Pray, allow me to impart the most extraordinary tidings concerning Ethereum, a digital darling whose recent ascent has set the ton all aflutter. According to the sagacious Mr. Matt Hougan of Bitwise, a gentleman of no small repute, a most remarkable structural shift in demand hath occurred, propelling its price to heights hitherto unseen. 🌟

Since the fifteenth of May, a veritable frenzy of purchasing hath ensued, with exchange-traded funds (ETFs) and corporations vying most ardently for the acquisition of nearly 2.83 million ETH, a sum exceeding $10 billion. Imagine, if you will, the scene at Almack’s, with suitors clamoring for the hand of the fairest maiden—only here, the prize is Ethereum, and the competition is thirty-two times more fervent than the supply can bear! 💸

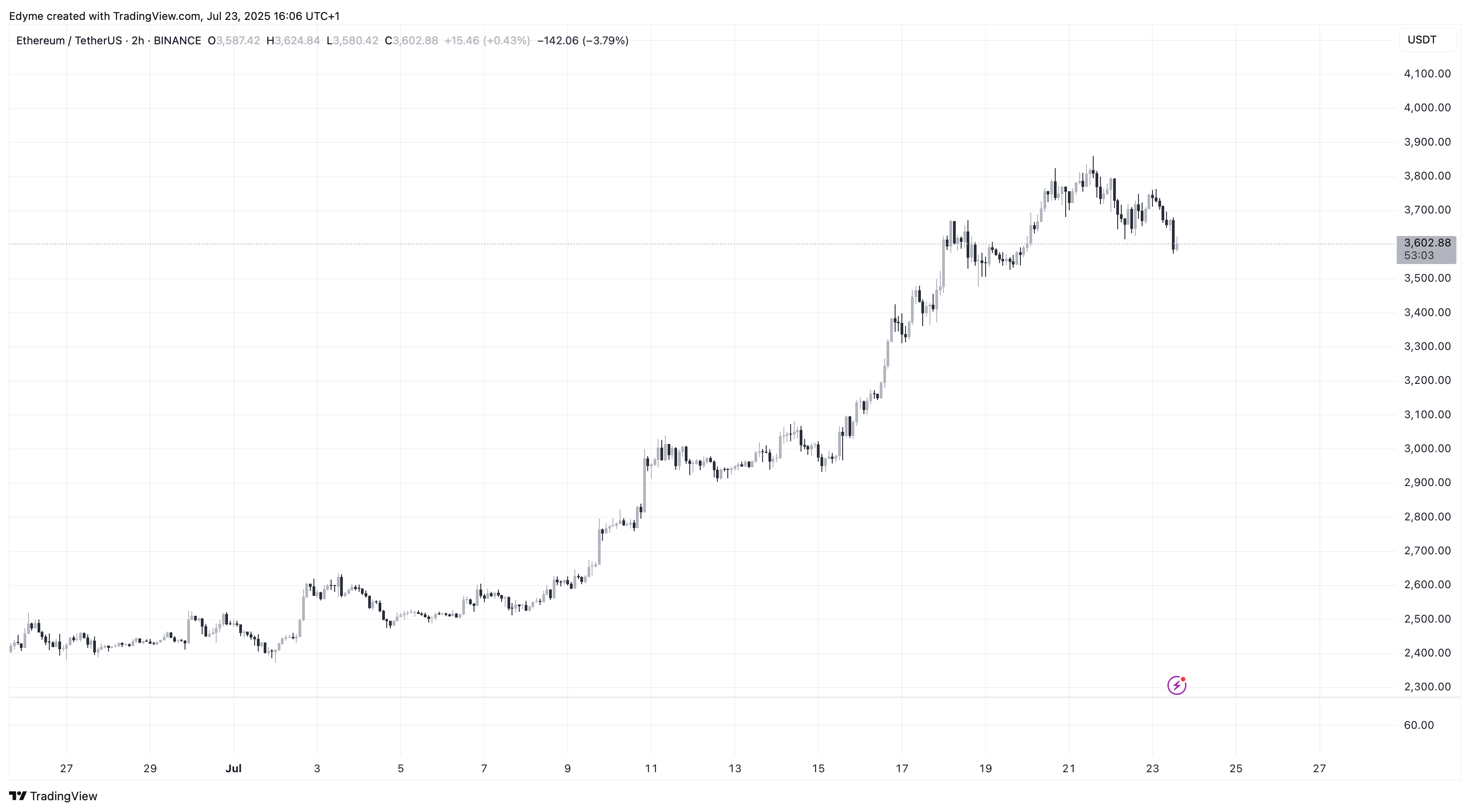

This prodigious demand hath outstripped new ETH issuance by a factor of 32, creating a most delectable imbalance that analysts predict may persist. Mr. Hougan, with his customary acumen, observes that Ethereum’s price hath soared by more than 65% in the past month and a staggering 160% since April. One might say it hath become the toast of the season, though I daresay its charms are not merely a matter of fleeting sentiment. 📈

While the whims of the market do play their part in this digital drama, Mr. Hougan attributes this surge principally to fundamentals—specifically, the chasm between the quantity of ETH being acquired and that being created on-chain. He draws a most apt parallel to the case of Bitcoin following the launch of spot BTC ETFs in early 2024, a comparison that lends Ethereum’s prospects an air of inevitability. 🔗

ETFs and Corporations: The New Beaux of Ethereum

The tide turned most decisively in mid-May, when inflows into spot Ethereum ETFs gained a momentum that would put even the most determined debutante to shame. Mr. Hougan reports that these investment vehicles have attracted over $5 billion since that time. Meanwhile, corporate entities have begun to regard ETH as a strategic asset, much as a gentleman might view a well-placed estate. 🏰

