Ah, Ethereum rises above the fabled $3,000 threshold, only to be met with the treacherous specter of profit-taking! What a delightful twist of fate!

As the shadows of on-chain signals and volume patterns encircle us like ominous figures from a Dostoevsky novel, the possibility of a fleeting price weakness dances before our eyes, mocking our hopes unless those sacred key levels yield! 🧐

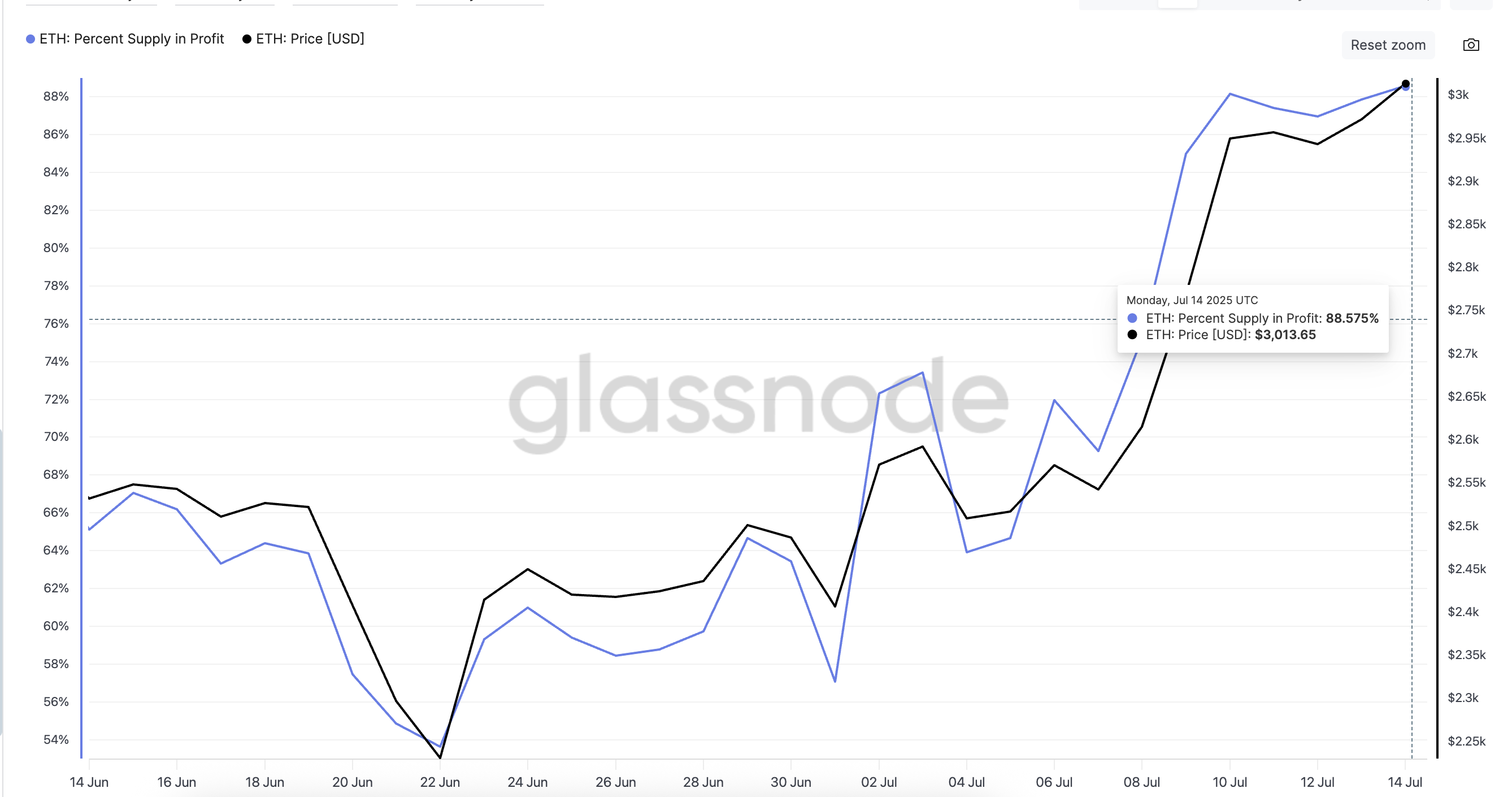

Behold, Over 88% of ETH in Profit! A Revelation or a Cautionary Tale?

Lo and behold, as recorded by Glassnode’s omniscient gaze, 88.57% of the ETH supply basked in profit as of July 14, moments before the price flirted with $3,013. Quite the spectacle, indeed! Yet, one must remember—whenever the ETH holders’ profit percentage swells, history tells us a short-term correction inevitably follows. Isn’t history simply a nagging acquaintance?

