Ethereum (ETH), that enigmatic beast of the blockchain jungle, is currently performing a supply shock ballet. Record-low exchange balances? Check. Surging staking demand? Double-check. Accelerating institutional inflows? Triple-check. Yet, like a stubborn mule refusing to budge, the price remains as flat as a pancake. 😴 What gives?

Analysts are scratching their heads, debating whether retail investors are secretly dumping ETH into the void, masking what might just be the most bullish setup since… well, ever. Or maybe they’re just too busy doom-scrolling on social media to notice. 📉🤷♂️

Ethereum Hoards While Bitcoin Flees

Per analyst Crypto Gucci (yes, that’s a real name), ETH reserves on centralized exchanges have plummeted to fresh lows, while Bitcoin (BTC) exchange balances are spiking faster than a caffeine addict after an espresso shot. ☕📈

“Investors are hoarding ETH and dumping BTC… ETH supply shock incoming,” the analyst ominously declared, perhaps while wearing a tinfoil hat. 🎩✨

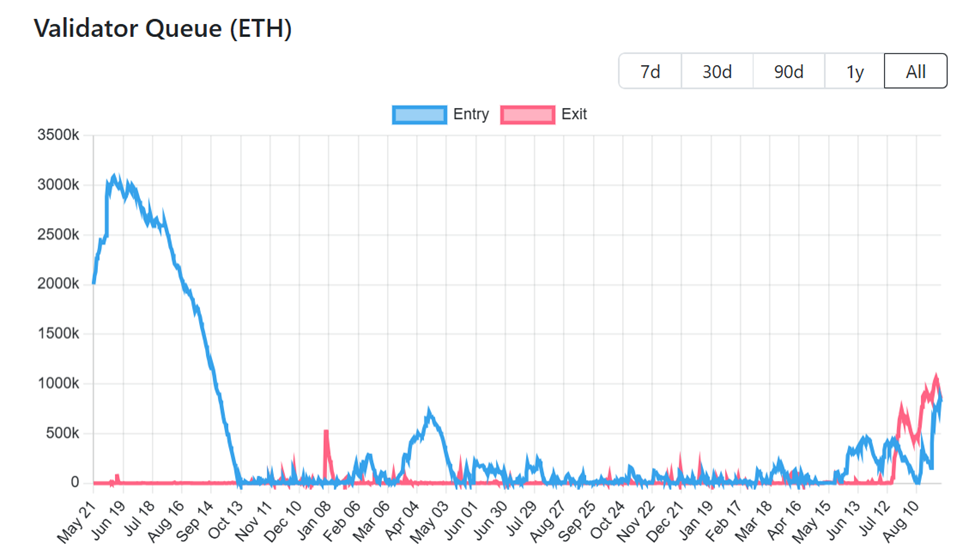

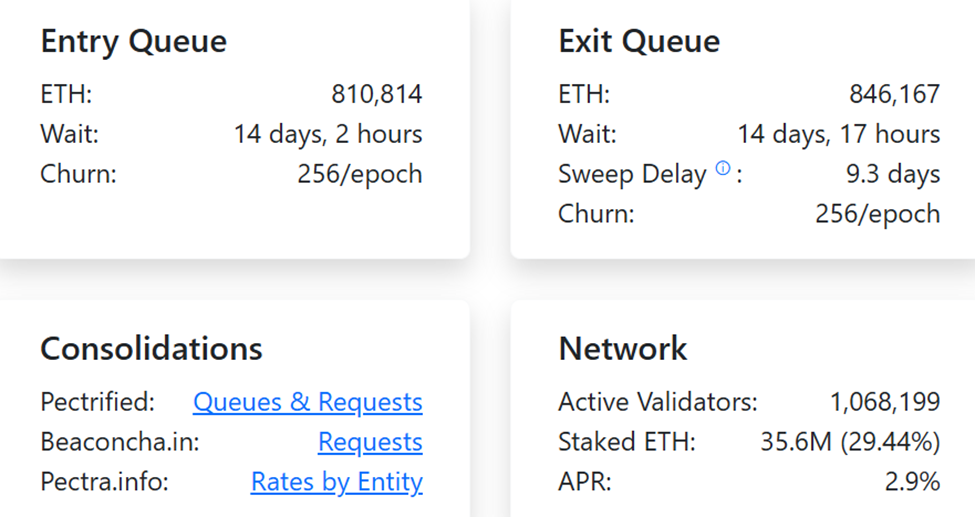

This divergence paints a picture of growing conviction in Ethereum’s long-term value proposition, even as its short-term price action resembles a sloth on a lazy Sunday. 🦥 Meanwhile, on-chain data confirms that ETH is being locked up at historic rates. Ethereum’s staking entry queue has surged to levels unseen since 2023, with 860,369 ETH-worth $3.7 billion-waiting patiently to be staked. Patience, it seems, is a virtue only whales possess. 🐳

Everstake, a staking protocol, noted this is the largest queue since the Shanghai upgrade enabled withdrawals two years ago. “More people trust Ethereum’s long-term value and want to participate in securing it,” they said, presumably while sipping champagne. 🍾

“Institutional participation, favorable market conditions, and network confidence are driving this trend,” they added, clearly proud of their optimistic forecast. 🌟

At present, more than 35.6 million ETH is already staked-a whopping 31% of the total supply, worth about $162 billion. That’s enough to make even Scrooge McDuck jealous. 🦆💰

Institutions Are Gobbling Up Ethereum Like Free Donuts 🍩

Meanwhile, institutional appetite for Ethereum is reaching fever pitch. Analyst Hasu observed that nearly 10% of ETH’s supply now resides in publicly traded vehicles-a milestone reflecting adoption. 🚀

