As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen countless bull and bear cycles, but none quite like this digital gold rush. The recent $163 million outflow from Ethereum ETFs is a stark reminder that even the most resilient market can face bearish pressure.

This week, Ethereum (ETH) exchange-traded funds (ETFs) have seen a sizable withdrawal of approximately $163 million. This trend is likely due to the diminishing optimism surrounding Ethereum, which has made it challenging for the coin’s price to surpass the resistance level at $3,400.

In light of the current downtrend, Ethereum’s value might progressively decrease over the following weeks, according to this prediction. Here’s the reasoning behind it.

Ethereum Buying Pressure Faces Dip

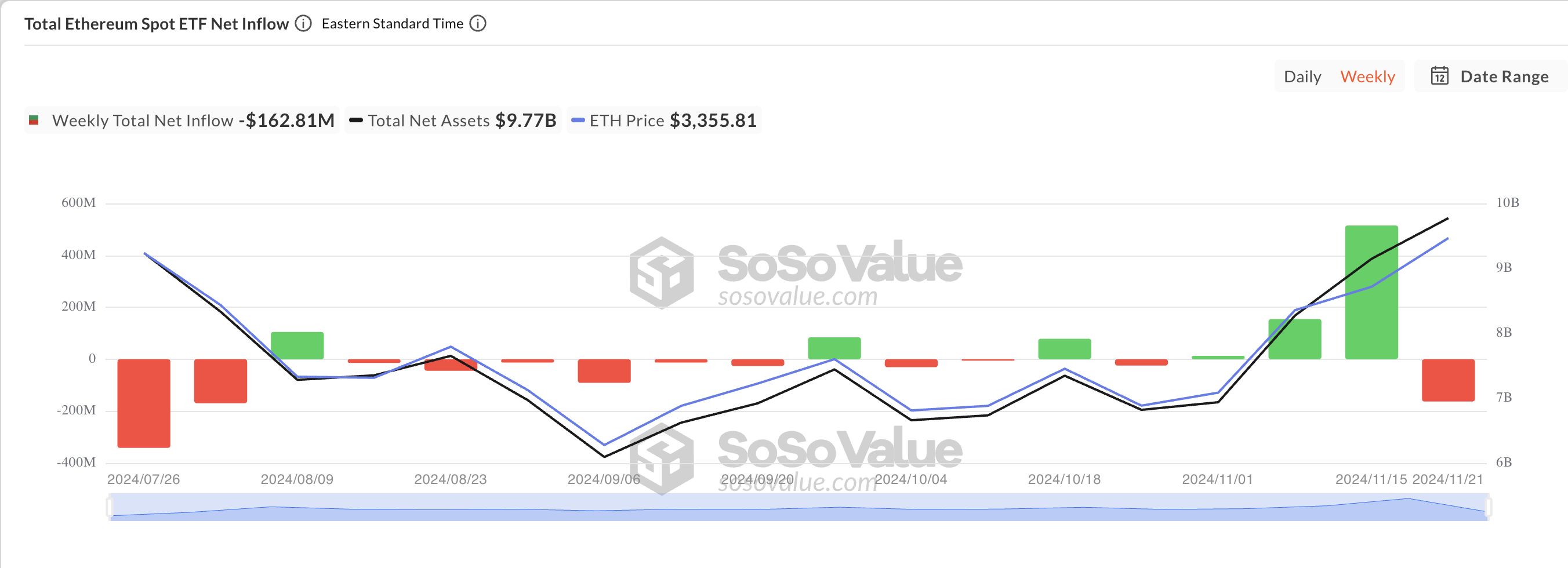

Based on figures from SosoValue, it’s been revealed that this week, there have been withdrawals of approximately $163 million from Ethereum ETFs. This figure marks the third-largest weekly net withdrawal since these investment products started trading on July 23.

Interestingly, after an unprecedented increase in Ethereum ETF investments that peaked at $515.17 million in weekly inflows – a high not seen since their debut – we’ve now witnessed a reverse flow of funds. This shift appears to be connected to the surge in inflows that took place following Donald Trump’s election victory on November 5, which sparked a dramatic crypto market rally.

Nevertheless, ETH’s price is facing difficulties as negative feelings towards it are growing stronger. Previous reports from BeInCrypto indicate that the ETH/BTC ratio, a metric showing Ethereum’s price performance relative to Bitcoin, has reached its lowest point since March 2021. This trend arises due to investors selling their altcoins, which allows bears to reassert control over the market.

