- ETH seems to be stuck in a familiar rut—accumulate, manipulate, and distribute. Oh, how predictable! 😒

- ETF holdings rising, realized cap soaring, and market dynamics… shifting? We’ll see. ⏳

Ethereum [ETH] seems to be repeating itself, as though stuck in a never-ending cycle of deja vu. Could it be that, once again, ETH is following the same ol’ accumulation-manipulation-distribution pattern? How terribly shocking! 🔄

Look, folks, during the last bullish run in November, ETH managed to climb a majestic 42%. And just when we thought it was getting comfortable, it decided to take a quick nap in the form of price consolidation. What a surprise!

But hold on tight, because after that, there was a glorious distribution phase that pushed ETH up another 21%, peaking at an all-time high of $4.1K. And here we are, still stuck with that all-time high as the benchmark. Lucky us. 🏆

Now, zooming into the daily chart, we see history mocking us by repeating itself once more. Since that breakout on May 8th, ETH has surged by… you guessed it, a 42% gain. And, just like clockwork, it’s consolidating again. But could we see the same glorious 21% rally to take us past $3K? Or will it just be another episode of “wait and see”? 🤷♂️

And, let’s not forget the stochastic RSI, that ever-present momentum indicator. It’s nearing the oversold zone, a region that *might* trigger breakout signals. But don’t hold your breath. After all, we’ve seen this story before, haven’t we? ⏱️

No guarantees, but there’s a whiff of hope in the air. And that, my friends, is the stuff Ethereum’s dreams are made of.

ETH Capital Influx: Confidence or Just Wishful Thinking?

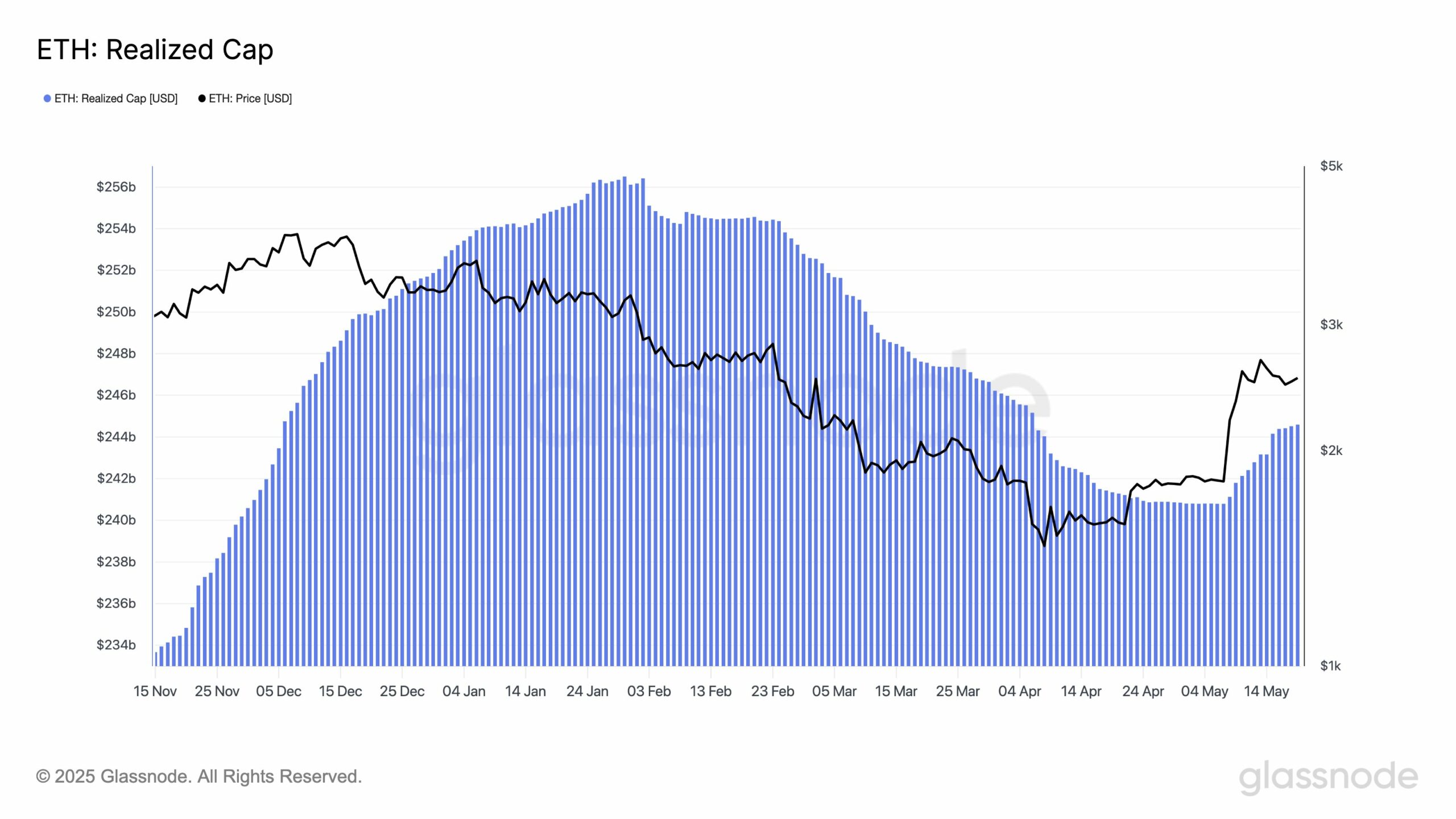

Let’s focus our analytical gaze on the on-chain metrics, shall we? Ethereum’s realized capital, the grand total of all ETH at their last transferred price, has seen a decent rise in May. From $240.8 billion on May 7th to $244.6 billion on May 19th, a juicy $3.8 billion increase.

This surge might just be the sign of newfound conviction among holders—or it could be the product of another bubble. Either way, it’s here, so let’s embrace it. 😏

Such a rapid surge typically signals less selling pressure, which can only mean one thing: Ethereum is being held for the long term. Oh, the sweet scent of stability. 😌

This surge might just solidify the foundation for the next bullish rally—assuming those technical indicators can manage to stay on track. Fingers crossed! 🤞

Institutional Interest: The Return of the Big Players

But wait, the plot thickens. Institutional players are joining the fray. According to AMBCrypto’s meticulous CryptoQuant data, ETH ETF holdings are on the rise, signaling renewed interest from the big boys.

With Bitcoin ETFs taking center stage, ETH ETFs are not far behind, and—who knows—larger capital influx might be just around the corner. Oh, the drama! 🎭

These growing holdings typically reflect institutional sentiment, and with this upward trend, institutions are *finally* warming up to ETH’s long-term potential. It only took a while, but hey, better late than never! 🙄

With a restored technical momentum, a surge in realized capital, and growing ETF exposure, Ethereum is starting to look… well, less like a circus and more like a serious contender. If this trend keeps up, that $3,000 mark is only a stone’s throw away. And who knows, maybe even $3.3K is within reach. But again, I wouldn’t bet my house on it. 🏠

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-05-21 21:14