Our dear Percent Supply in Profit metric reveals the glaring truth: it signals the proportion of circulating ETH whose acquisition scars are below the dizzying heights of today’s market price. Spike, dear spikes! They hint at frenzied rallies or a weary post-rally state, much like the aftereffects of a grand feast where all have indulged and now lie in stupor. 😅

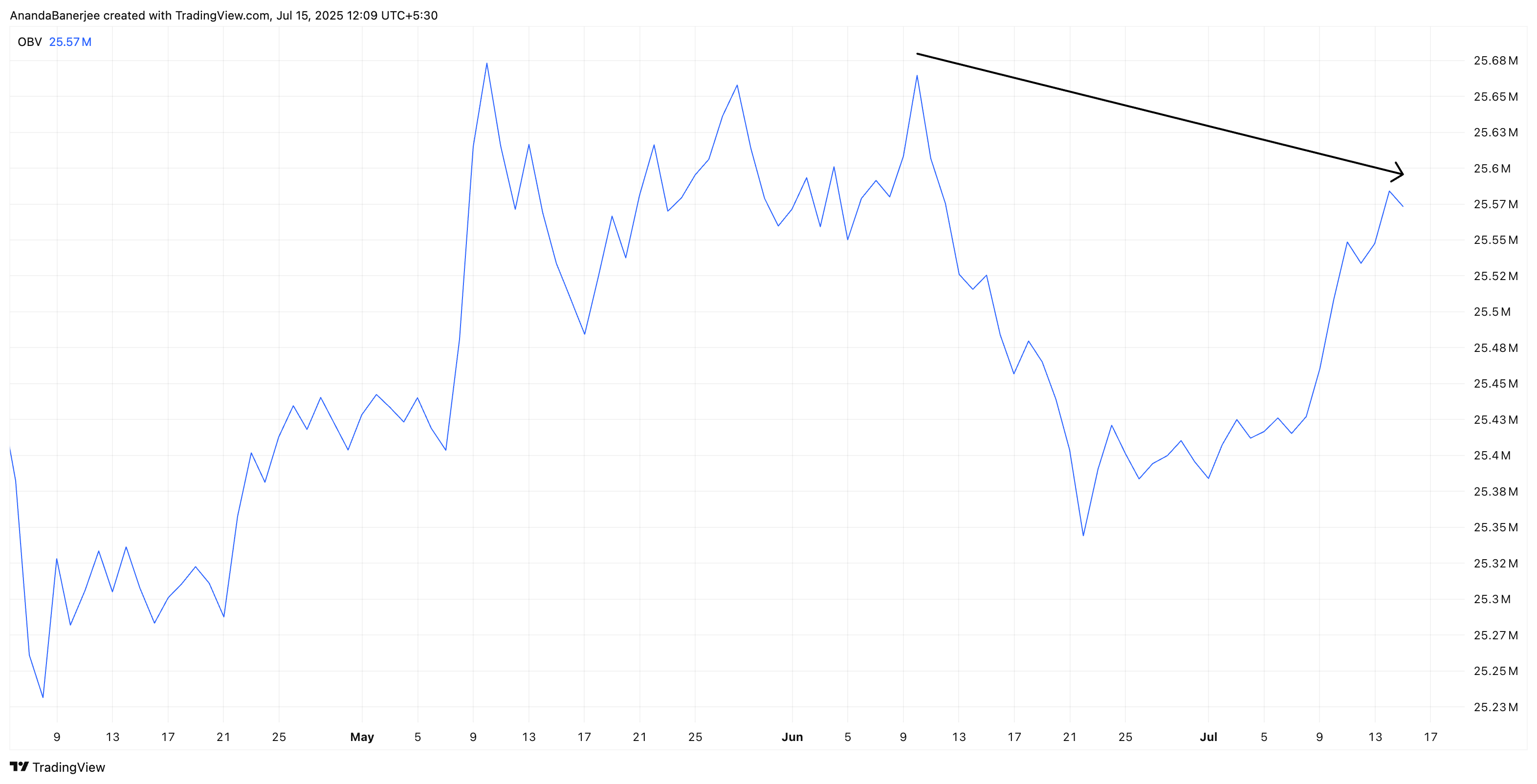

OBV Divergence: The Harbinger of Doom? 🥴

As Ethereum’s price soared from June 11 to July 14, the On-Balance Volume (OBV) whispered a troubling tale—constructing lower highs, thereby confirming a beguiling bearish divergence. Are fewer traders clinging to the current rise? A red flag, perhaps? The OBV threat lurks ominously, portending imminent correction.

Even as corrections unfold before our very eyes, the OBV remains stagnant, perpetuating the threat of further declines, as if mocking our naive hopes.

