That’s enough to buy a moon, a star, or maybe a few Teslas for Elon’s next party.

Of that jackpot, Ethereum mainnet waltzes away with $152.8 billion-a 78% year-on-year boost! Meanwhile, Layer 2 networks like Arbitrum and Base are flexing with billions too, and newbies Mantle and Linea are basically growing like weeds on a crypto summer day.

Translation? Ethereum’s stacking cash and cementing its spot as the DeFi lemonade stand everyone’s lining up at.

Ethereum Technical Analysis: Key Levels to Watch

We got charts showing ETH crawling up that ascending trendline since September, making higher lows like it’s climbing Mount Everest wearing loafers. The Supertrend indicator switched to bullish mode, chilling around $4,639-right on the resistance doorstep.

-

Upside goals: $4,638, $4,700, and $4,820-then maybe a rocket ride to $5,000-$5,500 if things get spicy.

-

Downside cushions: $4,547, $4,476, and $4,370-with $4,200 playing the role of the safety net. It’s like Ethereum’s wearing an emotional support blanket.

The RSI’s sitting comfy near the mid-50s, so no overselling drama yet. And don’t forget the 100-EMA and 200-EMA are hanging around $4,493 and $4,370, ready to catch ETH if it trips on its own ascension.

Looking Ahead: Will Ethereum Go Up?

The big question-can Ethereum hop over the $4,638-$4,665 resistance fence? If yes, it’s straight to $4,820 and maybe, just maybe, a smashing debut at $5,500. The bulls are dreaming big-call it crypto’s version of Cinderella’s ball!

Sure, there’s a chance of ETH slipping below $4,476-a downfall no one wants, like a bad sequel nobody asked for-but steady stablecoin inflows and on-chain hoarding say, “Nah, we got this.” Ethereum’s struttin’ bullishly, folks, enjoying its rising cycle like a diva on opening night. Bravo! 🎭💃

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-18 23:57