In a world where the digital and the traditional intertwine, Geoffrey Kendrick, the sage of digital assets at the venerable Standard Chartered Bank, has unveiled a truth as subtle as a morning mist over the Thames: Ethereum treasury companies, those guardians of the digital realm, are poised to outshine the mere mortals known as spot ether ETFs.

A Turgenevian Tale of Ethereum Treasury Holdings and Spot ETFs

It was a week of revelations, and among them, Kendrick’s insight stood out like a beacon in the fog. For those who have not yet delved into the intricacies of digital finance, let me elucidate: while the spot ETH funds languish without the allure of staking rewards, the treasury companies bask in the glory of compounded gains. 🎉

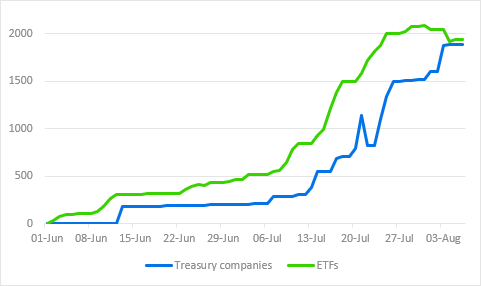

In a meticulously crafted research note, Kendrick and his esteemed colleagues revealed that ether treasury companies, such as the illustrious Sharplink, have been acquiring the cherished cryptocurrency at a rate that doubles that of their ETF counterparts. A subsequent note, as if to underscore the point, noted that since the fateful month of June, both treasury firms and ETFs have each laid claim to roughly 1.6% of all ether in circulation. 🤑

With the pace of acquisition already rapid, the added allure of compounded staking rewards, and the relative ease with which holding companies navigate the treacherous waters of regulation, Kendrick and his team foresee a future where ETH treasury firms not only outpace their fund counterparts but even surpass their bitcoin brethren. 🚀

“We think ETH treasury companies have even more growth potential than BTC ones from a regulatory arbitrage perspective,” Kendrick and his team muse. “We think they may eventually end up owning 10% of all ETH, a 10x increase from current holdings.”

The team’s optimism extends to the broader market, predicting that the steady flow of investments could propel ether past the coveted $4,000 mark. After a somewhat lackluster performance in the first quarter of 2025, ether, which once soared to an all-time high of $4,891.70 in November 2021, was trading at $3,816.40 at the time of this writing, a respectable 3.81% gain over the past 24 hours, according to Coinmarketcap. 📈

“If the flows can continue, ETH may be able to break above the key USD 4,000 level (our current end-2025 forecast),” Kendrick and his team conclude, their words as hopeful as a poet’s verse on a spring morning.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-08 09:52