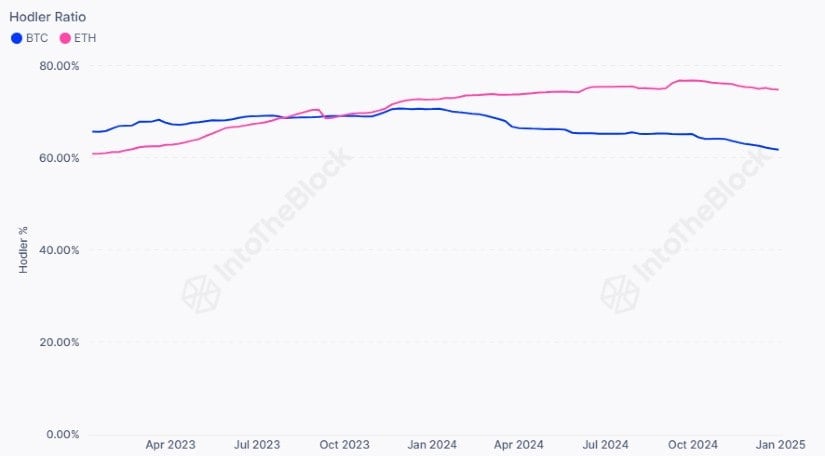

According to IntoTheBlock, approximately 75% of all Ethereum is being held by long-term investors. This figure stands in sharp contrast to Bitcoin‘s long-term holdings, which have been decreasing gradually at around 60%.

IntoTheBlock underscores a persistent long-term investment in Ethereum throughout 2024, a trend that remained robust. The percentage of long-term ETH holders increased significantly from 59% at the start of the year to 75% by its end. Conversely, Bitcoin experienced a decline in its long-term holders, dropping from 70% to 62% over the same timeframe.

The attractiveness of Ethereum for long-term investors can be linked to several aspects. One essential factor is staking incentives, which motivate asset holders to keep their assets locked in for longer durations, thereby decreasing the inclination to sell. The Shanghai/Capella update, rolled out on April 12, 2023, enabled staking withdrawals, strengthening Ethereum’s shift towards proof of stake.

Ethereum: More Than Just a Cryptocurrency

The network of Ethereum plays a crucial role in its standing as a leader. Through its support of decentralized finance (DeFi), unique digital assets known as non-fungible tokens (NFTs), and the use of smart contracts, Ethereum has earned a reputation for practicality and innovation, as reported by IntoTheBlock.

It’s expected that this pattern will continue until Ethereum gets close to reaching its record peak, at which point investors might decide to cash out their profits.

Despite Ethereum holders demonstrating strong determination, Bitcoin is facing turbulent conditions. Lately, Bitcoin plunged below $95,000 and then rebounded slightly to trade above $96,000, as per earlier reports from BNC. Nevertheless, the market’s robustness is uncertain since Bitcoin’s Funding Rate—a vital signal of demand in the futures market—remains relatively low.

According to CryptoQuant, robust funding rates are crucial for steady price increases in cryptocurrencies like Bitcoin. It’s not unusual to see a lag in demand during a rally, but if this doesn’t occur, it might indicate vulnerability. The recent rejection of Bitcoin at the $108,000 resistance level caused the funding rates to drop sharply, which may have weakened the bullish sentiment.

Ethereum’s Path to $6,000 — A Rally or a Dip?

If Bitcoin drops below its essential support at $90,000, it may encounter more selling and potentially larger price decreases. However, Ethereum’s technical analysis paints a different scenario. Analyst Ali Martinez points out that Ethereum is moving within an ascending parallel channel, indicating that a potential drop to $2,800 might serve as a springboard for a surge towards $6,000.

The prolonged tendency of investors to keep Ethereum for extended periods signifies more than simple faith; it’s a change in investment focus. Staking options and a burgeoning ecosystem are strengthening the dedication of Ethereum owners, making them appear less interested in immediate profits.

The journey of Bitcoin serves as a reminder of caution. Bitwise anticipates that Bitcoin could reach $200,000 by 2024, but the decrease in long-term holders and the volatile market sentiment suggest difficulties it might encounter. Despite these challenges, Bitcoin’s past influence and high value keep it a significant figure, even as Ethereum forges its unique path. On the other hand, Ethereum faces its own hurdles, with emerging chains like Solana claiming larger portions of the smart contract platform market.

Read More

2025-01-11 13:44