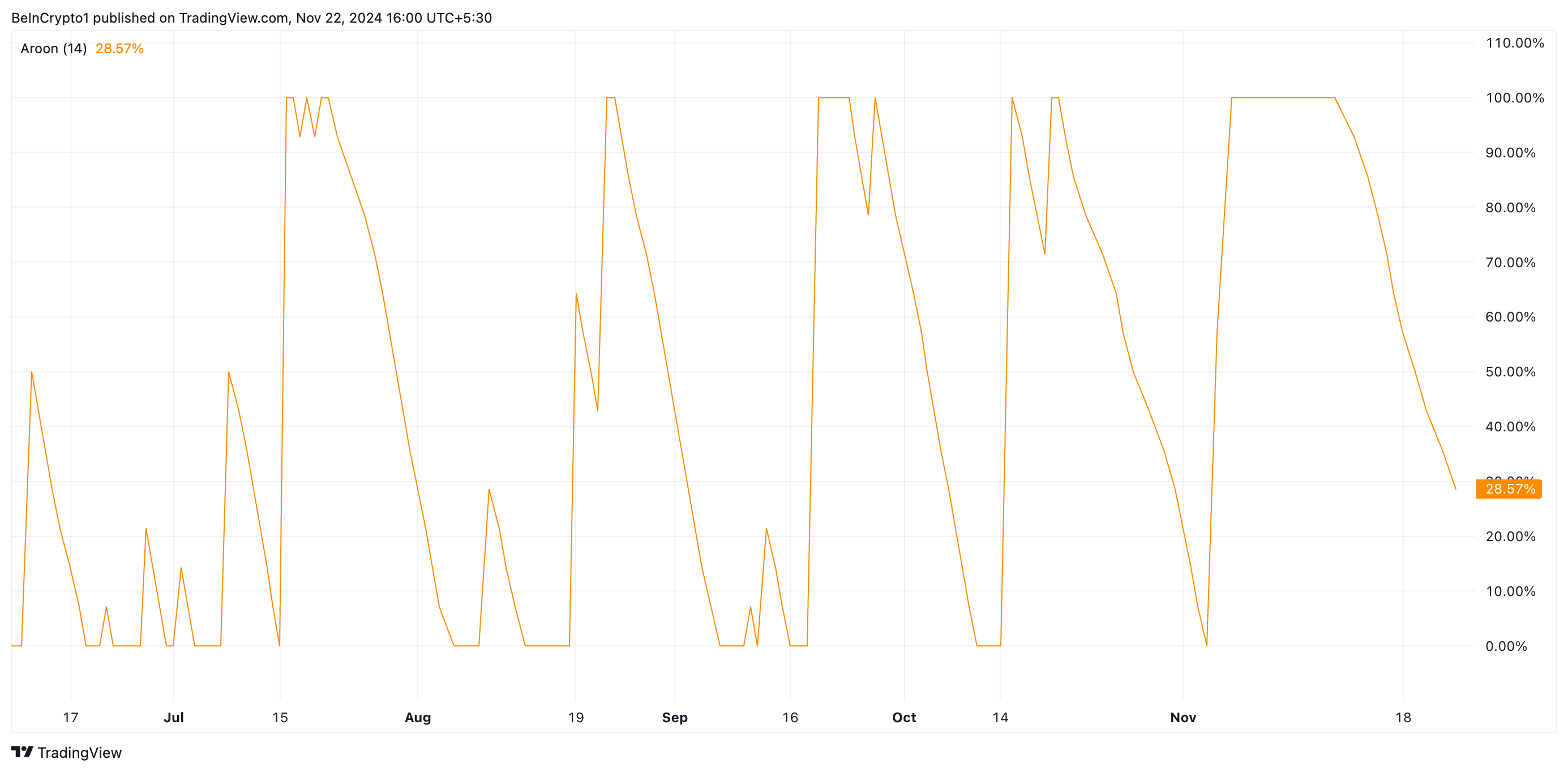

Additionally, the descent of Ethereum’s Aroon Up Line indicates a lessening bullish influence in the market. Presently, the Aroon Up Line stands at a decreasing 28.57%.

The Aroon indicator identifies trends and their strength. It consists of two lines: Aroon Up and Aroon Down. Aroon Up measures the time since a new 25-period high, while Aroon Down measures the time since a new 25-period low.

When the Aroon Up Line descends, it indicates a waning uptrend or a possible trend change. This happens when the price needs more time to reach new highs, demonstrating a decrease in momentum. A decreasing Aroon Up line is seen as a bearish sign, implying that bullish energy might be dwindling, and a potential downward trend could be emerging.

ETH Price Prediction: Is a Bull Flag Forming?

It’s intriguing to note that a potential ‘bull flag’ formation appears to be emerging in the one-day ETH/USD chart. This pattern typically signals the continuation of an upward trend.

A bull flag is formed when there’s a swift rise in price (referred to as the ‘flagpole’) which is then followed by a phase of sideways movement or slight price correction (the ‘flag’). When the price surpasses the flag’s upper boundary, it could indicate a possible continuation of the upward trend.

If Ether (ETH) manages to surpass its channel’s upper boundary at $3,997, it will signal a continuation of the upward trend, potentially driving the coin’s price up to around $3,534. But if buying interest wanes significantly, ETH could instead drop to approximately $3,262, contradicting the bullish perspective we have now.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

2024-11-22 14:29