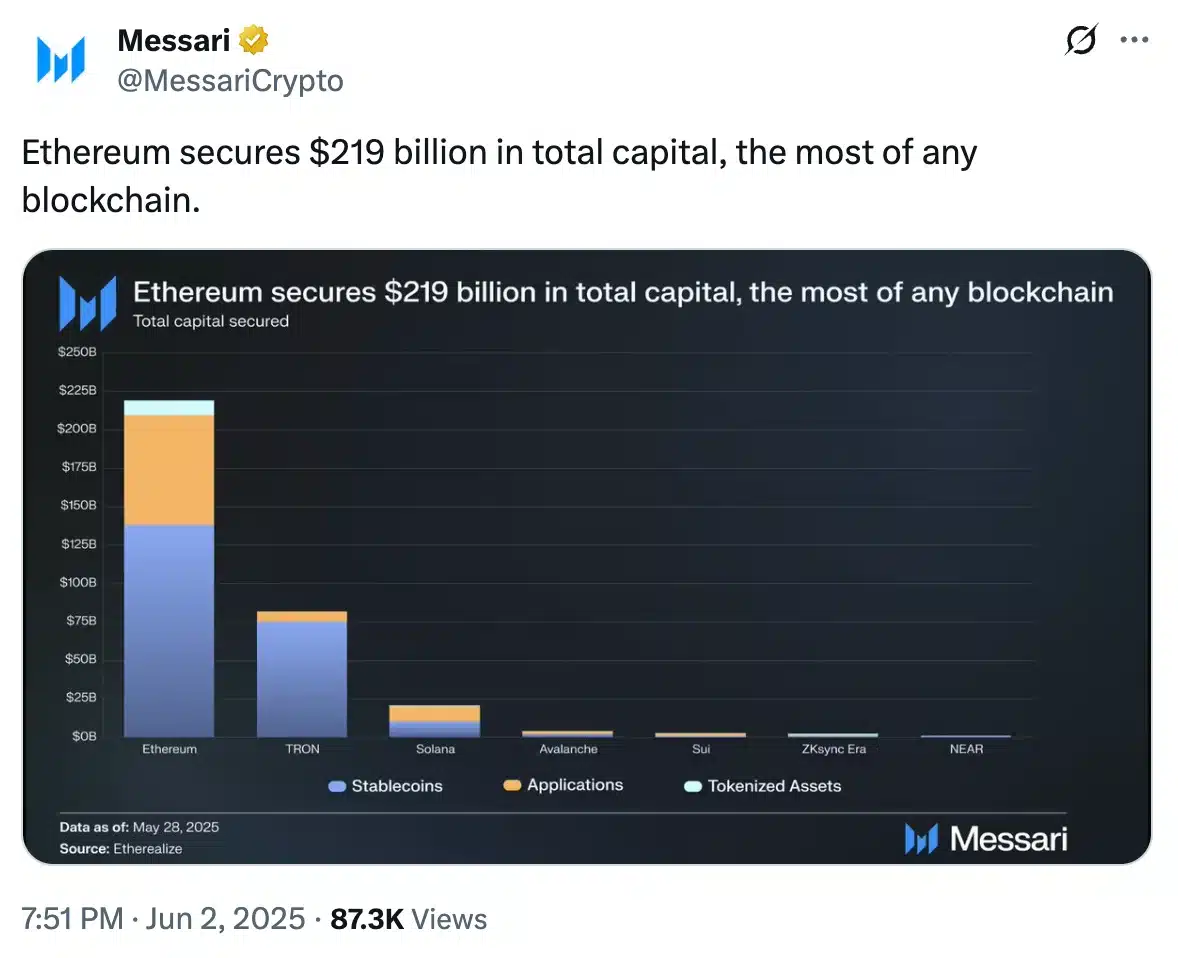

- Ethereum has hoarded a staggering $219 billion on-chain, thanks to stablecoins and dApps (yes, those things that no one really understands but everyone loves).

