As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed the rise and fall of countless assets, but none quite like cryptocurrencies. The ever-evolving landscape of digital currencies has been an exciting rollercoaster ride for me, especially Ethereum.

In my early days as a research analyst, I remember when Ethereum was barely a blip on the radar, and many dismissed it as just another altcoin. But its unique value proposition in the form of smart contracts and decentralized applications has proven to be a game-changer. The recent data points towards a robust backing from deep-pocketed investors, despite the temporary dip in whale netflow late last year.

The ongoing accumulation by prominent whales and the influx of new entrants into the network have me optimistic about Ethereum’s potential for growth in 2025. While short-term price turbulence may persist, I believe that Ethereum has the catalysts to stage a decisive breakout and close the performance gap with Bitcoin.

However, as with any investment, it’s essential to remain cautious and well-informed. As my grandfather used to say, “The market can stay irrational longer than you can stay solvent.” So, let’s keep an eye on those whales, the developer ecosystem, and transaction efficiency improvements while enjoying the ride!

Oh, and as a final note, remember that investing in cryptocurrencies is like playing a game of chess with a penguin – it may not always make sense, but it sure can be entertaining!

It seems that some big investors reduced their ETH holdings towards the end of last year, but now, other significant investors are buying more ETH. This suggests that Ethereum, the second-largest cryptocurrency by market capitalization, still has strong support from major players.

Experts continue to be hopeful that increased whale involvement and robust foundations will help Ethereum reach higher price points within the next few months. Essentially, this implies a favorable outlook for Ethereum’s price in 2025.

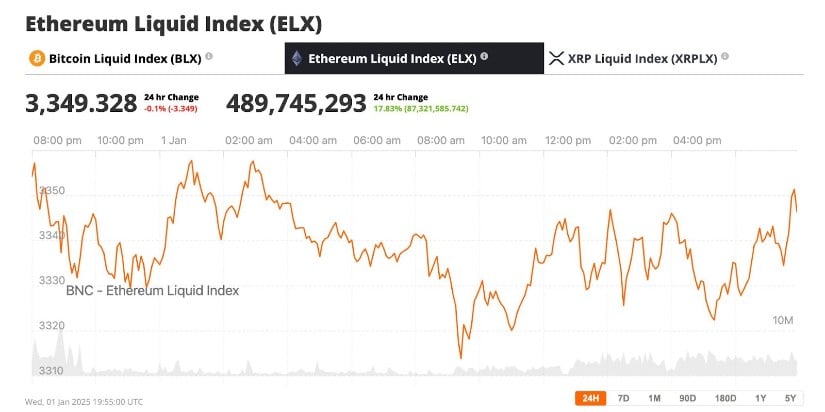

2024 data revealed a significant 73% decrease in whale netflow, indicating possible hesitance among major investors. However, an unexpected event occurred in January 2025 when a notable whale bought over 22,000 ETH around the $3,300 price point. This action demonstrated a contradictory perspective: although there may be temporary market fluctuations, influential players continue to perceive opportunities for substantial profits in the immediate future.

Simultaneously, on-chain analysis suggests a vibrant and changing landscape in Ethereum. The number of new Ethereum addresses has grown by more than 3% during the past week, indicating fresh participants joining the network. While active addresses momentarily dipped, this decrease is perceived as a temporary pause rather than a broader decline, due to recent whale activity and the overall robustness of the ecosystem.

Sideways Price Action and Near-Term Targets

Following a prolonged period where Ethereum was trading around $3,500, it has encountered multiple attempts to break out of its price range. Technical indicators like the Moving Average Convergence Divergence (MACD) and Buy-Sell ratios have fluctuated between slightly bearish and bullish readings, causing some traders to stay on the fence.

Nevertheless, many industry experts believe that if Bitcoin surpasses the $3,800 threshold, it might trigger an upward trend towards $5,000. This potential occurrence seems to be contingent upon strategic buying by significant investors (whales) and a general enhancement in market optimism.

Competition with Bitcoin, But a Unique Value Proposition

In 2024, Bitcoin surpassed many cryptocurrencies in terms of performance, but when it comes to Ethereum’s developer ecosystem and Web3 integrations, nothing else comes close. The world of decentralized applications (dApps), DeFi protocols, and non-fungible token (NFT) platforms heavily depends on Ethereum’s network. Despite the occasional surge in fees and the increasing use of Layer-2 networks, Ethereum remains the go-to platform for pioneering blockchain innovation.

As a crypto investor, I ponder if Ethereum (ETH) can surge past $4,000 or even $5,000 in the remainder of this year. The key factors that will determine its success are:

1. Continued backing from significant ‘whale’ investors.

2. Attracting more retail users by offering a user-friendly and appealing experience.

3. Delivering enhanced transaction efficiency through recent and upcoming upgrades.

If these elements fall into place, Ethereum could witness a powerful surge, potentially narrowing the performance gap with Bitcoin.

As a crypto investor, I firmly believe that Ethereum’s pivotal position within the digital currency market makes it resilient even amidst short-term market fluctuations. With larger investors utilizing the sideways movement to amass holdings, the foundation is being laid for Ethereum to regain its footing and possibly reach unprecedented heights by 2025. The optimistic forecast for Ethereum’s price in 2025 persists.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-02 15:36