Two massive Ethereum whales decided that, instead of blowing their cash on Ferraris or islands, they’d throw a tantrum with the market instead. And by tantrum, I mean buying the dip with the enthusiasm of a kid in a candy store — if that kid also had $400 million lying around. 🍭💸

In the first days of August, these aquatic giants collectively dropped over $400 million into ETH, shouting, “We believe in this digital magic pudding.” Apparently, confidence in the long-term future of their digital goldfish is a thing — or at least, it’s what they tell themselves as they watch their $300 million silverfish swim around in the deep end of Galaxy Digital’s OTC pool.

Ethereum Whales Bounce Back, because Why Not?

One of the most glittering transactions involved a wallet monitored carefully by Arkham Intelligence (because someone has to keep tabs on whales’ shopping sprees). Over three days, this wallet scooped up around $300 million worth of ETH from Galaxy Digital’s over-the-counter trading desk. Imagine someone grabbing the last slice of digital pizza, only it costs about $3,530 per slice.

The wallet currently is sitting at an unrealized loss of around $26 million — but who’s counting? Certainly not the whales, who are busy accumulating as if they’re trying to fill an invisible swimming pool with ETH.

Somebody is buying a TON of ETH.

In the past 3 days, this address has accumulated $300M of ETH from Galaxy Digital OTC.

It’s currently worth $274M, with this address down $26M or 8.7% so far.

Address: 0xdf0A67Ded855F8ea4baB6399690883243c0e2EF3

— Arkham (@arkham) August 3, 2025

Really, this can only mean one thing: these whales are in it for the long haul — or perhaps they just really like throwing money into the deep end for fun. It’s not what you’d call speculative; it’s more like a strategic game of digital chess with way too much money on the table.

Meanwhile, another mischievous entity called SharpLink is busy adding ETH like a squirrel hoarding for winter. Over two days, they added 30,755 ETH, dropping a cool $108.57 million (which is apparently a lot of USDC.) Now they sit atop a stack of 480,031 ETH, valued at about $1.65 billion, which is apparently enough to buy a small moon.

SharpLink(@SharpLinkGaming) received another 15,822 $ETH($53.9M) 6 hours ago.

They spent 108.57M $USDC to buy 30,755 $ETH in the past 2 days, with an average buying price of $3,530.

SharpLink now holds a total of 480,031 $ETH($1.65B).

— Lookonchain (@lookonchain) August 3, 2025

These purchases arrived precisely when ETH/ether dropped to a very unimpressive $3,300 — probably a clearance sale at the crypto mall. But don’t worry! ETH has since boosted itself back to a sprightly $3,477, because if there’s one thing crypto loves, it’s a good ol’ bounce.

Industry sages (the ones who wear tinfoil hats and have crystal balls) suggest these whale antics are part of a bigger picture, a sort of “we’re serious about this” attitude. In July, ETH soared past $3,900, fueled by institutional investors with pockets so deep they could hide a small country in them, and DeFi platforms that apparently don’t understand the phrase “enough is enough.”

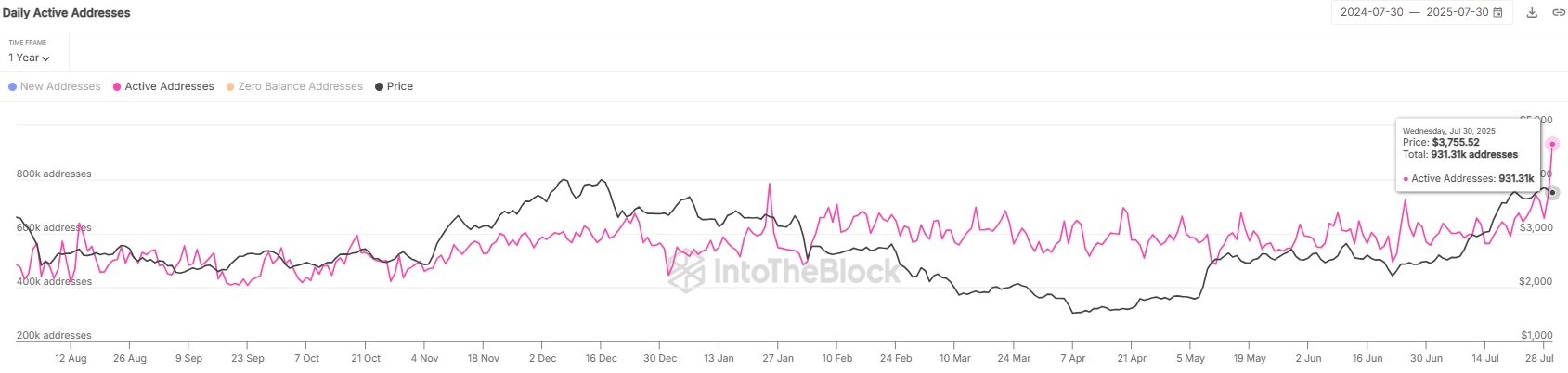

The clever folks say this isn’t just a passing mood but a sign that Ethereum is evolving from a digital pet project to a serious financial powerhouse. And the on-chain activity? Oh, that’s just Ethereum’s equivalent of a blockbuster movie: nearly a million active addresses in one day, its highest in almost two years. Guess people are finally paying attention — or at least hitting refresh repeatedly.

The regulators? Well, they’re basically toying with the idea of giving Ethereum a gold star and a handshake, especially since US officials are apparently willing to lead us all into a blockchain utopia. According to Thomas Lee, a venture capitalist with a penchant for bullish predictions, Ethereum’s market cap might even someday reach a whopping $60,000 — if it keeps acting like the world’s most enthusiastic puppy.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-03 19:27