- Whale capitulation and exchange outflows stirred uncertainty over Ethereum’s short-term market direction. Because, you know, whales are the ultimate market oracles. 🐳🔮

- Bearish technicals, rising NVT, and liquidations pointed to deeper downside risks for ETH. Or, as I like to call it, the crypto version of a midlife crisis. 📉😬

After selling 10,000 Ethereum [ETH] worth $15.71 million at an average price of $1,571, a long-term whale exited after holding for over 900 days without taking profits. That’s right, folks—900 days of HODLing, only to sell at a loss. Talk about commitment… or masochism. 🤷♂️💸

The investor had accumulated ETH at $1,295 during the 2022 bear market and witnessed its price rally past $4,000. Despite riding multiple market cycles, he chose to exit during the current downturn. Because why sell at the top when you can sell at the bottom? Genius. 🧠📉

This move reflects growing caution among large holders and adds weight to the prevailing bearish sentiment in the ETH market. In other words, the whales are jumping ship, and the rest of us are left wondering if we’re on the Titanic. 🚢❄️

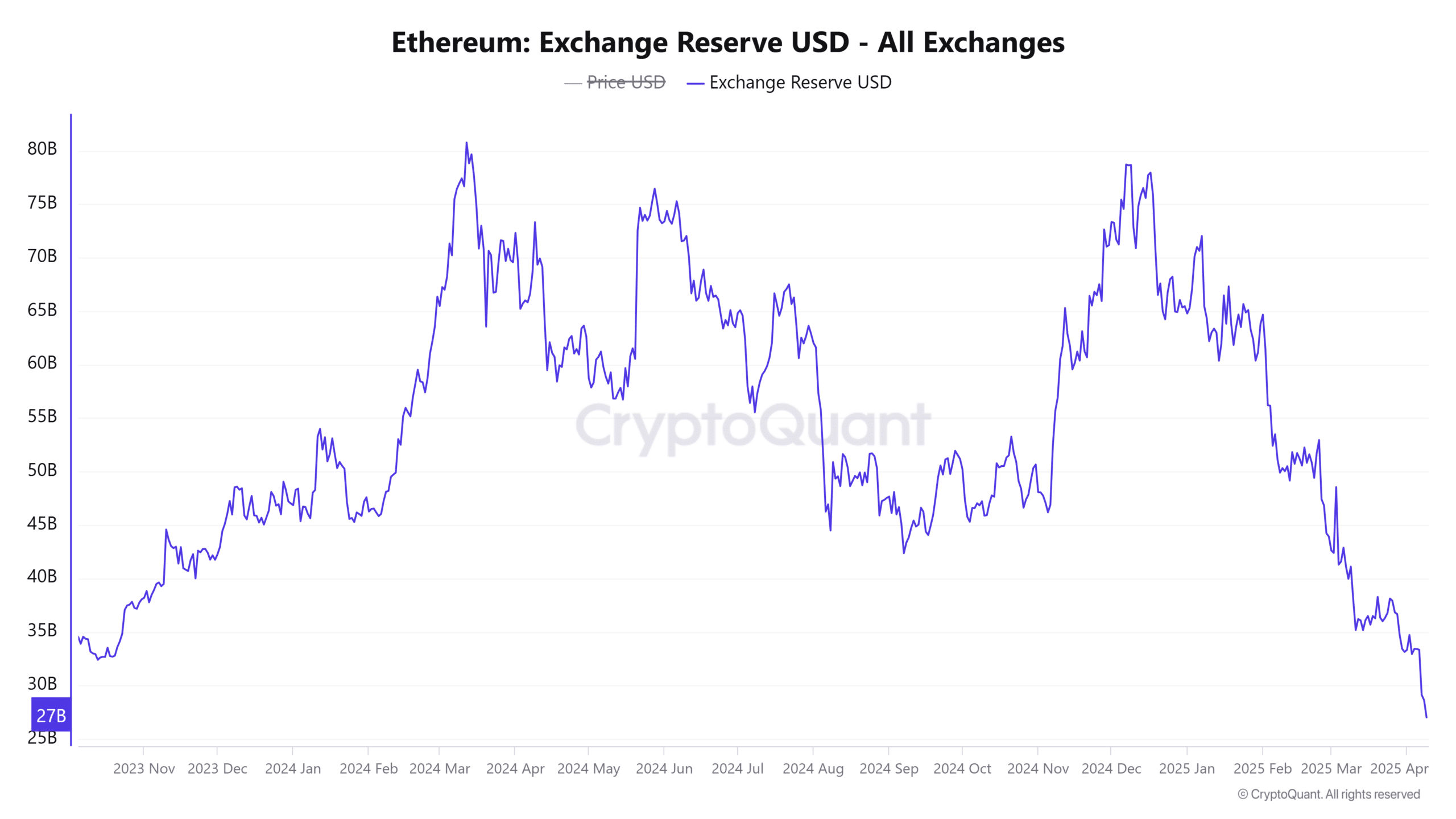

Are exchange reserves flashing a warning sign for Ethereum?

Ethereum’s Exchange Reserve has dropped by 9.03% in the past 24 hours, now totaling $26.63 billion. Typically, lower reserves imply reduced selling pressure as investors transfer assets off centralized platforms. But let’s be real—this is crypto. Nothing is ever that simple. 🤔💼

However, this decline coincides with significant selling activity and whale exits, raising doubts about its bullish implications. Large holders may be moving their assets to decentralized platforms, possibly for leverage or gradual position exits, adding uncertainty. Or maybe they’re just hiding their ETH under the mattress. 🛏️💰

As a result, the reserve drop should not be viewed as entirely positive but as a potential precursor to strategic sell-offs. In other words, it’s not a bug; it’s a feature. 🐛🎮

How is price action reacting to whale pressure?

