Ethereum, the cryptocurrency that once promised to revolutionize the world but now mostly just revolutionizes your stress levels, has started the week with what can only be described as a “minor relief bounce.” This is the kind of bounce that makes you think, “Oh, maybe things are looking up!” before reality slaps you in the face with a wet fish. Last week, ETH took a nosedive below $1,500, and while it’s currently clinging to support like a koala to a eucalyptus tree, the momentum is about as strong as a wet paper towel. On-chain sentiment? Still bearish. Upside potential? Limited, unless buyers suddenly develop a collective backbone and reclaim key resistance levels. Good luck with that.

Technical Analysis

By Edris Derakhshi, who probably needs a stiff drink after writing this.

The Daily Chart

ETH’s daily chart is a masterpiece of bearish despair. It’s trading below the 200-day moving average, which is currently lounging around $2,800 like it’s on a permanent vacation. Over the past two months, ETH has been printing lower highs and lower lows like it’s trying to win a “Most Depressing Trendline” award. After breaking below the $1,800–$2,000 range last week, ETH is now struggling to hold onto the $1,550 support zone. The RSI is hovering just above oversold levels, and momentum indicators are about as exciting as watching paint dry. A break below $1,550 could send ETH tumbling toward the $1,300–$1,400 demand zone, while reclaiming $1,900 might slow the bearish trend. Might.

The 4-Hour Chart

On the 4-hour chart, ETH has bounced from the $1,550 support, but now it’s facing a descending trendline that’s been acting as dynamic resistance for over a month. The price is currently testing the $1,650–$1,700 intraday resistance range. A breakout above the trendline and a successful flip of this zone could trigger a short-term rally toward $1,800. But let’s be real—sellers are lurking at every bounce like vultures waiting for roadkill. The market structure still favors lower highs unless ETH can close above $1,700 and hold. Spoiler: It probably won’t.

Sentiment Analysis

By Edris Derakhshi (TradingRage), who’s probably raging right now.

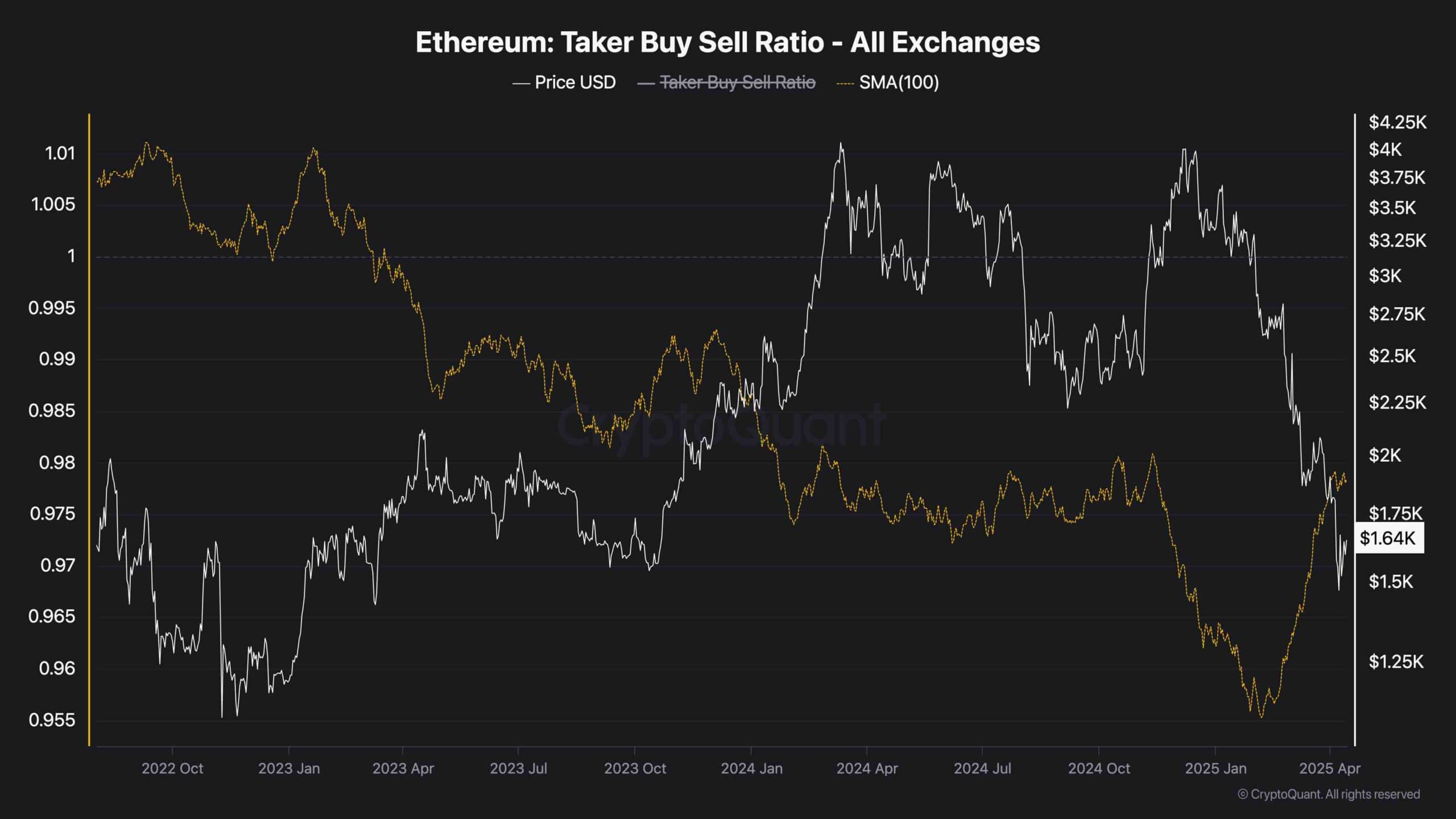

Taker Buy-Sell Ratio

The Taker Buy Sell Ratio for ETH is trending below 1, which is a fancy way of saying that market orders are mostly sell-driven. There’s been a slight uptick in recent days, but the overall trend is still bearish, meaning the bounce is about as convincing as a politician’s promise. The sentiment shows lingering fear, and the broader trend points toward further downside unless buyers can somehow force a shift in structure and volume. In other words, don’t hold your breath.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-14 15:21