As a seasoned analyst with over two decades of experience in financial markets, I have witnessed my fair share of market anomalies and short squeezes. The current state of Ethereum’s futures market is reminiscent of the infamous short squeeze in the Volkov & Lycos incident of 2001, where the sheer number of shorts forced to cover their positions resulted in a meteoric rise in the company’s stock price.

In simpler terms, Ethereum, the second most valuable cryptocurrency, may experience a sudden rise in price due to a possible short squeeze. This situation arises when traders who have bet against Ethereum (shorting) are forced to buy it back at higher prices because they cannot afford to keep the losses mounting. The futures market for Ethereum is displaying high levels of leverage, suggesting that many investors anticipate a drop in its price.

In the event of an unanticipated rise in Ethereum’s value, these traders might find themselves compelled to adjust their trades, possibly causing the price to climb even further due to a potential short squeeze scenario. This phenomenon occurs when sellers who have bet against the market are forced to buy Ethereum to protect their investments, thereby increasing demand and potentially driving up the price.

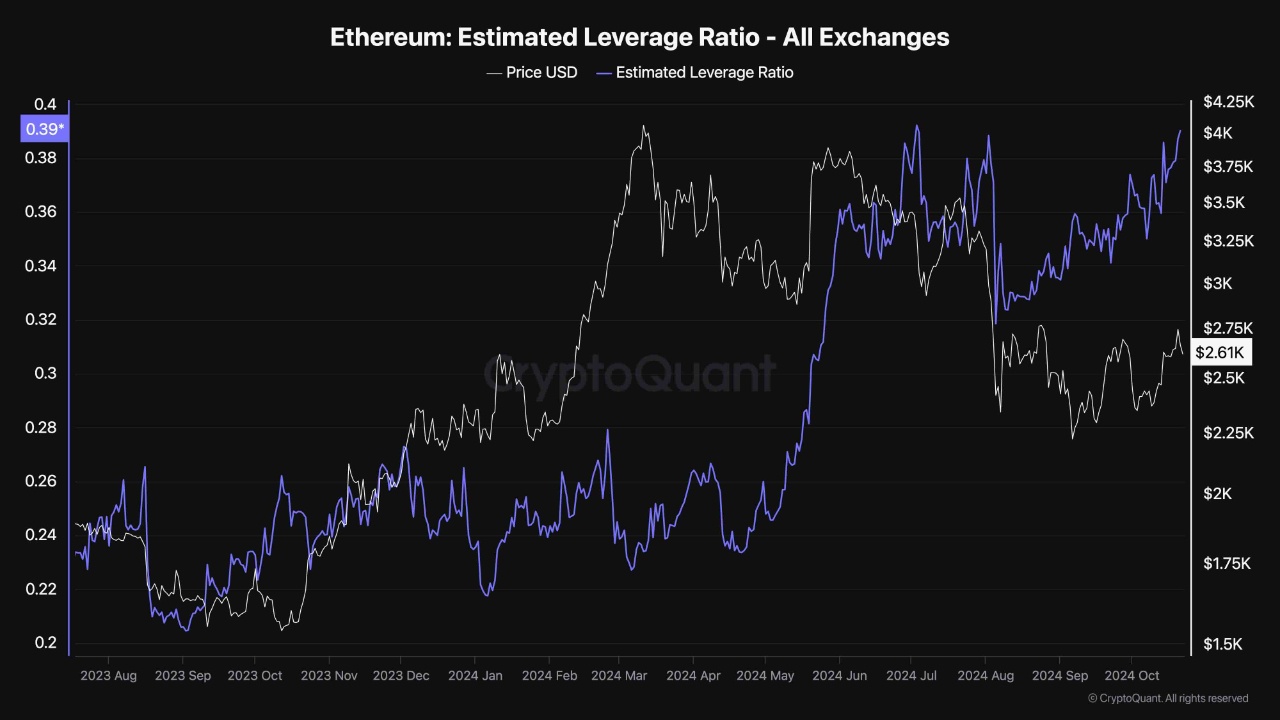

A key metric for gauging the level of risk in the futures market is the Estimated Leverage Ratio (ELR), which according to CryptoQuant analyst ‘ShayanBTC’ has been steadily rising in recent months, suggesting an increase in leveraged positions. Given Ethereum’s recent underperformance relative to Bitcoin, the metric implies that many traders are opening high-leverage short positions.

Currently, the futures market is seen as overly heated, with dangerously high leverage levels, as per the analyst’s assessment. This situation could make Ethereum susceptible to a sudden price drop due to a margin call or liquidation event (short squeeze).

An occurrence like this might trigger a self-reinforcing mechanism, pushing the price further up since an increasing number of investors are trying to offload their holdings. Currently, Ethereum’s 100-day moving average stands at $2,700, and analysts consider it as a significant barrier for the cryptocurrency’s growth.

The analyst noted that if a short squeeze leads to a breakout above this level, the cryptocurrency’s price could keep on climbing. As reported, another cryptocurrency analyst predicted Ethereum’s price could hit a $10,000 high after breaking out of an ascending trendline pattern formed with symmetrical triangles.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-10-25 03:28