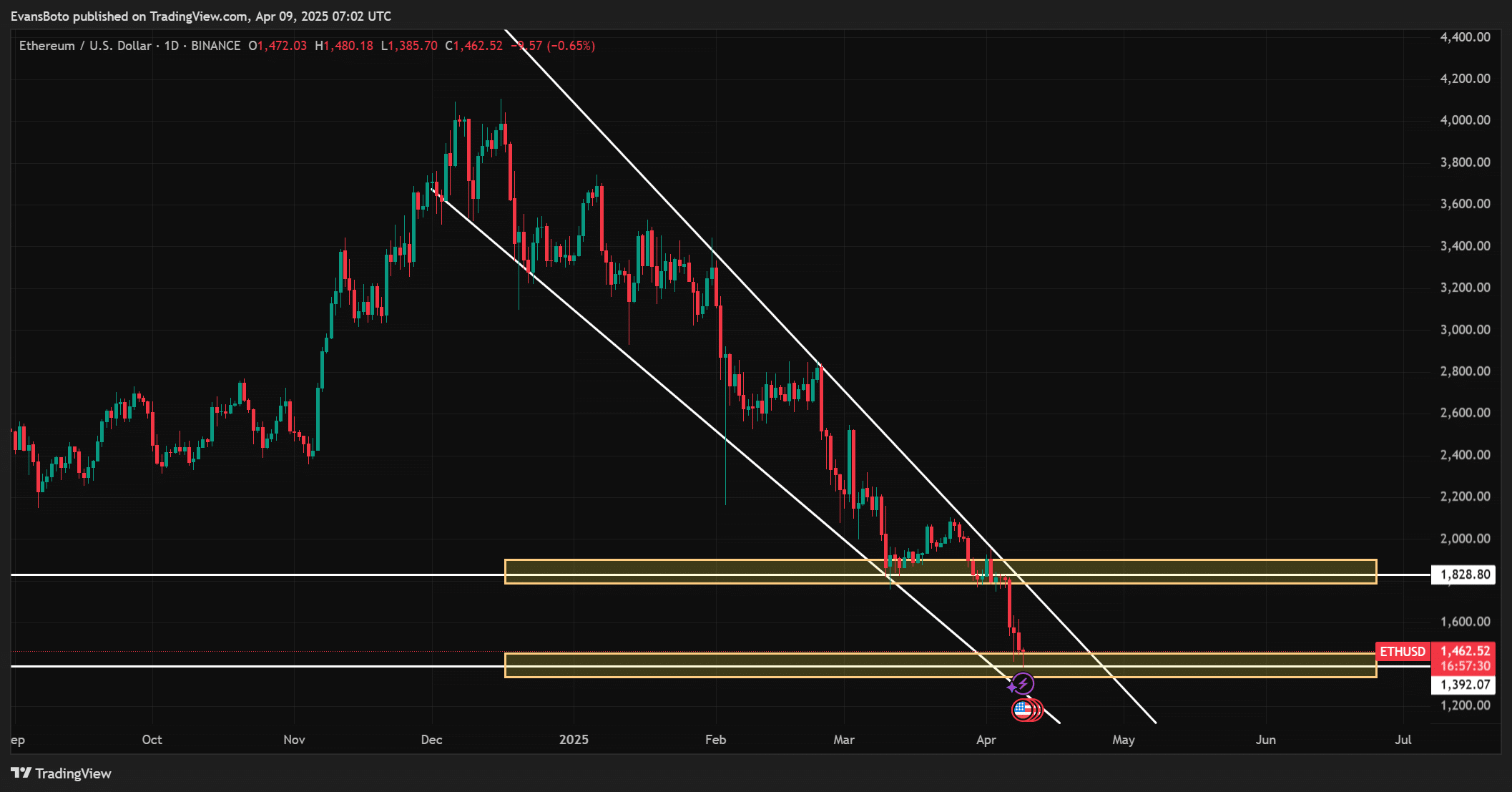

At the time of writing, ETH was trading at $1,474.01, reflecting a sharp 6.12% drop in the past 24 hours. Because nothing says “bullish” like a double-digit percentage drop. 🐻📉

Notably, Ethereum recently broke below a crucial demand zone near $1,828, making the current price level significant. It is now hovering just above the next major support at $1,392. Spoiler alert: it’s not looking good. 🚨📉

Moreover, ETH is trapped within a clear descending channel, forming lower highs and lower lows—a classic bearish pattern. Or, as I like to call it, the crypto version of a downward spiral. 🌀📉

If the current support fails, further declines may occur rapidly, especially with no strong demand zones directly below. In other words, brace yourselves. Winter is coming. ❄️📉

Is the Ethereum network losing its momentum?

