In recent days, the crypto market has been a veritable rollercoaster, with Bitcoin gallivanting to new heights, leaving mere mortals gasping in its wake. Yet, as is often the case with such exuberance, the specter of profit-taking has reared its head, sending the market into a temporary tailspin. Ethereum, that ever-ambitious sibling, has found itself struggling to maintain its lofty perch as the big fish—those notorious whales—begin to withdraw their considerable funds. One might wonder, is a short-term correction for ETH on the horizon? Spoiler alert: it seems likely! 🎢

Ethereum’s Struggles: A Comedy of Errors in Buying Demand

Thanks to Bitcoin’s meteoric rise and a smattering of improved economic conditions, Ethereum’s price soared to an impressive eight-week high of $2,731. However, it now finds itself in a rather awkward position, unable to attract the robust buying interest it so desperately craves. Many short-term investors, having locked in their profits, have left Ethereum feeling rather lonely.

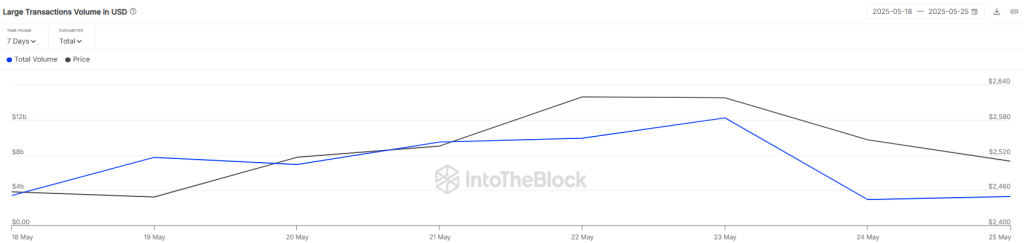

According to the ever-reliable Coinglass, a staggering $40.66 million in Ethereum positions were liquidated in the past 24 hours alone. Of this, a mere $15.12 million was from buyers, while a whopping $25.54 million was from sellers. Meanwhile, IntoTheBlock reports a dramatic plunge in large transaction volume, plummeting from $12.24 billion to a paltry $3.28 billion in just three days. Talk about a nosedive! 📉

This exodus of big investors suggests a weakening of the upward momentum in ETH’s price. With the whales retreating, sellers may soon find themselves in the driver’s seat, potentially leading to a price correction. Oh, the irony! 🐳💸

Despite these recent tribulations, Ethereum’s DeFi activity continues to flourish. The total value locked in Ethereum has surged from $50.63 billion on April 26 to a staggering $62.7 billion by May 26—a remarkable increase of over 25% in less than a month. Who knew Ethereum had such resilience?

Some of the most impressive gains have come from platforms like Pendle, where deposits have skyrocketed by over 50%, and Ether.fi and EigenLayer, both boasting a commendable 48% growth. Ethereum remains the reigning champion of blockchains in terms of total value locked, commanding a hefty 54% of the market. For context, Solana lags behind at a mere 8%, while BNB Chain clings to 5% among Layer-1 networks. 🏆

This robust DeFi growth could provide a cushion for ETH’s price, reducing the likelihood of a catastrophic drop, as many investors remain optimistic about a rebound. Fingers crossed! 🤞

What Lies Ahead for ETH Price?

Ether has recently encountered resistance around the $2,731 mark, resulting in a rather unfortunate drop below the immediate Fibonacci levels. As the bears flex their muscles, buyers are finding it increasingly difficult to spark a recovery rally. As of this moment, ETH is trading at $2,535, having declined over 0.6% in the last 24 hours. Not exactly a triumphant return, is it?

The ETH/USDT pair may very well tumble to the 100-day EMA (around $2,456), a crucial support level to keep an eye on. Should the price bounce back with gusto from this point, buyers might make another valiant attempt to breach the $2,750 barrier. If they succeed, we could be looking at a rise toward the elusive $3,000. However, there is some resistance around $2,870, but let’s be honest, it probably won’t hold for long. 😏

On the flip side, if the price dips below the 100-day EMA, this bullish outlook could swiftly turn sour. In such a scenario, the pair might plummet further toward the descending trend line at $2,329. As it hovers below the midline, the chances of a bearish correction for ETH price are looking increasingly likely. Buckle up, folks! 🎢

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2025-05-26 22:24