Ethereum is experiencing a bit of a “come back” after its meteoric dive below $4,000-because who doesn’t love a dramatic recovery, right? The broader market, meanwhile, is holding its breath as traders carefully reconsider their once-bold positions after the recent rollercoaster ride. Will this be the end of the bull market, or just another pit stop? Buckle up.

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, ETH has managed to break through its comfy little ascending channel and the 100-day moving average like a teenager breaking curfew. It even touched the 0.5 Fibonacci retracement zone around $3,400-$3,500-a level that had been quite cozy as support in the past. Naturally, this triggered a bounce to $3,800, because why not? It’s Ethereum, and it enjoys making a dramatic entrance.

However, the RSI still lingers below 40. Yes, folks, that means weak momentum. So, don’t start celebrating just yet. A daily close above $4,000 would be a glimmer of hope for a short-term recovery, but if ETH can’t reclaim its spot in the channel, it could slide below $3,000-and nobody wants that. If we’re being honest, that would probably be the final nail in the bull market’s coffin. RIP, Bull Market. 🕊️

The 4-Hour Chart

The 4-hour chart paints a picture of temporary relief. After a rather sharp and sharp-nosed decline, Ethereum found a bit of support around $3,400. The RSI briefly dipped into the oversold zone, sitting at a cool 24-because who needs to be overbought when you can be oversold, right? This might suggest a potential short-term reversal, though don’t hold your breath.

Resistance at $3,800 remains as stubborn as ever. A rejection here might send ETH back to the $3,400 range, while a breakout could propel it to a more optimistic $4,200. Decisions, decisions…

Onchain Analysis

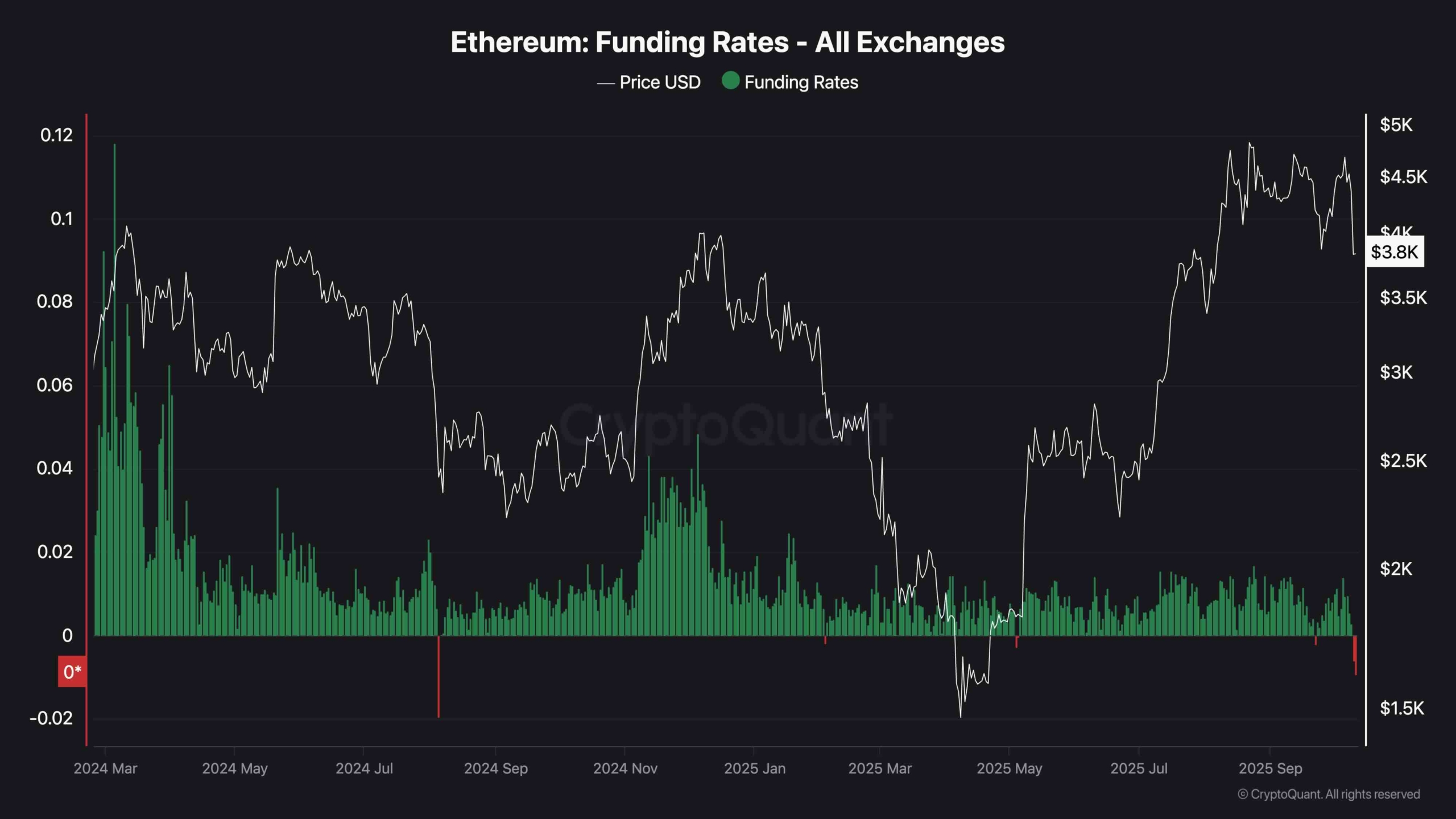

Funding Rates

Funding rates are in negative territory across exchanges-the lowest we’ve seen since late 2024, as traders scramble to close out their long positions like they’re escaping a sinking ship. This reset is the market’s way of saying “Uh-oh” but also could hint at a bottom if the bearish sentiment persists. In fact, negative funding rates during a big drop often lead to a short-term recovery once the panic fades. So, there’s hope. There always is, right? 😅

While the market may still be adjusting to a bearish reversal, this could just be the cleansing of the market’s soul. Think of it as a cooling-off period before a rally powered by spot-driven demand. So, don’t sell your ETH just yet. There might be a silver lining-or at least a faint glimmer of hope in the abyss.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Why Nio Stock Skyrocketed Today

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

2025-10-12 10:48