Consider the likes of Bitmine Immersion Technologies (BMNR), SharpLink Gaming (SBET), Bit Digital (BTBT), and The Ether Machine (DYNX), all of whom have announced substantial ETH holdings or purchasing plans. Bitmine, in particular, aims to secure 5% of the total ETH supply—a feat that would make even the most ambitious heiress blush! SharpLink Gaming hath acquired more than 280,000 ETH, while Bitmine boasts over 300,000 ETH. Bit Digital, not to be outdone, hath sold its Bitcoin reserves to amass more than 100,000 ETH, a clear indication of shifting institutional preferences. 🏆

These companies are not content merely to acquire; they proclaim their long-term strategies with all the fervor of a lover declaring his intentions. Such structural commitment bodes well for Ethereum’s future, though one wonders if they shall ever tire of their pursuit. 💍

The Outlook: A Continued Waltz of Demand

The upward trajectory of demand appears set to continue, much like a quadrille that shows no sign of ending. Mr. Hougan notes that while ETH’s market capitalization is but 20% of Bitcoin’s, ETH ETFs account for less than 12% of the assets under management held in Bitcoin ETFs. Bitwise anticipates this gap shall narrow as stablecoin growth and tokenization trends—both championed by Ethereum—attract further capital inflows. 🕊️

Moreover, the growing allure of ETH treasury companies, whose stock valuations trade at premiums to the value of their underlying ETH holdings, provides a most compelling incentive for further accumulation. Mr. Hougan projects that these entities could collectively purchase another $20 billion in ETH over the next year, representing nearly seven times more demand than new supply. Though Ethereum lacks Bitcoin’s hard cap, he insists that short-term price action is governed by supply and demand mechanics, and with the current imbalance, an upward movement seems all but assured. 📉

Whether this trend shall endure in the long term remains to be seen, but for now, Ethereum’s near-term price action appears increasingly influenced by institutional behavior and treasury adoption strategies. One might say it hath become the belle of the digital ball, with suitors lining up to secure its favor. 🎭

Featured image created with DALL-E, Chart from TradingView 🖼️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2025-07-24 10:14