- Whales flee like it’s Black Friday, leaving Ethereum’s bullish dreams in tatters. 🐋🏃♂️

- On-chain metrics scream “Sell!” as exchange reserves balloon like a bad soufflé. 📉🎈

Ethereum [ETH] has witnessed a staggering 63.8% plunge in large transactions since February 25, as whales abandon ship faster than rats on a sinking vessel. Over the past fortnight, these aquatic giants have offloaded over 760,000 ETH, flooding the market with selling pressure. 🐳💧

Adding to the drama, a long-term Ethereum holder recently cashed out their remaining 2,001 ETH for $3.82 million, after initially scooping up 5,001 ETH at $277 back in 2017. Talk about timing the market—or maybe just timing the exit. 🕰️💸

These sales suggest that the big players are reducing their exposure, perhaps anticipating further price drops or simply shifting their strategy. Either way, it’s not a good look for Ethereum. 🎭📉

With whales exiting stage left, retail investors are left holding the bag, struggling to absorb the selling pressure. This makes Ethereum more volatile than a caffeinated squirrel. 🐿️⚡

Unless demand makes a swift comeback, Ethereum could face short-term downward pressure. The next few days will be crucial in determining whether the market finds new support or continues its descent. 🕰️📉

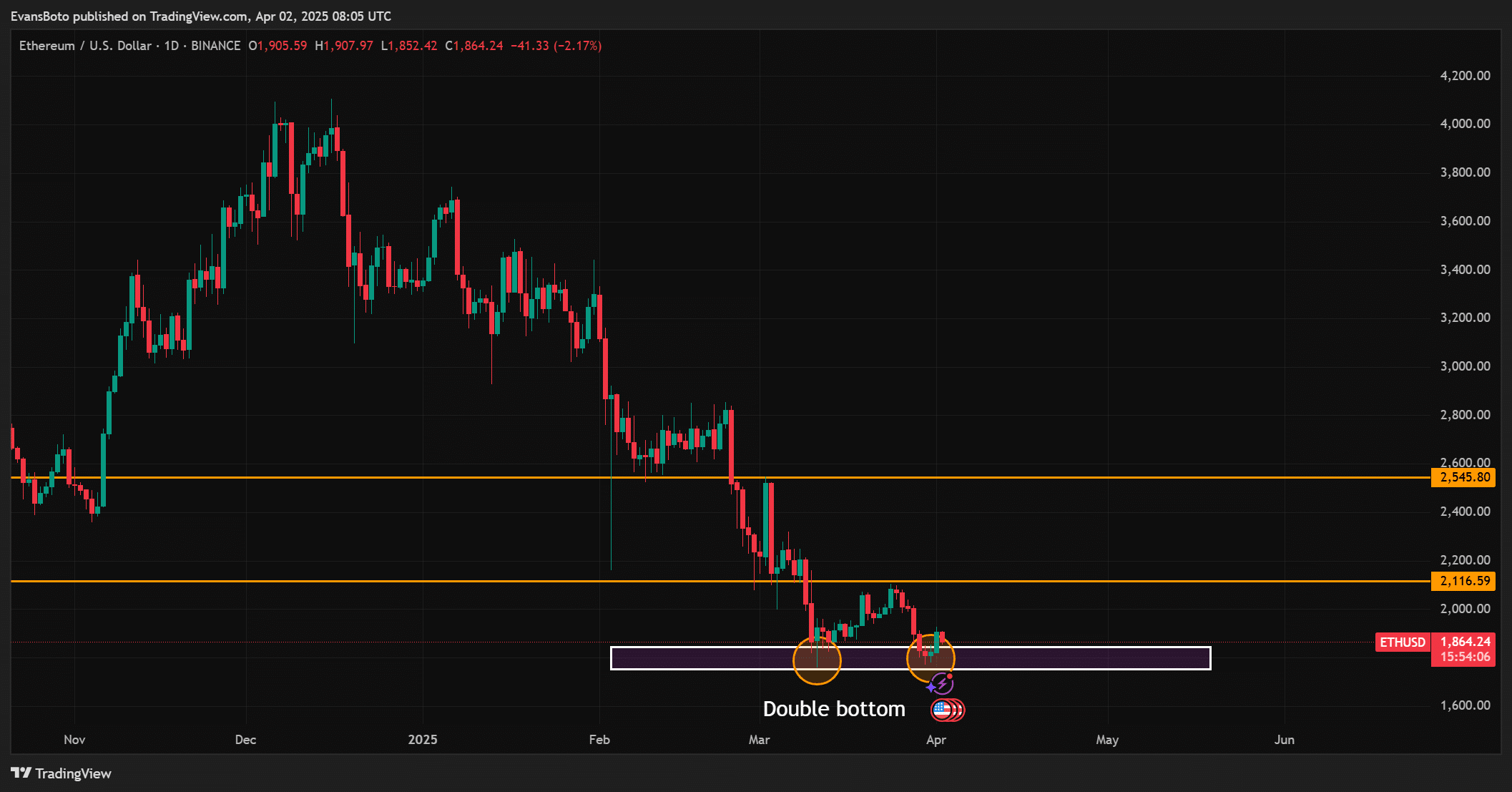

Ethereum’s Double Bottom: A Bullish Mirage or a Lifeline? 🐂🕳️

At the time of writing, Ethereum was trading at $1,863.12, reflecting a modest 0.53% daily increase. 🤑📈

