As a seasoned crypto investor with more than a decade of experience navigating the digital currency market, I have learned to be both cautiously optimistic and adaptable to the ever-changing tides of the crypto world. The latest analysis by Tardigrade on Ethereum’s price trends has piqued my interest, as I have seen similar patterns in the past that ultimately led to significant gains for ETH investors.

Enthusiasts of cryptocurrency are brimming with excitement and optimism about Ethereum, currently the second most valuable digital currency. Market analysts predict a significant increase in its value, leading some to speculate that during this bull market, Ethereum could potentially reach an unprecedented high of $10,000. This forecast rekindles investor interest after a phase of volatility.

As an analyst examining Ethereum’s price movements, I’ve observed the development of symmetrical triangles along an upward trendline – a pattern often indicative of a period of consolidation preceding a notable price shift. My prediction is rooted in this observation.

The tardigrade further explained that Ethereum is showing signs of a potential price surge based on its upward trajectory defined by symmetrical triangles. These patterns, he noted, have been a precursor to significant price hikes since 2022. Each time Ethereum has formed such a triangle, it has led to substantial increases: the first breakout resulted in an over 70% rise, and the second one saw gains exceeding 140%.

Ethereum’s Breakout Patterns Suggest 280% Surge

If Ethereum’s current breakout from its third symmetrical triangle follows Tardigrade’s analysis, it could potentially surge by 280%, placing it near the significant price point of $10,000. In other words, if this upward trend persists, Ethereum might reach a 280% increase and touch the coveted $10,000 mark.

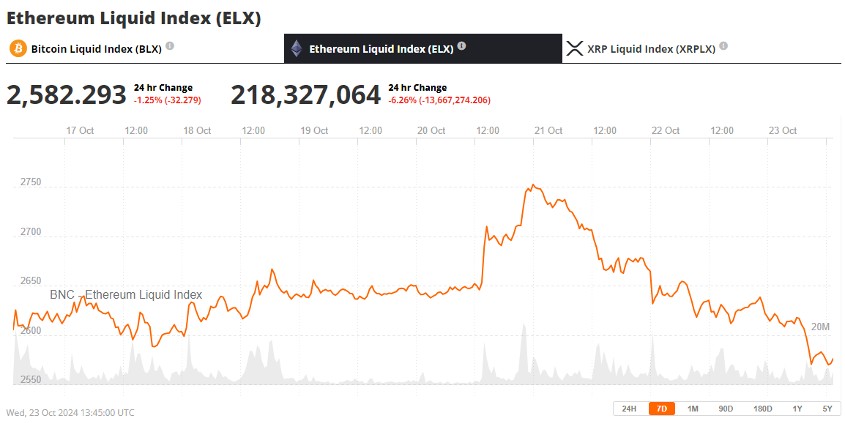

Regardless of Ethereum’s optimistic outlook, its price has dropped to approximately $2,600 in recent market fluctuations, representing a nearly 6% decrease over the past three days, as reported by Brave New Coin’s Ethereum Liquid Index. This downturn has had a broader impact on the cryptocurrency market, causing some uncertainty among investors.

Over the past week, Ethereum’s market capitalization and trading volume have seen a dip of approximately 2.65% and 13.83%, respectively. Despite this recent decline, there are strong indications pointing towards a possible rise in ETH, based on previous performance trends and current market conditions. These factors include growing institutional interest due to the forthcoming Ethereum exchange-traded funds (ETFs).

Ethereum’s Bull Cycles Point to $10,000 Mark

In a wider perspective, Ethereum’s price progression seems to follow similar patterns from past bull markets, notably the recurring patterns between January 2023 and March 2024. During this phase, Ethereum fluctuated between $1,500 and $2,000 before soaring above $3,500. If current tendencies persist, Ethereum might repeat this trend and aim for the $10,000 milestone as its potential culmination in this cycle.

Additionally, it’s worth noting that the expansion of M2 money supply is significantly impacting market trends. In the past, the price movements of Bitcoin and Ethereum have shown a strong positive correlation with global liquidity growth. This suggests that central banks may respond to economic instability by loosening monetary policies.

Based on various experts’ opinions, the creation of Ethereum ETFs might significantly impact the market due to their past positive effects on Bitcoin prices. The initial wave of institutional investments linked to these ETFs is predicted to begin soon, potentially enhancing Ethereum’s dominance in the financial landscape.

As Ethereum faces challenges in sustaining its pace, there’s speculation about whether it can surpass significant resistance barriers, notably around the $3,500 threshold. Experts propose that breaching this point might lead to large-scale short position liquidations, possibly fueling a rapid price rise.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- DODO PREDICTION. DODO cryptocurrency

- Everything We Know About DOCTOR WHO Season 2

2024-10-23 19:22