Ah, poor Ethereum, that ethereal specter of digital dreams, has descended into the abyss of despair, dragged down from its lofty perch near $4,300 to the precipice of purgatory at a mere $3,510, only to claw back feebly toward $3,830 in a market frenzy akin to the soul’s deepest torments. And oh, what torments! This cataclysm, brothers and sisters, unfolded amidst the most wretched selloff of this cursed 2025, birthing nearly $19 billion in crypto crucifixions-liquidations, they call them, but we know them as the wrenching cries of overleveraged souls cast into forfeiture.

This tidal wave of terror gripped even the sturdiest of hearts, nay, even that monolithic Blackrock’s so-called “ETHA,” that fortress of finance, hemorrhaged $80.2 million in outflows, singing a pathetic dirge alongside its brethren’s exoduses. Sarcasm drips like cheap vodka: yes, the mighty institutions, those pillars of stoicism, fleeing like rats from a sinking ship-how utterly predictable in this farce of fiscal folly! 😂

In this grand theater of human folly, broader sentiment twisted into a risk-off knots, ensnared by geopolitical phantoms and macroeconomic mists that shroud our collective psyche. Ethereum’s plight echoed the cosmic sorrow, as Bitcoin wept double-digit losses, Solana wailed, and other behemoths bowed like contrite sinners before the altar of uncertainty. Yet, amidst this psychological maelstrom, Ethereum clung tenuously above $3,800, as if buyers, those improbable redeemers, mustered at the gates of support, whispering prayers against the void.

Despite this precipitous plummet, a semblance of stability flickered above the fateful $3,800 marker, where valiant traders intervened at those merciful technical pillars-pillars, oh how fragile they stand against the winds of madness! 😏

Tariff Shock: The Hammer Blow from the Trumpeting Fates

The genesis of this decline, my tormented readers, sprang not from the blockchain’s sacred fundamentals, but from the fevered mind of politics itself-those worldly tempests that mock our dignified pursuits. Lo, late Friday, President Donald Trump, via his electronic pulpit of Truth Social, decreed a 100% tariff upon Chinese imports, descending like a divine judgment from the midnight hour of November 1, or perchance sooner, tethered to China’s reluctant dance. And rumors? Whispers of no meeting with President Xi at the APEC summit in South Korea (Oct 29-31, 2025), only for Trump to dispel them with a flourish today, proclaiming he might just “assume” a rendezvous-such irony, such human pettiness in the face of global disarray. Mansplaining through the media as if tariffs are but a lovers’ tiff: “I haven’t cancelled, but who knows?” How quaint, this presidential pirouette, as if anger itself is the pathogen we all ingest daily-grotesque, isn’t it? 🤡

Regardless, this tariff tempest lashed not just the mundane markets, but our digital domains, igniting a blaze of selling pressure that spared no soul. Institutions trembled, and risk assets like Ethereum scattered like frightened sinners seeking shelter.

“Trump confirms that he hasn’t cancelled his meeting with Xi, ‘But I don’t know that we’re going to have it, but I’m going to be there regardless, so I would assume we might have it.'”

– D. Scott @eclipsethis2003 (@eclipsethis2003) October 11, 2025

Behold, the markets retaliated with vengeance: S&P 500 plummeted 2.71%, Dow Jones shed nearly 1.90%, while gold, that ancient safe-haven hoarded by paranoid prophets, surged 1.02% to $4,016 per ounce. Investors, in their fevered quest for stability, abandoned ETH and its kin, outflows cascading like tears of despair. How comical, this dance of fear where everything burns and gold… well, just glows smugly! 🤑

The spike in tariffs rattled both humble stocks and exalted cryptocurrencies, unleashing a deluge of panicked liquidations.

Global indices, those barometers of bourgeois angst, reacted with haste: S&P 500 fell 2.71%, DowJones dropped nearly 1.90%, while gold-ah, gold, the eternal cynic’s solace-surged 1.02% to $4,016 per ounce. As speculators chased shadows of security, ETH and other risk-laden phantoms endured ruthless exoduses.