The price action hints at a potential double bottom near the $1,800 support zone, suggesting that bulls might be attempting a comeback. But let’s not pop the champagne just yet. 🍾🐂

Ethereum’s price remains below critical resistance levels at $2,116.59 and $2,545.80, which are essential for confirming a bullish reversal. Without breaking above these levels, the current rebound could be as short-lived as a New Year’s resolution. 🎉📉

While the structure of this bounce shows a glimmer of optimism, the overall trend remains cautious. Recent whale exits and low market participation significantly dampen the likelihood of a sustained breakout. 🐋🚫

As a result, the $1,800 support level becomes a critical threshold; if breached, it could lead to accelerated selling. To prevent further declines, bulls must act decisively and with strength. 🐂💪

Liquidation Data: The Resistance Wall ETH Bulls Can’t Climb 🧱🐂

The 24-hour liquidation heatmap on Binance showed significant activity between the $1,900 and $1,950 range. This indicates a high concentration of leveraged traders being forced out of their positions, creating short-term resistance. 🧨📉

Ethereum has struggled to maintain levels above this range, highlighting a lack of buyer confidence. To regain upward momentum, ETH needs to build stronger bullish support and break through this zone. 🐂💥

If the price continues to stall below these levels, bears could seize control. Strong liquidation walls often act as barriers, trapping price action within a sideways trading range. 🐻🧱