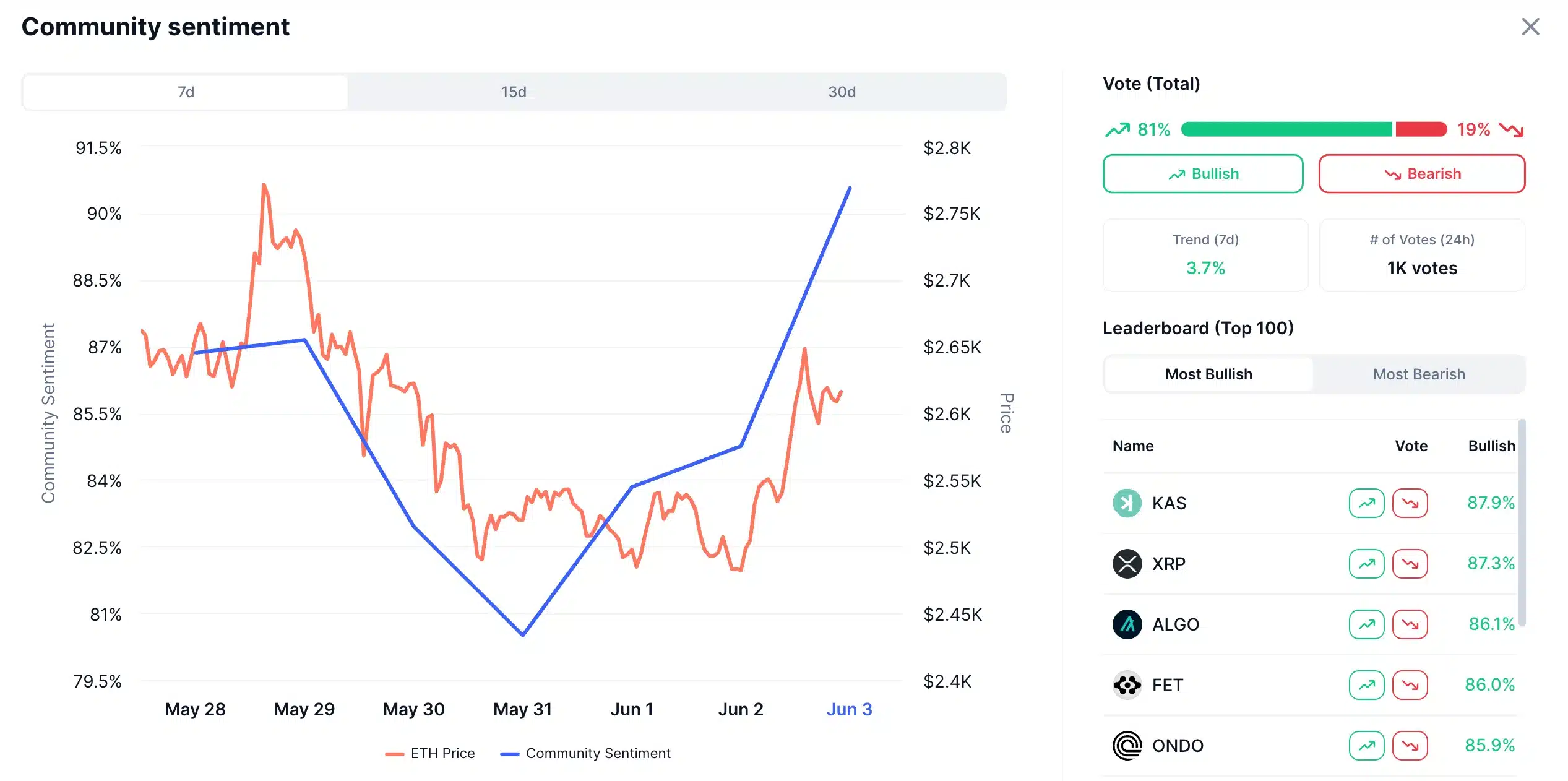

- Sentiment is looking as bullish as a bull in a china shop, eyeing the elusive $3,000 despite some technical mumbo jumbo suggesting otherwise.

Ethereum [ETH], the blockchain darling that thinks it’s the center of the universe, recently strutted around at $2,604.49—up by 4.64% in the last 24 hours, because apparently, money does grow on blockchain trees. According to CoinMarketCap, of course, because who else would be keeping tabs?

This upward march indicates that people still trust Ethereum more than their own grandma’s cooking, now anchoring a sprawling $219 billion in value—primarily in stablecoins, dApps, and fancy-pants tokenized assets that might someday be worth something… or not.

Blockchain analytics platform Messari, the slightly obsessive numbers nerds, highlight Ethereum’s ever-expanding ecosystem—probably because they find it fascinating to watch a digital coin grow while in their pajamas.

And yes, Ethereum continues to dominate the blockchain space like a grumpy king reigning over an empire of code and chaos, with most of those shiny $219 billion coming from stablecoins—those trusty digital pizzas, holding everything together.

Ethereum wins—more than just a pretty blockchain

Beyond just stacking cash, ETH is also cashing in elsewhere—like in NFTs (those digital pictures that people say have value but nobody really knows why), DeFi (DeFi: “Decentralized Finance,” or “How to lose money securely”), and staking (basically, locking up your coins and hoping they don’t run away).

DeFiLlama, the slightly eccentric data people, report that ETH’s Total Value Locked (TVL) is now $61.10 billion—more zeros than a banker’s nightmare—and it’s not even close to stopping.

Meanwhile, Artemis Analytics declares that Ethereum is the king of net capital flow across DeFi bridges, making it the financial superhighway of the crypto world—probably with more potholes and tolls though.

Adding fuel to the bullish bonfire, social media sentiment has turned as positive as a cat in a sunbeam, encouraging traders to keep dreaming of that $3,000 milestone (because what’s life without a little hope and a lot of speculation)?

Is the market feeling optimistic or just pretending?

Indicators like the Relative Strength Index (RSI)—which is basically the ‘How Excited Are We’ meter—are still showing more green than red, hinting that optimism might just be contagious.

But don’t pop the champagne yet; the MACD indicator (which sounds like a robot trying to sing) still whispers warnings of bearish clouds lurking nearby, because nothing says ‘trust in a blockchain’ like a little chaos, right?

Despite all this, traders are playing it cautious and watching resistance levels as if they were guarding the crown jewels—because in crypto, every day is a rollercoaster, and nobody likes losing their lunch.

And then there’s the recent Pectra upgrade, which basically means Ethereum got smarter but also a tempting target for those pesky attackers eager to exploit the shiny new EIP-7702 feature—because nothing says “happy holder” like a security breach, right?

But with market momentum on its side, ETH might just be heading for the big three-thousand mark—if the crypto gods are feeling generous or if everyone just really loves gambling with digital coins.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2025-06-03 23:07