For the past week, the primary altcoin Ethereum (ETH) has been trading under $3,500, reflecting a general negative outlook in the cryptocurrency market. Since it reached an intraday peak of $3,744 on January 6th, its value has decreased by approximately 13%.

In simpler terms, although Ethereum’s price has dropped, important data from its blockchain indicate that investors are hopeful about Ethereum’s short-term future.

Ethereum Traders Remain Resilient

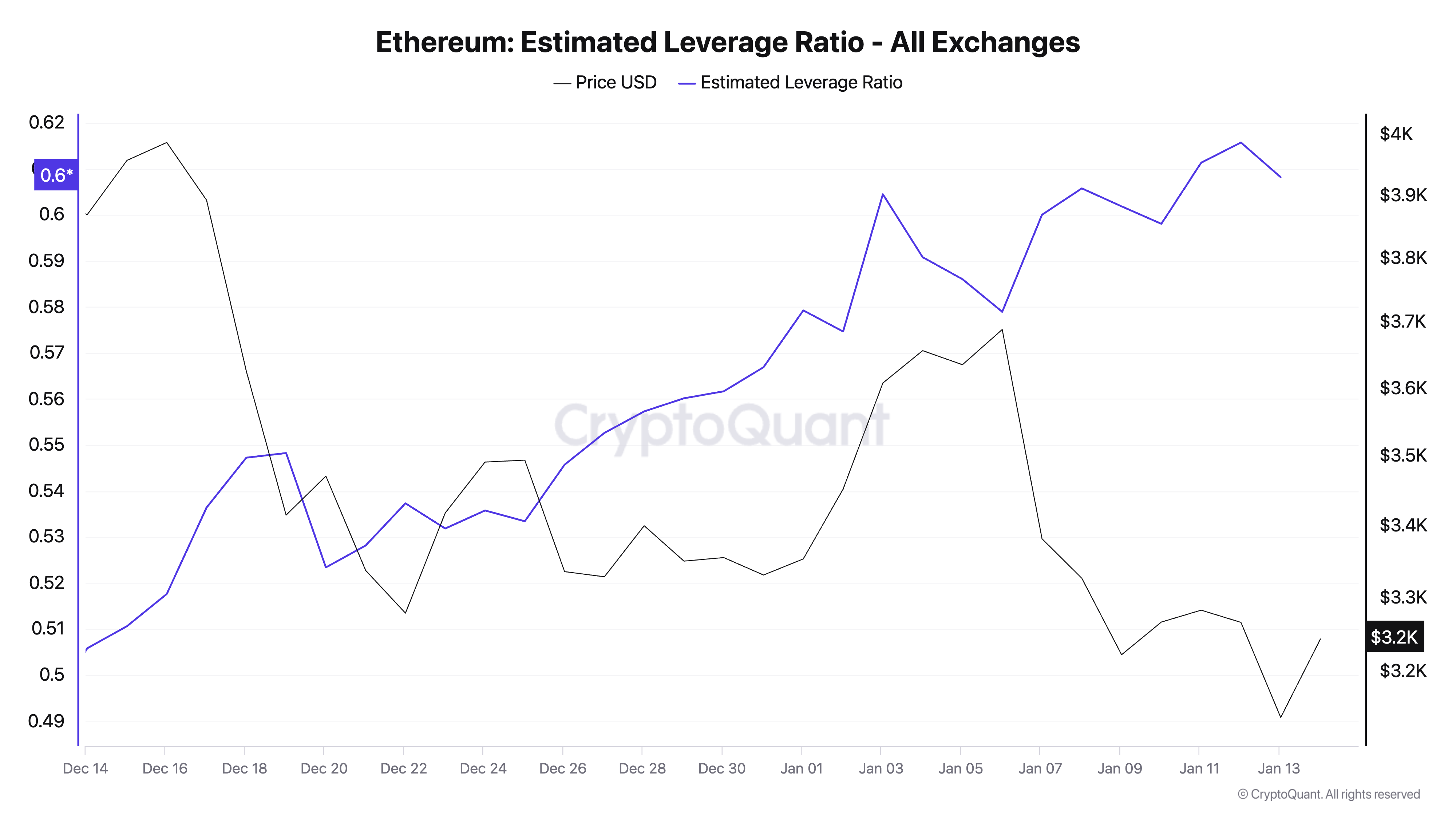

One key factor to consider is the upward trajectory of Ethereum’s estimated leverage ratio (ELR), as reported by CryptoQuant. Surprisingly, this metric has continued to rise even with Ethereum’s recent price decrease over the past few weeks. As we speak, ETH’s Estimated Leverage Ratio (ELR) stands at 0.60, marking a 20% increase in the last month. Meanwhile, Ethereum’s price has dipped by 15% during this same period.

As an analyst, I calculate the Exchange-Level Leverage Ratio (ELR) to gauge the typical amount of leverage employed by traders when executing trades on a given cryptocurrency exchange. This ratio is derived by simply dividing the total open interest for that particular asset by the exchange’s reserve held for that specific currency.

