Recently, the movement of Ethereum‘s price has attracted notice, as the leading altcoin has found it challenging to surpass the resistance at $3,721.

As a crypto investor, I can attest that the obstacle still looms large as Ethereum strives to reclaim lost territory and approach its peak of $4,107 from December 2024. While some of us remain hopeful, recent market corrections have served as a reminder of why others exercise caution.

Ethereum Investors Are Sending Mixed Signals

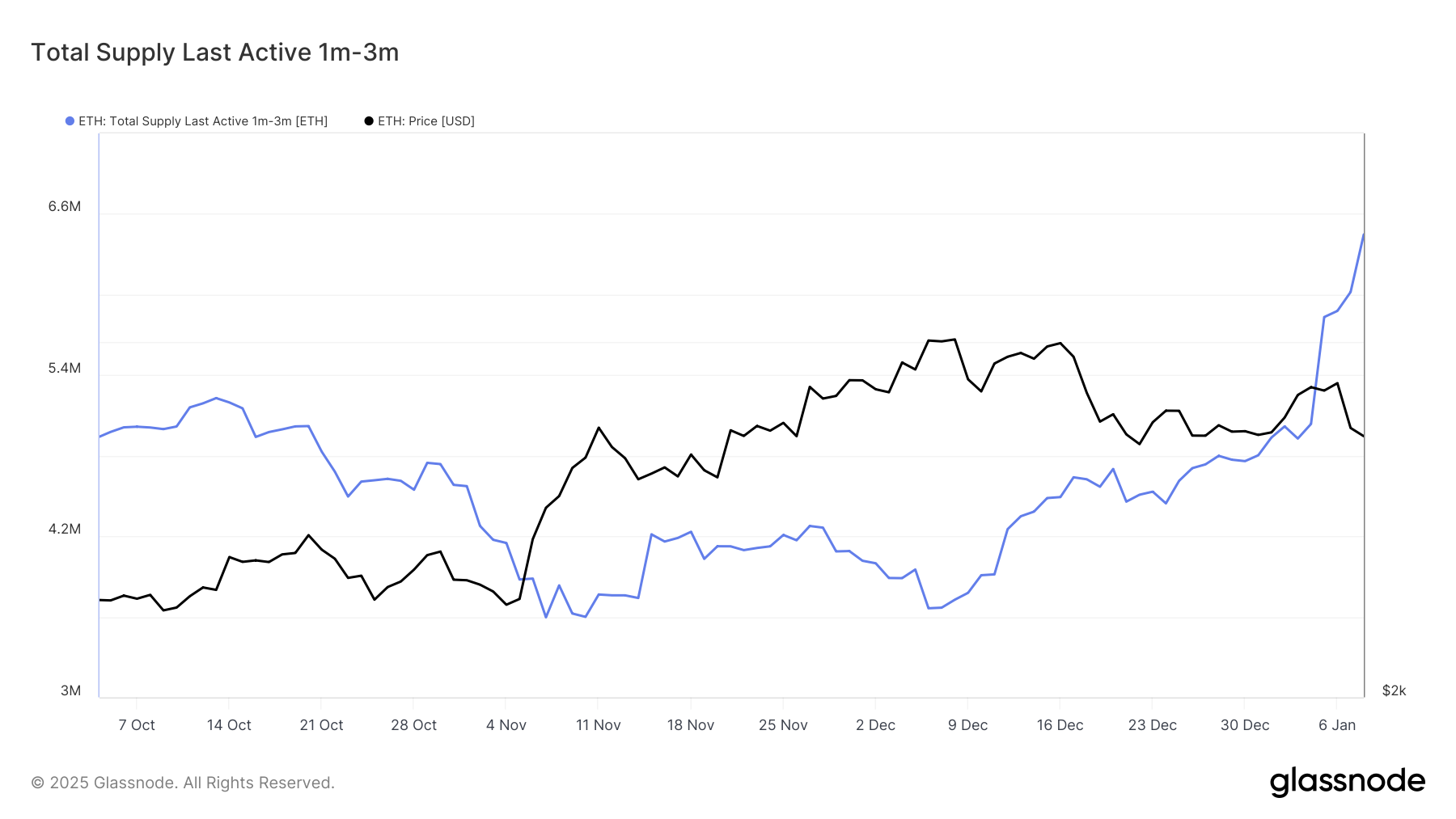

The amount of Ethereum in circulation, held between one and three months, has significantly risen, indicating a growing confidence among investors. In the last week alone, this group’s Ethereum holdings have grown by approximately 1.52 million ETH. This pattern implies that even amidst Ethereum’s recent market fluctuations, investors are choosing to keep their positions rather than selling them off, demonstrating a positive outlook towards potential future growth.

Yet, there’s a clear split in opinion among investors. Some are showing resilience, while others are expressing apprehension. This contrasting attitude underscores the ongoing challenges for Ethereum, as the market grapples to strike a balance between optimism and prudence.

Or:

The investor community remains divided. Some investors maintain a wait-and-see approach, while others show signs of anxiety. This conflicting conduct illustrates Ethereum’s present predicament, as the market seeks equilibrium between hopefulness and caution.

The Liveliness measure shows that there’s been significant liquidation of Ethereum among its owners. This statistic suggests that certain investors are still offloading their Ethereum, possibly due to worries about prolonged market consolidation or potential future adjustments. This wave of selling suggests that overall market trust has not completely rebounded, despite some Ethereum holders showing optimism.

In spite of current challenges, Ethereum’s resilience in maintaining above key support points suggests a hidden robustness. Should market turbulence calm down, Ethereum might recover its pace, potentially surging towards its next substantial resistance barrier.

ETH Price Prediction: Breaching Barriers

Currently, Ethereum’s value stands at around $3,336, marking a 9% decrease this week as it struggled to break through the resistance at $3,721. This dip caused Ethereum to challenge the significant support level of $3,327. Maintaining this support is crucial for preventing any potential additional losses, as the market mood among investors is somewhat uncertain, leading to a tug-of-war between optimism for recovery and selling pressure.

Considering the current trends, Ethereum seems ready for a period of stabilization between approximately $3,524 and $3,327. Historically, this area has been a significant zone of balance during volatile market periods. A prolonged period of stability could give Ethereum the necessary push to break through its current limits.

As an analyst, I find myself anticipating that Ethereum might leverage its current bullish investor optimism to re-establish $3,721 as a strong support level. This development would effectively debunk the bearish-neutral hypothesis and set Ethereum on course toward revisiting its recent peak of $4,107. A convincing surge could revive market trust, potentially sparking renewed fascination for the undisputed altcoin leader.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-09 12:19