“We’re about to hit 10% of ETH supply in publicly traded vehicles,” Hasu tweeted, likely while adjusting his monocle. 👓

Tom Dunleavy, head of venture at Varys Capital, chimed in with more jaw-dropping stats: treasury companies scooped up over 3% of the total ETH supply in just two months. “Wild that in less than 2 months, over 3% of the entire supply of ETH was scooped up by treasury companies,” he wrote, possibly while hyperventilating. 😮💨

Corporate treasuries now hold 4.7 million ETH, or $20.4 billion, with most committed to staking strategies. This has helped push the validator entry queue to record levels while reducing the risk of a mass exodus, as the exit queue has declined 20% since August. Phew! 😌

Retail Selling Meets Whale Accumulation: The Eternal Tug-of-War ⚔️

Despite these bullish flows, ETH is trading at $4,368 as of this writing, down over 12% from its August 24 all-time high. Analysts blame retail selling for suppressing price momentum. Defi Ignas notes that holders of 100-1,000 ETH are dumping, while whales in the 10,000-100,000 ETH range are “loading fast.” It’s the same setup seen before every major ETH rally, where supply shifts from weak hands to strong ones. 🔄

“$ETH has large ETF inflows, DATs buying, and HL whale publicly rotating billions of BTC into ETH.

Price still flat. Why?

Retail is selling:

• 100-1k ETH holders dumping

• 10k-100k whales loading fastSupply moving from weak to strong hands. Same setup before every big run.” – Ignas | DeFi (@DefiIgnas) August 30, 2025

Sigil Fund CIO Dady Fiskantes suggested some investors may be swapping spot ETH for Ethereum ETFs to reduce custody risks, à la earlier Bitcoin flows. However, Ignas questioned the timing, contradicting the notion that ETH whales operate like their Bitcoin counterparts. Others remain bullish, though. 💪

“Retail’s exit liquidity has always been the ignition fuel. Once they’re fully flushed out, ETH rips. The flat price is the bullish signal,” analyst Tradinator remarked, channeling their inner fortune-teller. 🔮

Analysts argue that the fundamentals are ripe for an explosive move. Ethereum’s price is caught in a tug-of-war between strong institutional accumulation and persistent retail selling, with exchange reserves at record lows and staking queues at record highs. Will the bulls prevail, or will the bears have the last laugh? Stay tuned for the next episode of “As the Blockchain Turns.” 🎬📺

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-03 15:47