If you thought Ethereum was just a bunch of nerds nerding out over digital coins, think again. Turns out, the world’s largest Ethereum treasure chest-yes, you read that right-BitMNR, the financial equivalent of that kid with a giant piggy bank, just decided to finally dip its toes into staking. And not even for fun-no, this is serious business, with a cool $219 million on the line. 🐳💸

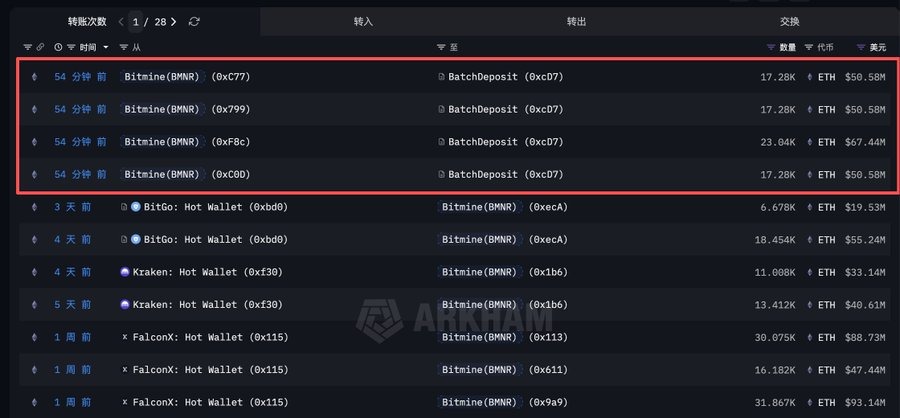

On-chain data shows that BitMNR deposited a whopping 74,880 ETH into Ethereum’s proof-of-stake system. That’s nearly twenty-two hundred million dollars, or as I like to call it, “the amount you’d need to buy an island… or two.” Considering they’ve been sitting on this Ethereum like a squirrel on acorns, it’s a bit like discovering Uncle Larry finally decided to invest in stocks-after all these years of just looking at the ticker.

Bitmine Stakes $219 Million in Ethereum

According to some mysterious on-chain wizardry shared by Arkham Intelligence, this was the first time BitMNR thought, “Hey, maybe this staking thing isn’t just for crypto bloggers.” They’ve got one of the biggest Ethereum treasuries in the whole market, yet until today, they played it safe-like a cat that hides under the couch just to avoid socializing. Now, they’re basically saying, “We’re in it to win it,” securing the blockchain and potentially earning enough rewards to buy a yacht-or at least a nice grill for the backyard. 🚤

What’s the big idea? Instead of banking on the price of ETH doing the moonwalk, BitMNR wants a steady paycheck. Because nothing says “financial genius” like earning passive income while the crypto market whiplashes itself around. It’s like putting your retirement funds into a machine that constantly hums… and occasionally shocks you, but hey, at least it produces some rewards.

How Much ETH Does BitMNR Hold?

Turns out, they’re sitting on about 4.066 million ETH. That’s like owning a small country’s GDP, or, more accurately, about $11.9 billion-enough to make your eyes pop out and your brain do somersaults. And with Ethereum’s annual staking yield dangling around 3.12%, defending the network might soon turn into a full-time job-earning roughly 126,800 ETH a year, which roughly translates to $371 million. Not bad for just locking up some tokens and waiting.

Thomas Tom Lee from BitMNR (who probably wears a fancy top hat when making these remarks) says they’re gunning for a 5% return. Because why not aim high when you’re already sitting on nearly 12 billion bucks? If everything goes according to plan, they’ll be swimming in ETH rewards faster than you can say “DeFi”-which, for some of us, is just a fancy word for “money making magic.”

Ethereum Price Outlook

Meanwhile, Ethereum itself is doing that jittery dance between $2,900 and $3,000. Evidently, traders are more bored than a TV host with a bad script, so the market’s been as quiet as a library during finals week. But professional prognosticators like Thomas Tom Lee are still feeling bullish, eyeing the potential push to $7,000 or $9,000 by 2026. So, if you’ve got some ETH, keep your fingers crossed-you might just get rich enough to finally buy that yacht, or at least a really fancy blender.

BREAKING:

TOM LEE PREDICTIONS:

– $9,000 ETH in early 2026

– $200,000 BTC in 2026

– $20,000 ETH Long-term

– Crypto SupercycleHere we go 🤑

– CryptoGoos (@cryptogoos) December 27, 2025

As of now, Ethereum is trading near $2,928-down just a hair (about 1%) in the last 24 hours, which is less exciting than the latest season of a reality TV show, with a market cap of around $354 billion. Quite the rollercoaster, just not the kind you’d want to ride without a snack.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Superman Still Lost Money Theatrically Despite ‘Strong Performance’ in WB’s Q3 Earnings

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-27 12:58