The rising level of ETH’s Expected Leverage Ratio (ELR) suggests that ETH’s traders are growing more eager to assume risk, even with the current slump in its price. This trend implies that these traders are becoming progressively confident that the value of ETH is likely to rebound, disregarding recent market challenges. A persistently high leverage ratio indicates a strong belief among traders that ETH’s price will recover despite the prevailing negative winds.

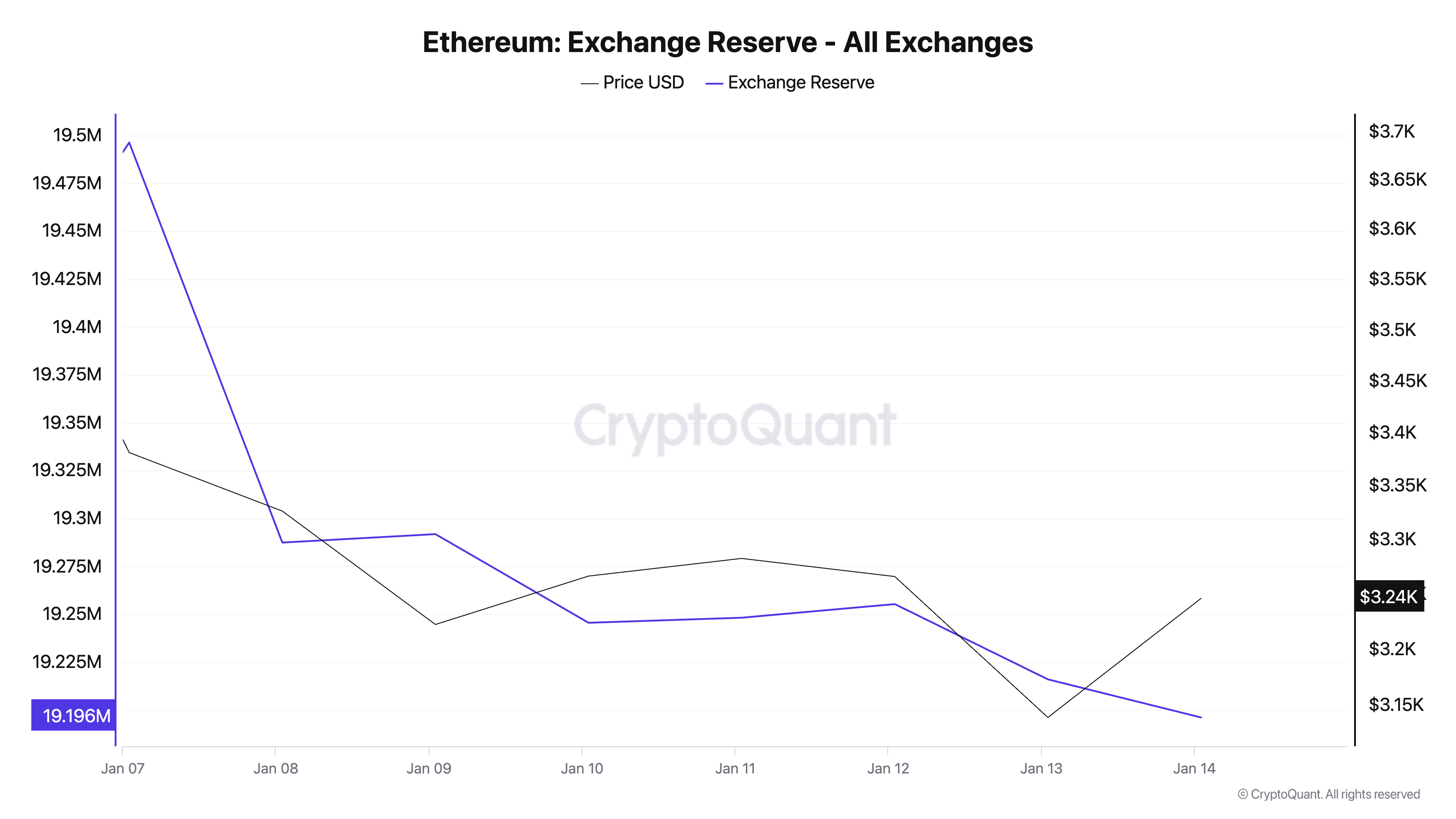

As a crypto investor, I’ve noticed a significant decrease in Ethereum (ETH) exchange reserves, which have dropped to a two-month low of 19.19 million ETH. Over the past week, this figure has decreased by 2%, indicating that market players are reducing their selling pressure and opting to hold onto their ETH tokens instead.

It seems like ETH’s recent drop in price might be more attributable to the overall negative sentiment in the market rather than substantial sales of ETH specifically.

ETH Price Prediction: All Rests on the Broader Market

At present, Ethereum (ETH) is being traded at approximately $3,226, slightly higher than the potential support level of $3,186. If there’s a positive shift in market sentiment and more ETH is accumulated, its value might increase towards $3,563.

Should the market persistently dip, Ethereum (ETH) might challenge its support at around $3,186. If this support doesn’t withstand the pressure, the coin’s value could potentially fall to approximately $2,945.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-01-14 19:30