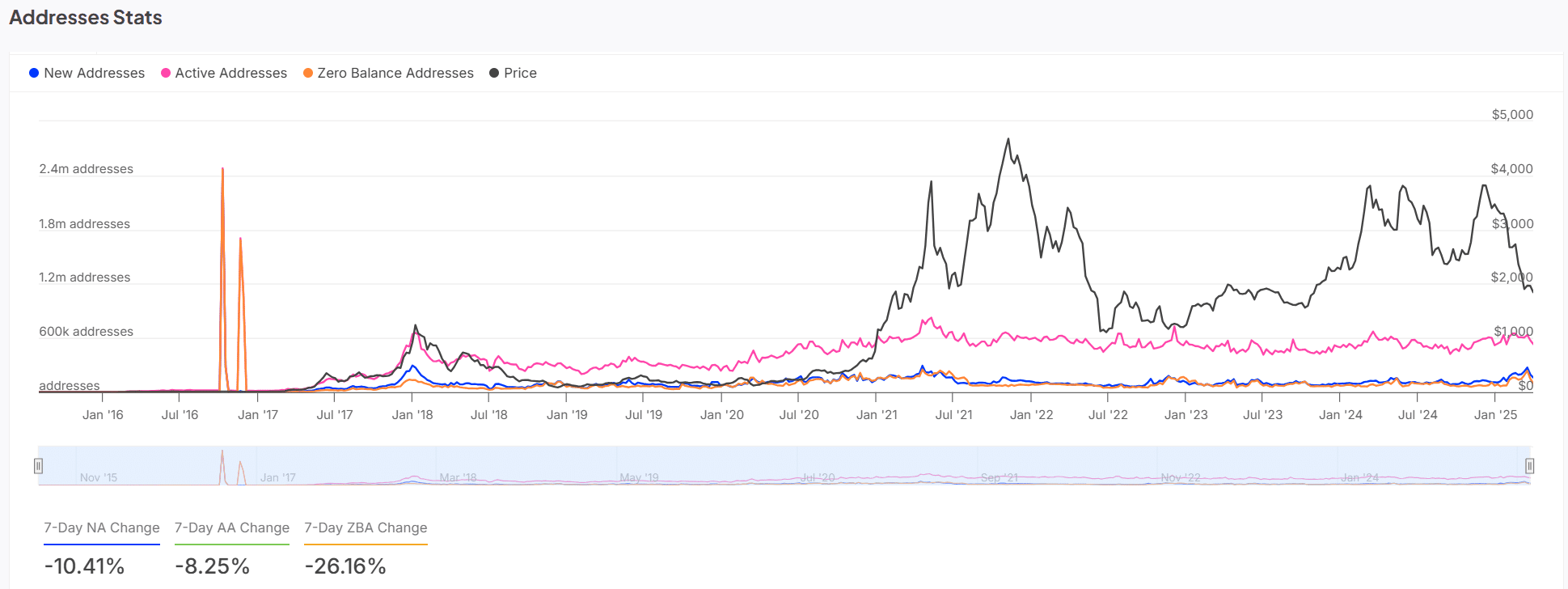

Address Stats: The Ghost Town of Ethereum 🏚️👻

Ethereum’s on-chain metrics reveal a decline in user activity. Over the past week, new addresses decreased by 10.41%, and active addresses dropped by 8.25%. Simultaneously, zero-balance addresses increased by 26.16%, signaling a rise in wallet abandonment. 📉🏚️

These trends indicate a pullback by both new and existing users, highlighting a contraction in network participation. This decline reflects weakening demand fundamentals. 🏚️📉

As fewer users transact or hold Ethereum, market stability weakens further. Consequently, low user engagement could amplify bearish pressure in the coming weeks. 🐻📉