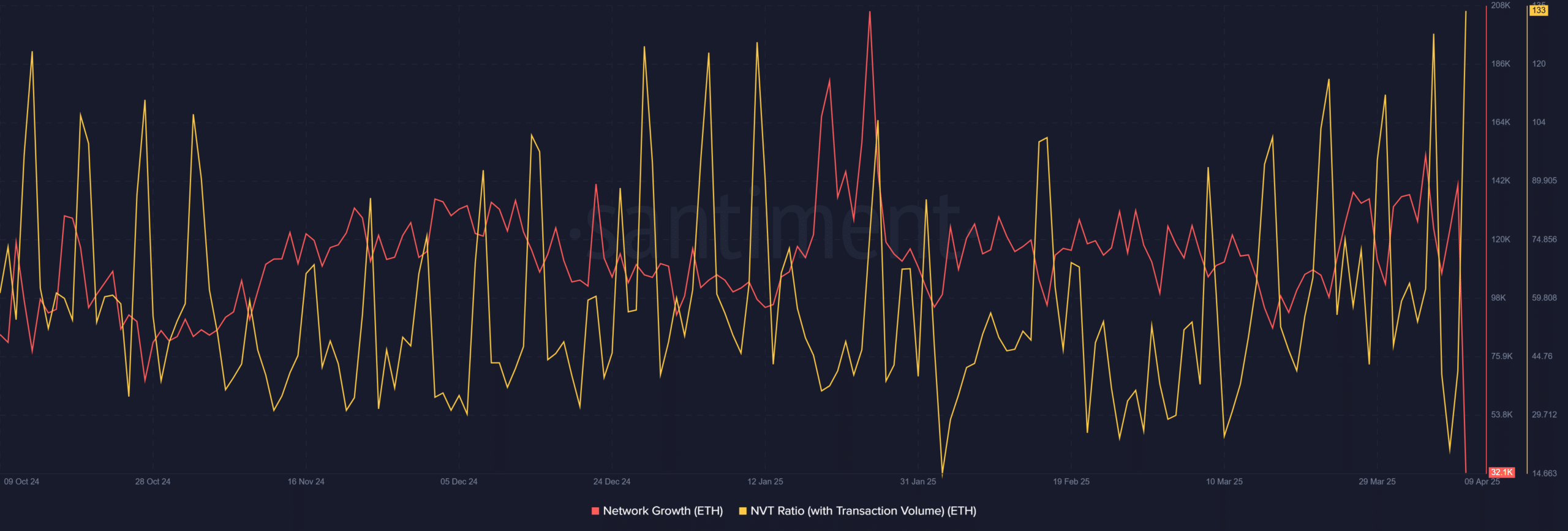

Beyond that, on-chain data paints a troubling picture. Because who needs optimism when you have data? 📊😬

Ethereum’s network growth has declined drastically and sat at just 32.1K at press time, which indicates falling interest from new participants. In other words, the party’s over, and the guests are leaving. 🎉🚪

Meanwhile, the NVT ratio surged to 133.71, suggesting that Ethereum is becoming overvalued relative to the actual transaction volume on-chain. Because nothing says “overvalued” like a triple-digit ratio. 📈💸

Together, these metrics paint a picture of shrinking utility amidst price volatility. Historically, such divergences between valuation and real usage often precede sharper corrections. In other words, it’s not a matter of if, but when. ⏳📉