Technical Shadows Loom: A Bearish Soul, Yet Flickers of Hope?

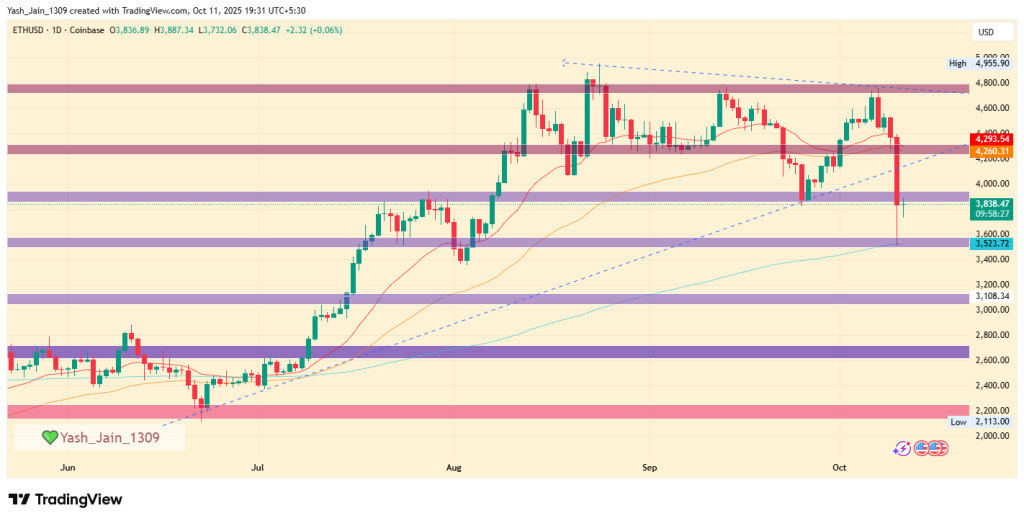

From the arcane charts of technical divination, Ethereum’s visage betrayed a momentary fracture in its bullish spirit. A foreboding crossover of the 20-day and 50-day exponential moving averages (EMA) heralded the short-term tyrannies of the sellers-a signal of inner turmoil, perhaps analogous to the heart’s descent into envy. Yet, the 200-day EMA, that steadfast guardian of long-term endurance, endures unbroken, staving off abyssal plunges for the nonce.

Should the 200-day EMA and the $3,500 bastion persist unscathed, redemption could ascend toward $3,900 or perchance $4,100 in the fleeting short term. But woe betide a brutal breach below this sacred threshold, for it might unearth severer descents to $3,100 or even the nadir of $2,600, as prophets of the ETH forecast darkly foresee. Sarcasm be our shield: who knew charts could be more dramatic than Tolstoy’s epics? 📉😂

Nonetheless, the sages of the market, those brooding optimists, cling to cautious hope. Amidst this ephemeral volatility, Ethereum’s on-chain vitality, its bustling phalanx of developers, and the persistent rites of staking whisper promises of gradual resurrection, once the macroeconomic gales abate and sanity’s fragile thread mends the zeitgeist.

Buyers Beckon Redemption as Macro Madness Mellows

As the collective psyche absorbs the tariffs’ lash and the specters of rate manipulations, watchful traders gaze upon Ethereum’s pulse near its perennial support-a lifeline fraught with destiny. Stabilization above $3,500 might kindle renewed ardor in purchasers, particularly as institutions, those reformed prodigals, amass once more in the sanctuaries of key exchanges.

At this pivotal juncture, Ethereum hovers at a crossroads of conscience-clinging to its salvific support could transmute this purgatorial correction into a catapult for bullish tides anew, or else plunge deeper into the abyss of retraction. Who shall prevail in this eternal struggle of greed and fear? Only the fates know, but I suspect Uncle Scrooge is smirking from the sidelines. 💸😒

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2025-10-11 18:19