Ah, Ethereum (ETH), that capricious creature of the digital realm! After a rather dramatic plunge, courtesy of the Bybit hack, it has decided to don its finest attire and make a comeback. Yet, let us not forget, dear reader, that it still languishes nearly 18% below its former glory over the past month, a testament to its volatile nature.

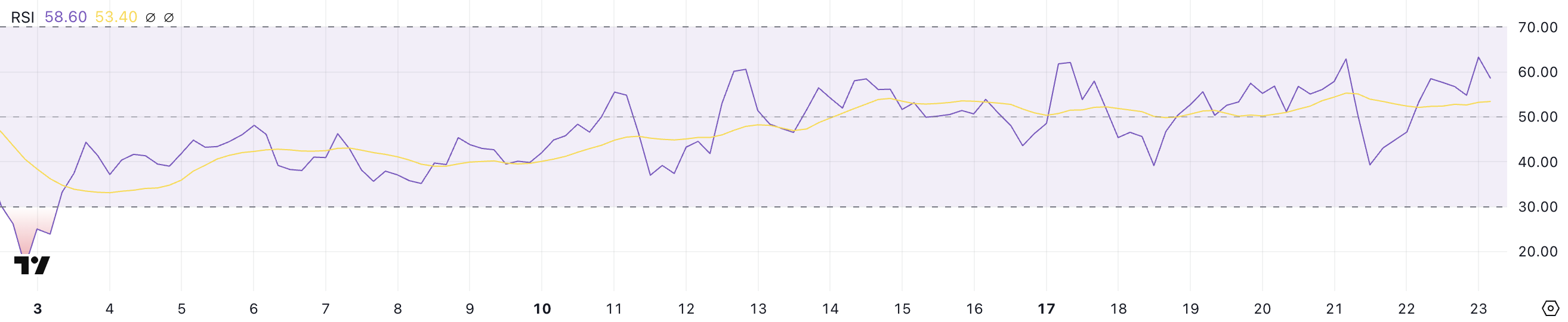

In a twist of fate, ETH’s RSI has bounced back to a respectable 58.6 from a dismal low of 39.2 during the sell-off. This resurgence hints at a flicker of renewed buying pressure, as if the market is slowly awakening from a long slumber, perhaps dreaming of price gains if the momentum holds. 💤💰

ETH RSI: A Phoenix Rising from the Ashes

ETH’s RSI now stands at 58.6, a remarkable leap from the depths of 39.2 it reached post-hack. This recovery is akin to a breath of fresh air after a long winter, reflecting the buying momentum that has returned since the sharp decline.

This upward trajectory in RSI suggests that the buying pressure has returned, much like a long-lost friend, helping Ethereum stabilize and perhaps paving the way for further price gains if the momentum continues. 🌱

Now, let us ponder the enigmatic RSI, or Relative Strength Index, a momentum oscillator that measures the speed and change of price movements. It dances between 0 and 100, with thresholds at 30 and 70, much like a tightrope walker balancing precariously.

When the RSI dips below 30, it is deemed oversold, a siren call for potential buying opportunities. Conversely, an RSI above 70 is a warning bell, signaling a possible price correction. Currently, ETH’s RSI is in a neutral zone, leaning ever so slightly towards bullish momentum, suggesting there is still room for growth before it reaches the overbought territory. 🌈

