So the price of Ethereum drifts by the sad light of $2,540—an increase of 3.57% in the last week. Whispers of the $5,000 summit flutter like ration slips in a Siberian wind. The line for hope, as always, is longer than the line for bread.

Yet the metrics of the chain, indifferent and unforgiving as the overseer in a penal colony, do not join in this march toward glory. Once, in the fabled days of November 2021, ETH kissed $4,891. Four years on, if anyone is still awake, the prospects seem as stale as state-issued rusks. Each “signal” for $5,000 is like a memo slipped under the gulag cell door: “Maybe later, comrade… maybe later.”

Developer Drought: $5,000? Wake Me Up When the Shift Is Over

No need to check under your bed for innovation tonight. Since May, development activity—measured by code commits and repo updates—has dropped from 71 per week to a shabby 25, according to our ever-cheery Sentiment data.

The result? A spectacular 65% collapse in developer enthusiasm. Still, the price keeps slogging upward, like a bureaucrat with nothing left but stubbornness. When dev activity spiked last December, did we get fireworks? No, just the pop of another balloon animal. It’s as if the foundation of Ethereum is built atop piles of old, yellowing paperwork rather than steel. Good luck storming the $5,000 fortress with this work ethic. 😂

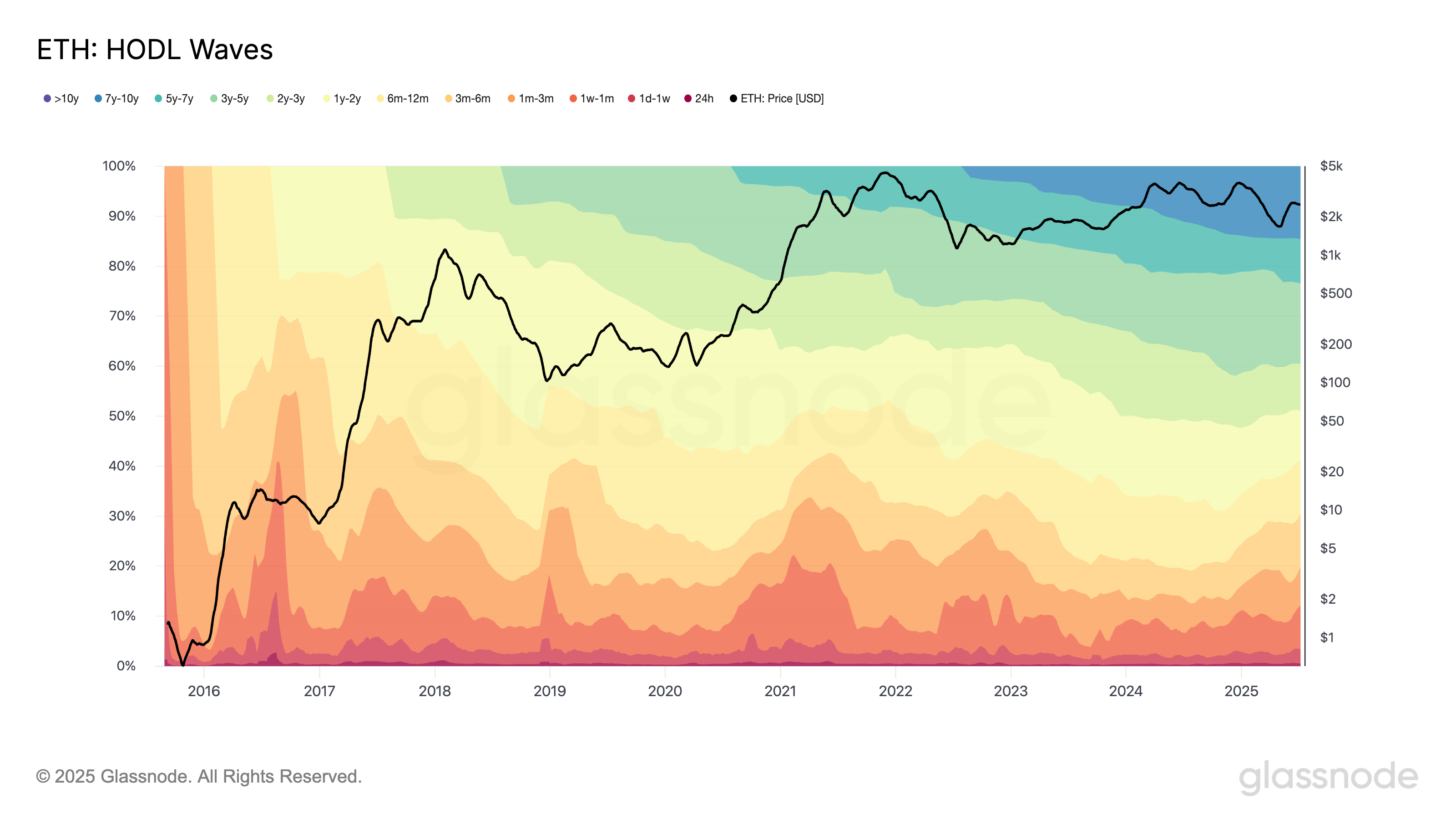

HODLers: Gone With the Ice Wind

The so-called HODL Waves—those poetic lines that once showed the courage of souls holding ETH for a year or more—now reveal a mass migration. Six months, they say, is now considered “long term.” Patience lasts as long as the rations do.

If you peer deeply into the waves, you’ll notice most coins rest not with the old-guard believers but with hands as twitchy as a KGB informant at the morning roll-call. In the good old days, veterans clung to their ETH through thick, thin, and rampant inflation. Today, at the first sign of resistance, whoosh—they’re gone faster than the last potato.

The Money Flows Like… Actually, It Doesn’t

CMF—the vaunted Chaikin Money Flow—reminds one of the Soviet postal system: after a brief surge in April–May, it sits unmoved, marked “pending” for weeks. In the time it took for Ethereum to rise from $1,300 to $2,700, one might have expected smart money to come pouring in, champagne corks popping… instead, it froze. Below 0.10, a number so disappointing it could only make sense to a professional optimist. As silent as the commissar’s office after an audit!

Resistance: Not Just a Slogan, but a Lifestyle

Ethereum, like a prisoner before the warden’s desk, rattles the bars at $2,647 but does not break through. Should morale wane, it must look to the bunks at $2,491 and $2,467. Beware: drop below, and $2,376 awaits—cold, lonely, and with plenty of introspection on offer.

OBV—that is, On-Balance Volume—remains nailed under -2.12 million, determined to go nowhere. Whales? Nowhere to be seen. Large wallets? Spotted only at the rumor mill, not the trading desk. The price clings to its perch with desperation, and the idea of $5,000 is little more than the ghost of a rumor told on a cold night.

If, by some miracle—or perhaps, mere exhaustion—Ethereum flips $2,647 into support, perhaps then the blacklist gets shorter, and the price may noisily shuffle over $2,800. But for that, developer enthusiasm and a CMF with a pulse must return. One can always hope—for hope, unlike bread, is never rationed. 🍞✨

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-07-08 15:07