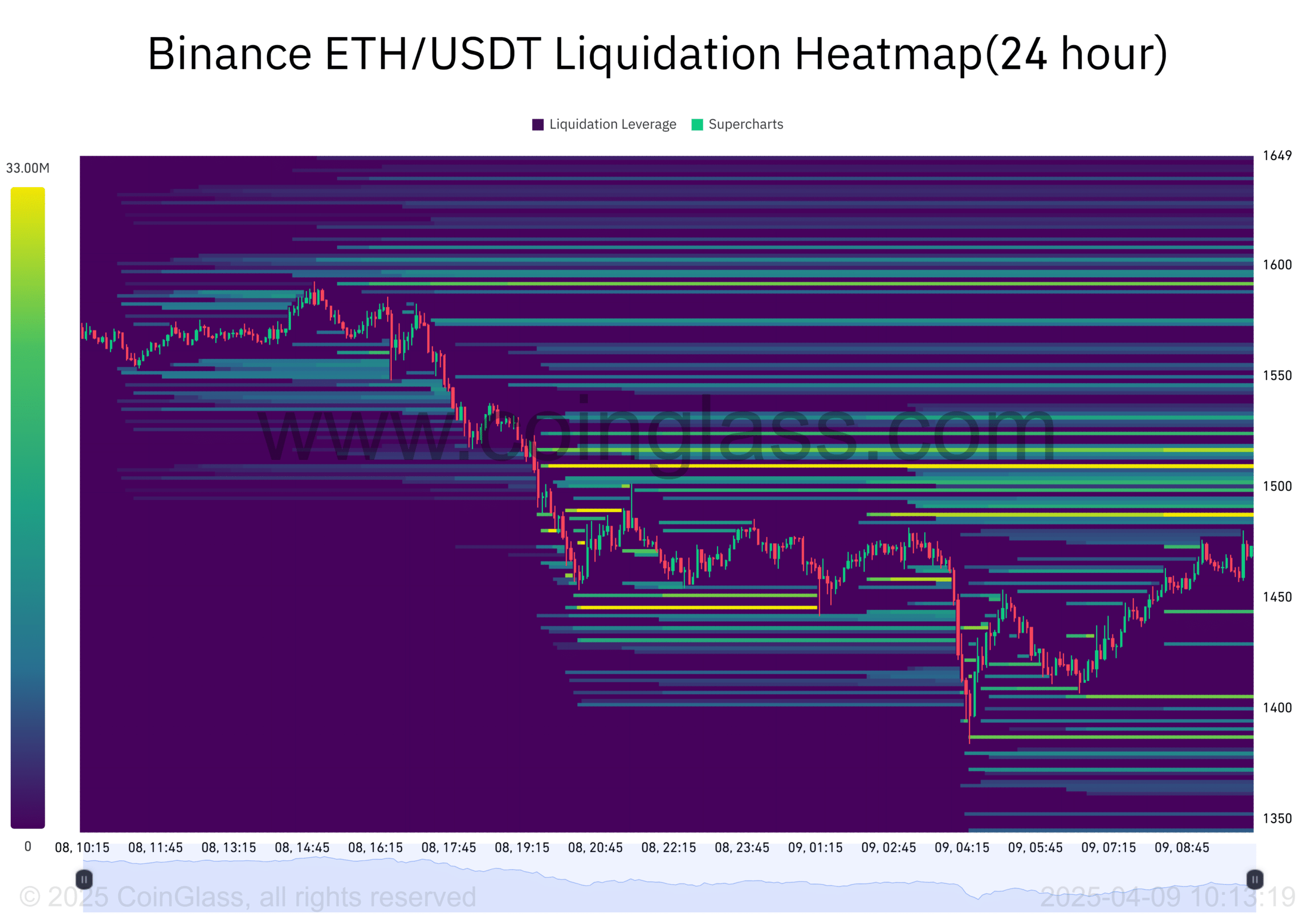

Where are liquidations piling up the most?

Derivative market data highlights the growing importance of liquidation zones. The Binance ETH/USDT liquidation heatmap reveals significant liquidations near $1,500. Because nothing says “fun” like forced liquidations. 🎢💥

When prices pierced this zone, long positions were forcibly closed, causing a cascade effect. Liquidation levels are densely concentrated between $1,500 and $1,600. Any upward price movement may encounter immediate resistance from sellers re-entering the market. In other words, it’s a minefield out there. 💣📉

With leverage wiped out and volatility surging, the risk of deeper liquidations remains high. This is particularly true if prices fail to stay above $1,392 in the near term. In other words, buckle up. It’s going to be a bumpy ride. 🚗💨

Considering all these indicators, the current market conditions point to Ethereum entering a deeper correction phase. Because nothing says “correction” like a 6% drop in 24 hours. 📉😬

Whale capitulation, declining network growth, a rising NVT ratio, critical support breaks, and liquidation pressure collectively confirm a bearish trend. In other words, the bears are in control, and the bulls are nowhere to be found. 🐻📉

Without significant bullish catalysts emerging soon, Ethereum is likely to maintain its downward trajectory. In other words, it’s not looking good, folks. 🚨📉

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Oblivion Remastered: How to get and cure Vampirism

- Does Oblivion Remastered have mod support?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DODO PREDICTION. DODO cryptocurrency

- Kingdom Come Deliverance 2: Top 5 Best Bows & Arrows

- Top Potential TGEs To Watch Out For in Q1 2025

2025-04-09 14:20