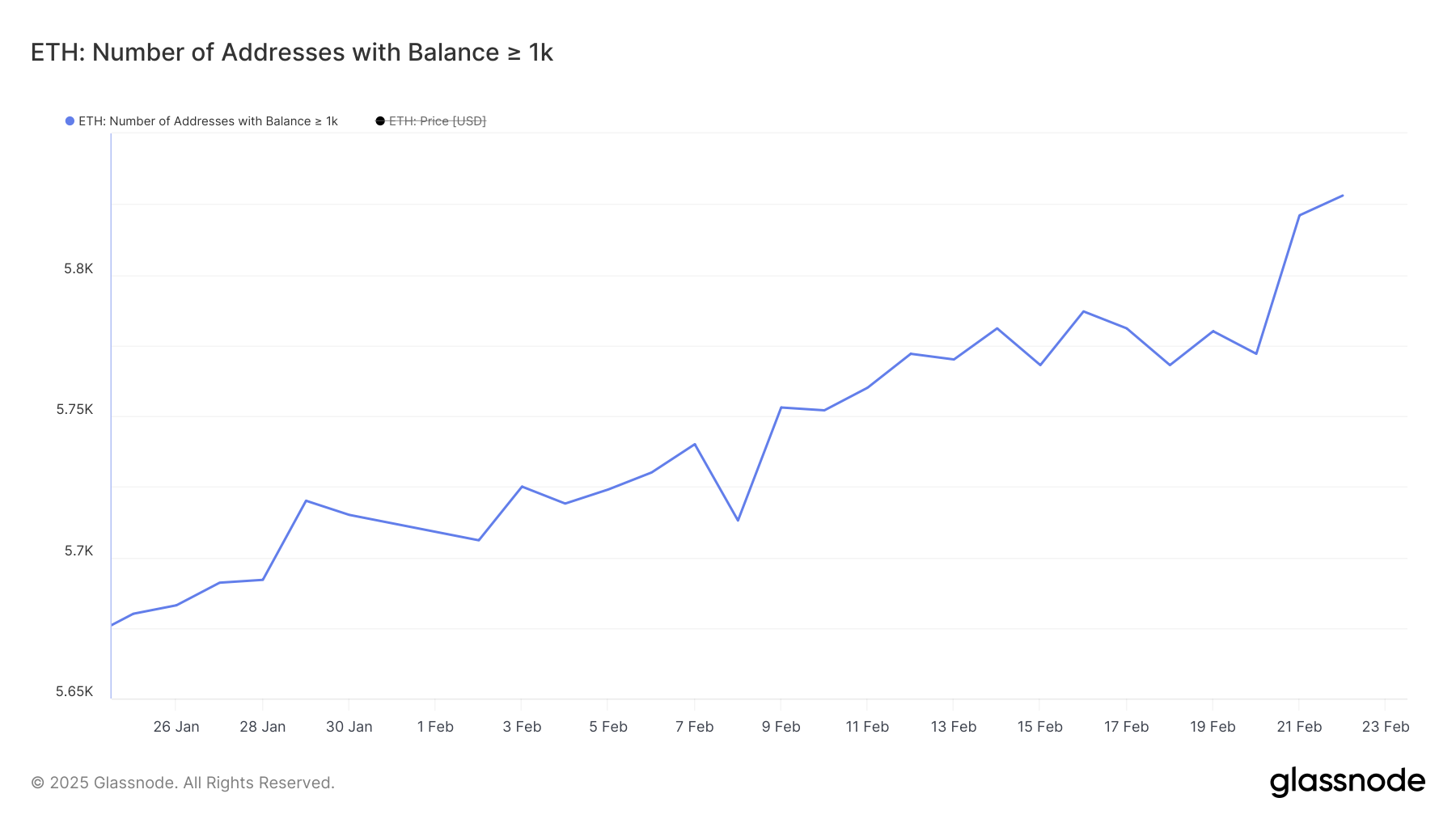

Ethereum Whales: The Silent Accumulators

In a curious turn of events, the number of Ethereum whales—those addresses holding at least 1,000 ETH—has been steadily increasing. From 5,680 on January 25 to 5,828 on February 22, we witness a rise that echoes the highest levels since December 2023. 🐋

This surge signals a renewed interest among large holders, perhaps institutional investors or high-net-worth individuals, who are building their positions, anticipating future price gains. Especially between February 21 and February 22, when ETH prices took a nosedive post-hack, these whales have been quietly accumulating, laying the groundwork for a potential price rise.

Tracking these Ethereum whales is akin to watching a game of chess; their buying and selling behavior can significantly sway the market. When they accumulate, the circulating supply diminishes, potentially driving prices up as demand meets reduced availability. Conversely, when they sell, it can create a downward spiral, much like a soap opera plot twist. 🎭

Currently, the rise in whale addresses indicates a growing confidence and bullish sentiment among large investors. While this is the highest level since December 2023, it remains relatively low compared to historical data, suggesting there is still room for more accumulation. If this trend continues, we may witness a sustained upward movement in ETH price as demand outpaces supply.

Will Ethereum Finally Break the $2,900 Barrier?

Ethereum’s EMA lines whisper of a golden cross forming soon, a signal of a bullish trend and potential upward momentum. If this occurs, Ethereum may first test a price level near its long-term line (the blue line in the chart) around $2,876. Should it break this resistance, the door may swing wide open for a move to $3,020. 🚪💨

If the uptrend continues with vigor, ETH could even reach heights of $3,442, a lofty ambition indeed!

However, dear reader, ETH has faced challenges in reclaim

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-02-23 16:46