As a seasoned financial analyst with extensive experience in the investment industry, I find Samara Cohen’s insights during her recent interview on CNBC regarding the launch of spot Ether ETFs both insightful and compelling. Having closely followed the cryptocurrency market for years, I can attest to the growing significance of Ethereum as a versatile platform for innovation and its potential impact on the future of technology-driven investments.

On July 23rd, Samara Cohen, the Chief Investment Officer of ETF and Index Investments at BlackRock, appeared as a guest on CNBC’s “Squawk on the Street” program to discuss the upcoming launch of spot Ethereum exchange-traded funds (ETFs) and their prospective significance.

The conversation kicked off with Bob Pisani, the host, recognizing the highly anticipated debut of Ether Exchange-Traded Funds (ETFs). Cohen confirmed the launch, explaining that these ETFs were already transacting during both the pre-market and post-open periods. She highlighted that these ETFs accurately reflect the price movement of Ether, boasting narrow premiums and spreads, as well as gaining substantial backing from market makers. This development represents a momentous stride in merging cryptocurrencies with traditional finance, with over twenty market makers actively engaging.

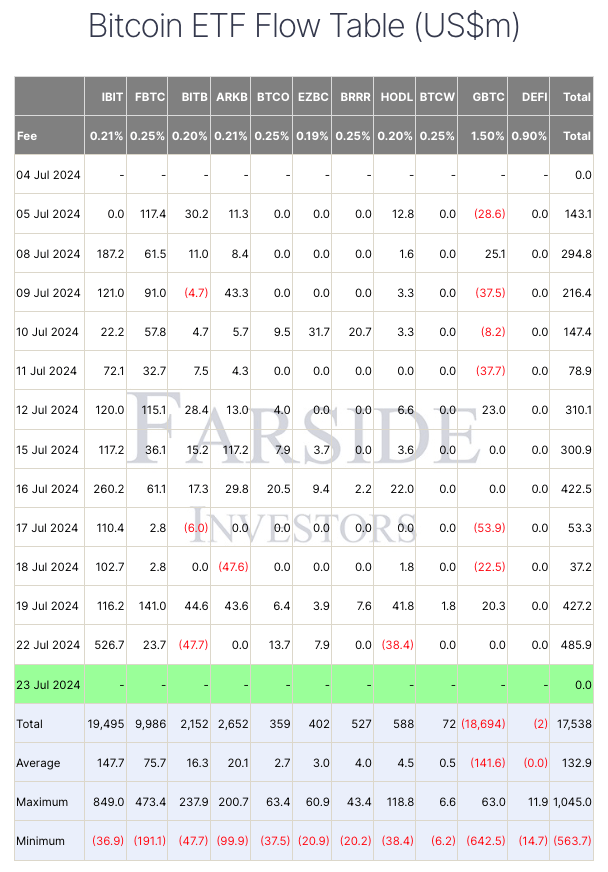

After 90 minutes, the total amount collected for these ETFs reaches $361 million. This places their combined volume within the top 1% among all ETFs, roughly comparable to that of $TLT and $EEM. However, it is important to note that this is significantly more than what an average ETF launch gathers on its first day, which typically does not surpass the $1 million mark.

— Eric Balchunas (@EricBalchunas) July 23, 2024

Cohen spoke about the differences between Bitcoin Spot ETFs, which have experienced substantial investment since their debut approximately 7 months ago.

She noted that Bitcoin’s market value stands at about $1.3 trillion, whereas Ethereum’s is around $400 billion – a significant yet smaller portion compared to Bitcoin. Emphasizing the infancy of Ether Exchange-Traded Funds (ETFs), she mentioned that they had just begun trading, contrasting this with the six-month tenure of spot Bitcoin ETFs. Moreover, she drew attention to the fact that Bitcoin’s blockchain history goes back 15 years, while Ethereum’s spans over 9 years.

One key idea Cohen highlighted was the significant disparity between Bitcoin’s and Ethereum’s applications. Bitcoin, recognized for its limited supply and “digital gold” label, stands apart from Ethereum due to its unique utility. Ethereum’s flexible blockchain technology empowers developers to create decentralized apps (dApps), transforming it into a dynamic platform fostering innovation. This difference is essential for investors eager to stay informed about advancements in market technologies and the development of groundbreaking applications.

Pisani raised the point that it might be challenging for investors to recognize the unique technological advantages of Ethereum over Bitcoin. On the contrary, Cohen admitted that Bitcoin’s description as digital gold could be more easily grasped by investors. Yet, Ethereum’s diverse applications and potential use cases provide an enticing argument for those eager to explore deeper. Cohen holds the view that both Bitcoin and Ethereum bring distinct benefits to investment portfolios.

As a researcher studying the dynamics of the cryptocurrency market, I was asked about the influence of political developments on enthusiasm for digital assets. Specifically, there has been much discussion about former President Trump’s self-proclaimed title as the “crypto president.” However, in my opinion, recent bipartisan support for digital asset legislation has held greater sway over market activity. The goal behind this legislative push is to establish strong and adaptable U.S. markets that enable investors to engage with cryptocurrencies through exchange-traded funds (ETFs).

As a researcher studying the world of crypto exchange-traded funds (ETFs), I’d like to summarize Cohen’s insights regarding the potential future of spot Bitcoin and Ether ETFs. According to her, these two cryptocurrencies currently meet crucial requirements such as liquidity, market quality, and proper tracking. However, she emphasized that there is still room for advancements in this field. In a light-hearted manner, Cohen hinted that we might need another discussion on this topic to delve deeper into future developments.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- Oblivion Remastered: How to get and cure Vampirism

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2024-07-23 19:31