Ah, Ethereum—our beloved second fiddle in the orchestra of cryptocurrencies—has grudgingly chosen to dance again after a prolonged nap that could rival a bear’s winter slumber. This week, it burst through that stubborn price barrier like a cat knocking over a priceless vase: sudden, chaotic, and impossible to ignore.

Active Addresses: Up Like Zombies at a Midnight Party

According to the ever-watchful CryptoQuant seer, Carmelo Alemán, Ethereum’s network woke up from its crypto slumber between April 20 and April 22, with active addresses skyrocketing from a modest 306,000 to a rowdy 336,000. A nearly 10% surge! One might say the blockchain’s getting a bit too hot to handle—fire alarms, anyone? 🔥

“Ethereum is Heating Up!”

“Active addresses jumped from 306,211 to 336,366, a 9.85% leap in 48 hours – proof that traders finally remembered Ethereum exists.” – @oro_crypto

Read all the drama unfolding

— CryptoQuant.com (@cryptoquant_com) April 23, 2025

This fresh outbreak of activity usually signals market moods swinging like a drunk ballerina—hope, fear, greed, and maybe a smidge of common sense all tangled in a thrilling mess. Analysts, armed with their crystal balls, often regard these spikes as the early whispers of price gyrations.

The Price Plays Hard To Get—Then Surprises You

Ethereum wrestled stubbornly below $1,640 for what felt like an eternity—perhaps because it enjoys the struggle—but finally scaled that grim fortress and sprinted past $1,780 with the gusto of a caffeinated hedgehog.

Buyers, usually shy as a monk in a tavern, have suddenly stepped into the spotlight, nudging prices beyond both the 10-day and 20-day moving averages. This is crypto’s version of showing off at a dull party.

The relative strength index hovers just above 50, wobbling like a tightrope walker who’s had one too many, hinting at some bullish energy without tipping into reckless overenthusiasm.

Technical Indicators: A Mixed Bag of Fortune Cookies

Some indicators are cheering wildly, others are giving grim warnings. The moving average convergence/divergence (MACD) tentatively whispers about a possible trend reversal, while the stochastic RSI is flirting with exhaustion—like a partygoer who’s not ready to go home but is looking a bit droopy.

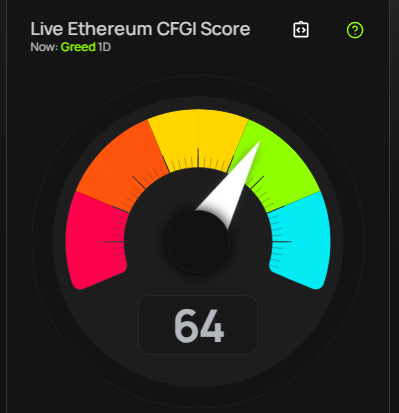

Price prophecies foresee a 6.5% tumble down to $1,652 on May 24, 2025. Meanwhile, the Fear & Greed Index lounges smugly at 64, comfortably eating popcorn in the “Greed” section of the theater.

And in the last moon’s cycle, Ethereum had a respectable 40% of green days—a polite little wave amid the tempest—with volatility at a modest 9.26%, as CoinCodex reluctantly reports.

Network Usage: The Quiet Wallflower

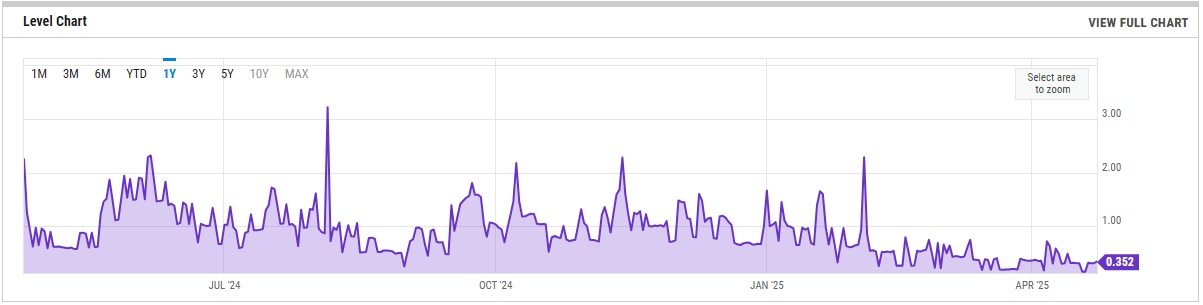

Despite the hustle of prices, Ethereum’s network usage remains stubbornly low, with transaction fees at a laughably modest $0.31. It’s as if everyone enjoys the party but no one wants to dance—a crypto conundrum wrapped in a blockchain enigma.

Still, with active addresses rising and Ethereum perched defiantly above previous resistance, some wily strategists squint through their charts, wondering if the tiny flame flickering now could blaze through to the vaunted $2,000 mark—or simply burn out with a smoky sigh.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-04-25 06:09