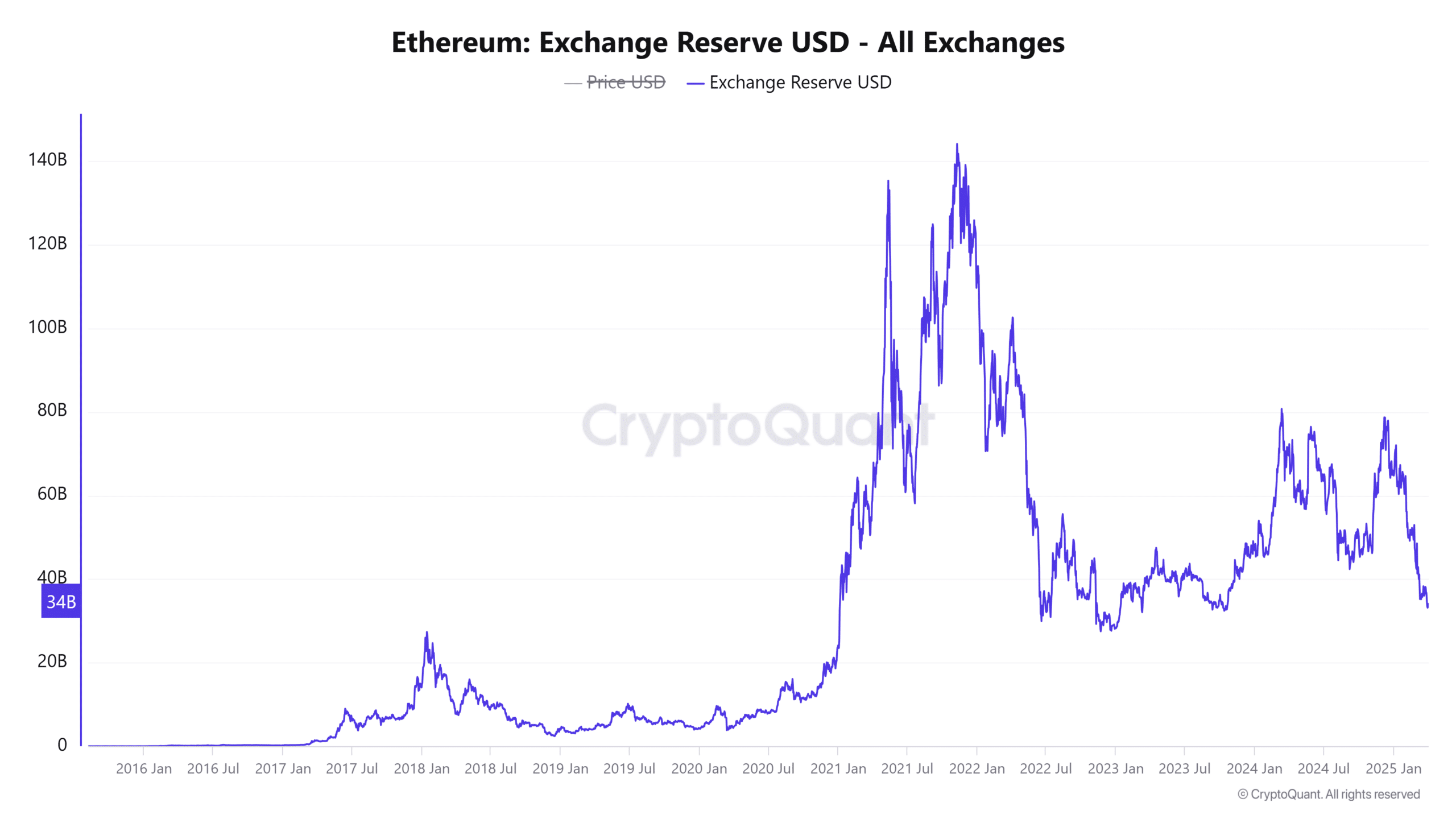

Ethereum Exchange Reserves: The Sell-Off Tsunami 🌊💸

The total value of Ethereum held on exchanges has increased to $33.98 billion, up by 0.77% over the past 24 hours. Rising exchange reserves often indicate that more investors are preparing to sell rather than hold. 🏦📉

This behavior aligns with the wave of whale exits and reduced on-chain activity. Therefore, elevated reserves suggest that further downside pressure could emerge if demand does not pick up. 🐋📉

Sellers currently dominate the sentiment, and until this trend shifts, price action may continue to face resistance. 🏦📉

What’s Next for ETH: A Correction or a Catastrophe? 📉🌪️

Ethereum appears to be headed for a short-term correction. A 63.8% decrease in whale transactions, a 0.77% rise in exchange reserves, and a 26.16% uptick in zero-balance addresses all indicate weakening demand and heightened selling pressure. 📉🐋

While the formation of a double bottom pattern hints at the possibility of a rebound, the absence of strong buying momentum increases the likelihood of a further decline. 🐂📉

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2025-04-02 15:09