Ethereum‘s Epic Comeback: Is the Bottom Finally Breached? 🤔🚀

In the dim corridors of the crypto market, where shadows dance and numbers whisper secrets, Ethereum stands at a crossroads. The recent Cryptoquant report suggests we’ve caught a glimpse of dawn—perhaps the start of an “Alt Season.” Last week, ETH/ BTC ratio soared by a staggering 38%, bouncing off its lowest point since January 2020—yes, a *real* vintage. Onchain data hints at a lull in selling, a serendipitous moment when institutional thirst for ether starts to rival an insatiable dessert craving. Ah, the plot thickens, and with it, the humor of fate. 🍰

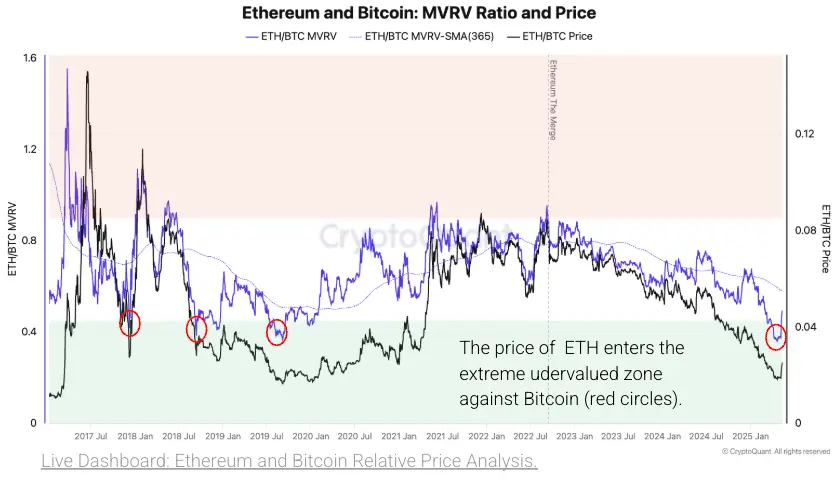

Breaking the Bottom: Ethereum’s Metrics Signal Long-Awaited Reversal Against Bitcoin

Cryptoquant researchers, those wise sages peering into crystal-ball charts, declare that ethereum’s (ETH) valuation against bitcoin (BTC) has plunged into an “extreme undervaluation zone”—a place so rare, it’s like finding a unicorn in a haystack. Since 2019, conditions mirror those in 2017–2019, moments before ETH decided to outshine Bitcoin in a dazzling performance—like a sprinter unexpectedly winning a race against a marathoner, leaving everyone confused but happy. The odds of mean-reversion look promising—think of it as a cosmic gamble, with a wink and a nod from the universe.

Meanwhile, ETH’s spot trading volume against BTC shot up to 0.89 last week—the highest since August 2024—making traders as excited as kids in a candy store. Historically, during 2019–2021, ETH outpaced BTC by four times, like that one friend who always outshines everyone at karaoke. This surge mirrors ETH’s price rebound, signaling market confidence is trying to shake off its mid-life crisis with a flamboyant dance. 💃🕺

Institutions are waking up—yes, those big, serious entities—ramping up ETH ETF holdings since late April. It’s almost as if they’ve finally realized ETH isn’t just a trendy dinner guest but maybe, just maybe, the guest of honor. Expectations of outperformance are fueled by scaling upgrades and macro fancy footwork. The ETH/BTC ETF and price ratios are dancing together—sharper than a ballroom waltz—hinting at a strategic portfolio shuffle, or perhaps just the market’s attempt at a synchronized swim. 🤽♂️

On the other hand, exchange inflows for ETH have plummeted faster than a GIF going viral—lowest since 2020—signaling a complete shutdown of sell pressure. Like a stubborn cat ignoring the fish, fewer tokens are entering exchanges for liquidation, and that’s good news for believers. Historically, whenTokens stay cozy outside the exchange, rallies tend to follow—they’re basically the crypto equivalent of “don’t poke the bear.” 🐻

But before anyone gets carried away on a rollercoaster, Cryptoquant analysts warn: the ETH/BTC ratio must climb above its one-year moving average to legitimize this rally. It’s like waiting for your coffee to brew—patience is key, and technical validation is the barista. The report ominously notes:

The ETH/BTC price ratio still needs to cross above its 365-day moving average to confirm a new leg up against bitcoin.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- PENGU PREDICTION. PENGU cryptocurrency

- Franklin Templeton’s 2025 Crypto Predictions: BTC Reserves, Crypto ETFs, and More

- USD CAD PREDICTION

- MOODENG PREDICTION. MOODENG cryptocurrency

2025-05-19 03:59