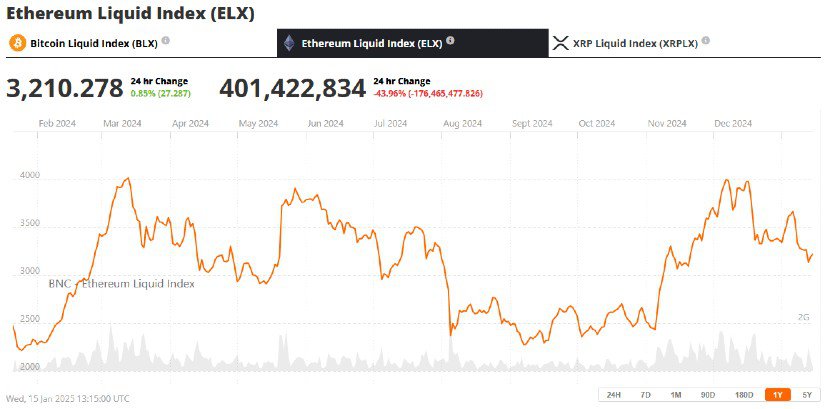

Despite some promising signs in the derivatives and spot markets, Ethereum (ETH) has found it difficult to pick up momentum again after dipping to $2,924 on January 13.

Market Sentiment and Short-Term Performance

Last week saw a significant 20.7% drop for ETH, leading to approximately $395 million worth of forced sales in positions that were leveraged long. At present, ETH is hovering around the psychologically important price point of $3,000, trying to maintain its position against persistent bearish market conditions.

The technical indicators suggest conflicting trends regarding ETH. Since the Relative Strength Index (RSI) and Stochastic Oscillator indicate that ETH is undervalued, there might be an impending increase in its price. However, its inability to surpass the resistance at $3,200 suggests that it may take some time before a consistent upward trend develops.

Based on data from Coinglass, Ethereum’s perpetual funding rate is currently in a neutral state, suggesting minimal bearish pressure on the asset even amidst recent market turbulence. The interest in ETH derivatives has risen significantly by over 40% since November, showing that investors who were previously sidelined are now preparing for a possible price surge.

Investor Behavior: Balancing Optimism and Caution

Investor behavior shows a mix of caution and hopefulness. The Market Value to Realized Value (MVRV) ratio for Ethereum, which measures profitability, currently stands below -10%. Historically, this indicator has often preceded increases in the price of ETH. Given this pattern, it might be reasonable to expect a recovery, and interestingly, Ethereum is already up by 8% today.

Over the past week, approximately 300,000 ETH were taken out from exchanges through the spot market, a clear demonstration of long-term confidence among investors. This trend, according to analysts at CryptoQuant, indicates that the dwindling exchange reserve might be indicative of accumulation, suggesting that investors could potentially be readying themselves for a future market rebound.

Over the past four days, there have been substantial withdrawals from Ethereum exchange-traded funds (ETFs), totaling approximately $354 million. This trend is being linked to investors reducing risk due to uncertain market conditions by analysts at Amberdata. Conversely, BlackRock, a significant ETF issuer, reported an inflow of $124.1 million, suggesting a contrast in institutional sentiment.

Challenges: High Fees and Layer-2 Concerns

Disputes persist over Ethereum’s network charges, as typical transaction expenses stay at approximately $2.70. Opponents claim that its ecosystem faces challenges in beating more affordable options such as Solana and the Binance Smart Chain.

The complexity of ensuring the security and decentralization of Ethereum’s off-chain solutions, also known as layer-2, is compounded because these networks operate autonomously with their own regulations and governance, which may not always guarantee the same level of protection as Ethereum itself. (Hasu, strategist at Flashbots and Lido)

Path Forward: Key Levels to Watch

The significant hurdle Ethereum faces before resuming its bullish trend is around $3,550, which is currently reinforced by the 50-day, 100-day, and 200-day Simple Moving Averages (SMAs). Overcoming this barrier might lead to a potential rise towards $3,776, where it could attempt to revisit the 2024 high of $4,093.

Should ETH fail to hold above $3,000, it might drop down to $2,817 or even lower levels. Interestingly, the $2,100 to $2,500 range continues to be an important area of demand due to past purchasing activity that has provided support in the past.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2025-01-16 17:40