Ah, the OBV, with its cunning ability to measure volume flow by adding volumes on joyous days and subtracting on melancholic ones, now shows signs of weakening accumulation. Perish the thought that a grand reckoning befalls the marketplace! 🎭

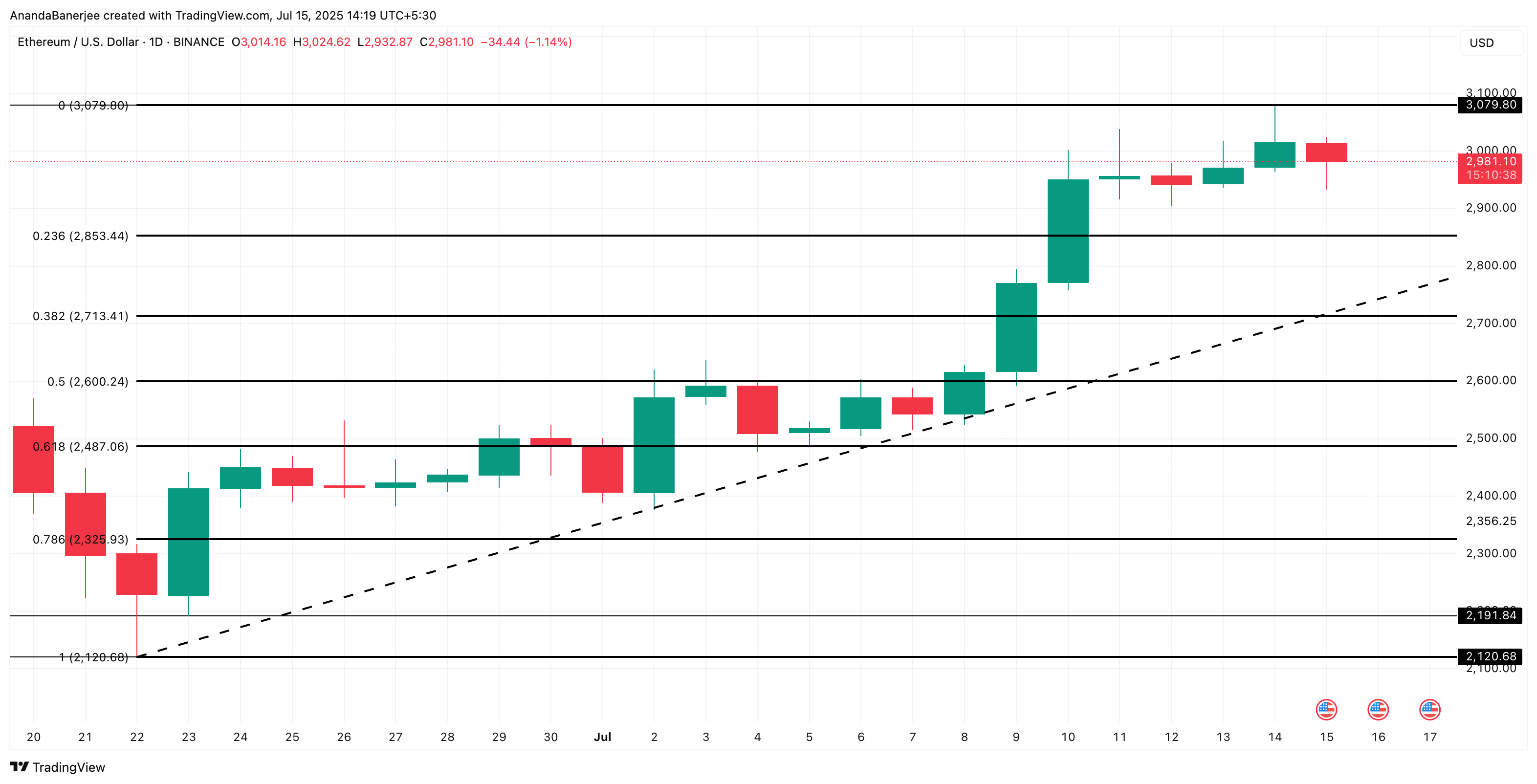

Fibonacci Levels: Our Resilient Beacon of Hope

The ETH price, alas, struck resistance at $3,079, yet after being rejected with what can only be termed dramatic flair, it now lingers around $2,981, sulking like a forlorn lover.

Immediate retracement support for our beleaguered ETH lies at:

- 0.236 level: $2,853

- 0.382 level: $2,713

But fear not, for the ETH chart reveals that $2,600 (the famed 0.5 Fib level) and $2,487 (the revered 0.618 Fib level) stand guard as vital support zones. Should these be breached, the denial of our hopes may transform into a full-blown catastrophe!

Yet, a glimmer of optimism remains as long as Ethereum clings to life above $2,713, entwined with a critical breakout candle, like a character in search of redemption. 🌟

If, by some miracle, Ethereum vaults beyond $3,079 and the OBV rises with renewed vigor, then the plot twist will be grand: the bearish scenario deemed inadequate, and a bold path to higher realms unveiled.

Until that fateful moment, the specters of profit-taking and volume divergence bid us to tread with caution, as ETH lingers in the treacherous territory of historically saturated profit levels. Oh, the drama of the marketplace! 🥸

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2025-07-15 13:48