As a crypto investor who has been closely following the Ethereum ($ETH) market, I’m cautiously optimistic about the recent developments regarding the potential launch of spot Ether exchange-traded funds (ETFs) in the United States. The SEC’s clearance of this path and the subsequent whale accumulation have given me reason to believe that Ethereum’s price could continue to rise, especially if a spot ETH ETF does indeed start trading.

Ethereum‘s ($ETH) price has successfully stayed above $1,800 following the SEC’s approval of spot Ether ETFs last month. Substantial purchases of Ethereum by large investors, or “whales,” have increased noticeably since then.

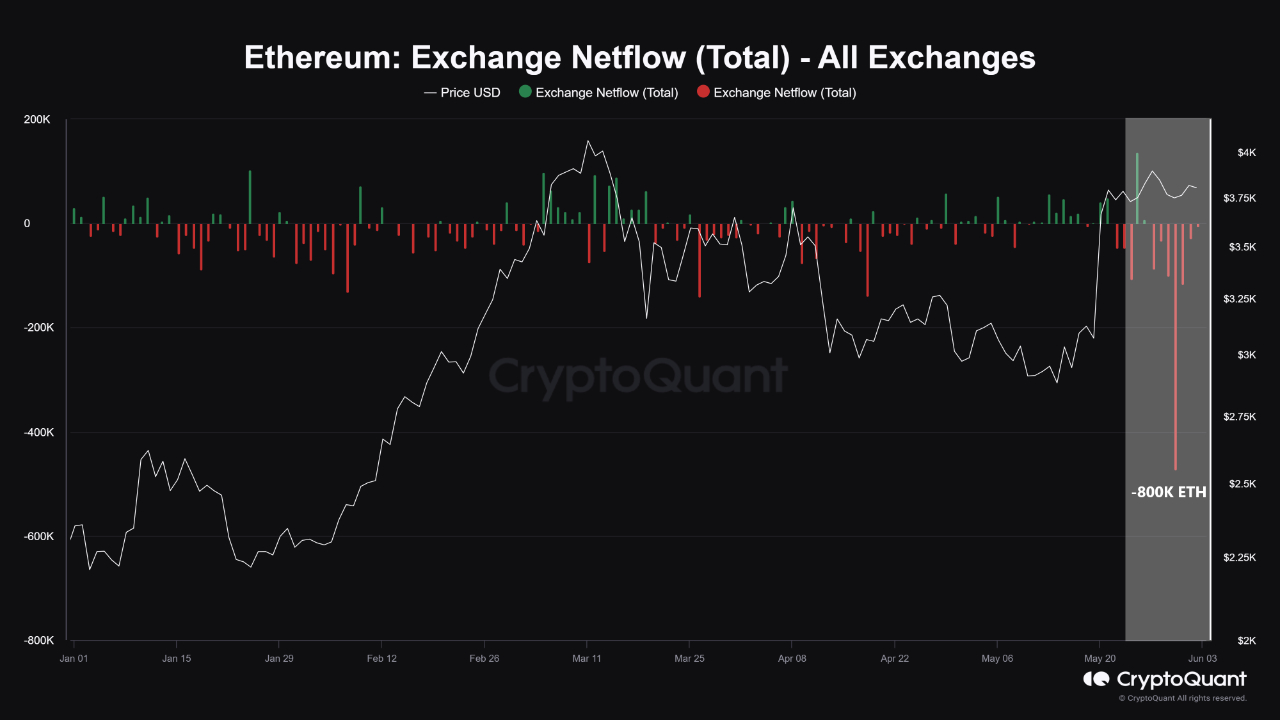

Approximately 800,000 dollars’ worth of Ethereum, equivalent to around 3 billion US dollars, has been transferred out of cryptocurrency exchanges within the past week, as reported by an industry expert from CryptoQuant’s analytics team.

Analysts have pointed out that the recent large-scale withdrawals from centralized Ethereum exchanges in the US could be due to institutions readying themselves to launch an Ethereum ETF, aiming to satisfy anticipated investor interest in this potential financial product.

The data emerges following the debut of the initial leveraged Ethereum exchange-traded fund (ETF) in the US. Specifically, the Volatility Shares 2x Ethereum ETF (ETHU), slated to commence trading on June 4 after obtaining the green light from the US Securities and Exchange Commission.

Significantly, IntoTheBlock, a well-known intelligence firm specializing in cryptocurrencies, has reported an increase in whale activity. Approximately 41% of the second largest digital currency’s supply is now held by wallets containing over 1% of its entire circulating amount, which represents a rise from 36% at the start of the year.

Per the firm, the trend highlights the increasing confidence in ETH among large holders.

According to CryptoGlobe’s latest report, the number of Ethereum investors holding 10 ETH or fewer reached an unprecedented peak last month. In contrast, larger investors, who previously held more than 10 ETH each, appeared to have sold off a significant portion of their holdings over the past few months and were yet to re-enter the market.

As a crypto investor, I understand that before any trading in spot Ether Exchange Traded Funds (ETFs) can commence, the issuers of these funds must first receive approval from the Securities and Exchange Commission (SEC) on their S-1 registration statements. The SEC does not have a set timeline for reviewing these filings, so we, as investors, need to be patient and keep an eye on the regulatory updates.

The Securities and Exchange Commission (SEC) has been conducting a thorough examination of Ether more intensely in recent months, with heightened scrutiny following the Ethereum network’s shift to Proof-of-Stake consensus mechanism.

If Ether is considered a security by the SEC, they may have justification to reject requests for spot Ether ETFs. However, the price increase has resulted in an influx of new small ETH investors and significantly boosted its trading activity.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2024-06-04 01:06