Behold, the ethereal token of Ethereum, having weathered the tempestuous seas of volatile trading, now finds itself anchored above the critical support zones, a beacon of hope amidst the chaos 🌪️. The market, ever fickle, now murmurs of potential upward surges, though the path remains shrouded in uncertainty 🧭.

Golden Signal: A Prophet of Profit or a Fool’s Errand?

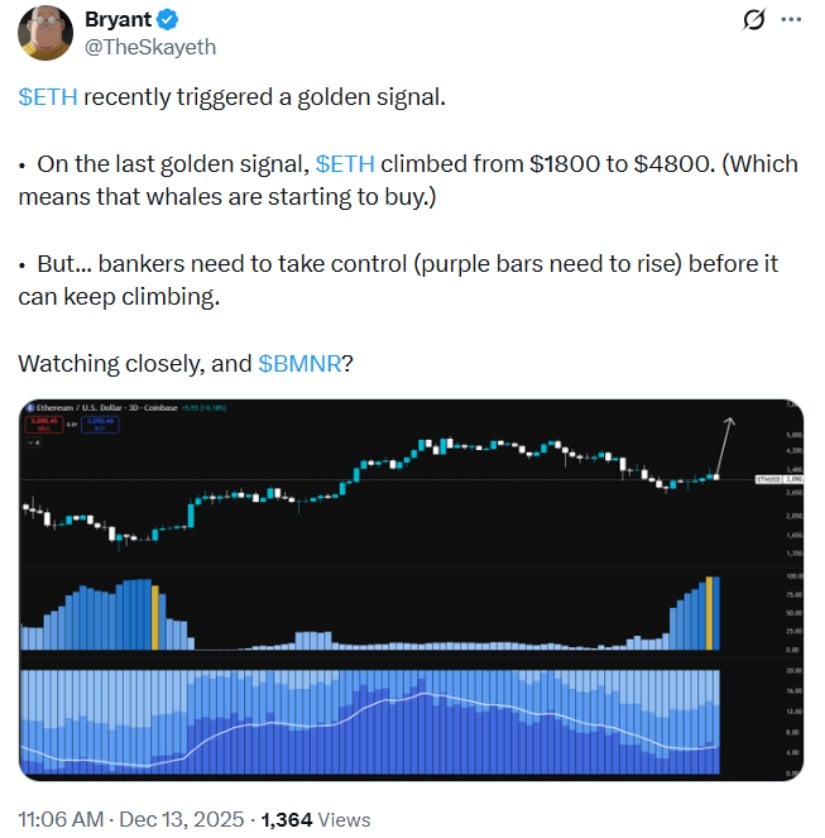

Lo, the so-called “golden signal” has captured the imagination of many, a mystical indicator tracking the movements of the mighty whales-those titans of the crypto ocean 🐳. Yet, as the sage Bryant warns, this signal, though historically prophetic (remember the ascent from $1,800 to $4,800?), is but a shadow, prone to lag in the maze of sideways markets 🧙♂️. The whales, it seems, are not mere traders but sages, their net holdings rising like the sun over a quiet horizon 🌅.

“A time of reckoning,” quoth Bryant, “when the tides of fortune shift.” Yet, the signal’s vagueness remains a thorn in the side of the overly eager investor 🐚. Still, the data whispers of defensive accumulation, not the frenzied chaos of speculation 🧊.

Interpretation: A bullish omen, yes, but one that dances on the edge of a knife, reliant on the whims of institutions and the macrocosm 🕊️.

ETFs: The New Pilgrims of the Market

The institutional horde, once a distant specter, now marches with renewed vigor. Ethereum ETFs, those modern-day pilgrimages, have seen inflows of $250 million, a reversal of prior exoduses 🚶♂️. BlackRock’s Ethereum ETF, a titan among titans, contributed a mere $56.5 million in a single session-a drop in the ocean, yet a ripple in the market’s vastness 🌊.

Yet, as with all things, the ETF’s influence is a double-edged sword, dependent on the broader market’s mood and the dance of derivatives 🕺. A delicate balance, indeed.

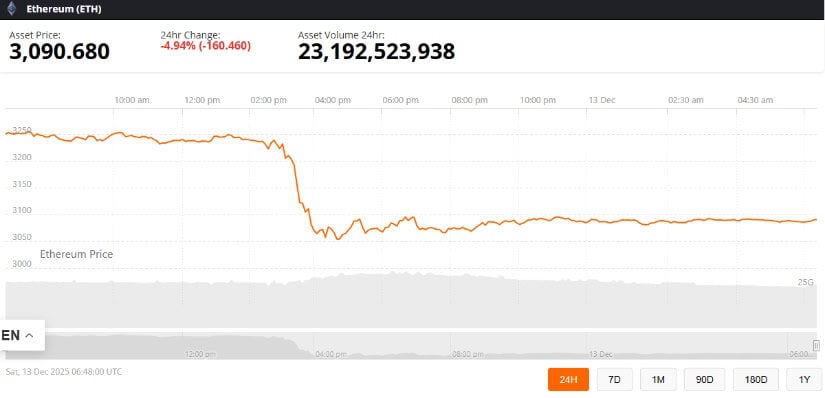

Analysis: The convergence of ETF inflows and on-chain accumulation creates a zone of buying fervor near $3,100, a fragile sanctuary against the storm 🌩️. But beware, for inflows alone cannot defy the laws of gravity 🚫.

Whales and Derivatives: A Dance of Power

The on-chain realm reveals wallets of 10,000-100,000 ETH, their net holdings swelling by 800,000 ETH, a sum worth $2.4 billion at $3,100 ⚖️. In the derivatives arena, leveraged giants cling to their positions, liquidation levels far below current prices, a testament to their unshakable faith 🙏.

Interpretation: A union of spot and derivatives, a symphony of confidence, yet a conditional promise of support, not a guarantee 🎶.

Technical Analysis: The Ascending Channel of Hope

Ethereum, like a noble steed, gallops within an ascending channel, its higher lows a testament to resilience 🐎. Yet, the bearish flag on the 12-hour chart looms like a shadow, a warning that failure to hold $3,100 may send it hurtling toward $2,400 🧨.

Interpretation: A range-bound dance, where a breach above $3,300 may herald a new era, while a fall below $2,800 signals a deeper retreat ⚠️.

Order Flow: A Balancing Act of Chaos and Calm

The order flow, once a tempest of aggressive selling, now teeters toward equilibrium, a fragile truce between buyers and sellers 🤝. Such transitions, though promising, require more than fleeting inflows to sustain the upward march 🚶♀️.

Network Upgrades: The Foundation of a Noble Cause

Ethereum’s network, a fortress of innovation, sees transaction fees dwindle to historic lows, a result of rollup adoption and protocol upgrades 🏰. Upcoming enhancements, like expanded data throughput, promise to further ease congestion, bolstering decentralized finance’s might 🧱.

Analysis: Lower fees and greater capacity make Ethereum a magnet for users, a beacon of value in a sea of uncertainty 🌊. Yet, the macrocosm remains a capricious master 🌬️.

Looking Ahead: The Crossroads of Fate

Near-term, the $3,600, $4,200, and $4,700 levels await, their capture contingent on continued support and stability 🌟. A fall below $2,800, however, may unravel the bullish tapestry 🧵.

While 2025’s forecasts remain a riddle, the current alignment of whales, ETFs, and technical stability suggests Ethereum’s consolidation phase, not an exhausted rally 🧩.

For now, the market breathes with cautious optimism, a fragile balance between measurable demand and the whims of the macrocosm 🌬️.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Top gainers and losers

2025-12-13 22:36