As a seasoned analyst with over two decades of experience navigating volatile markets, I have learned to read between the lines and find hidden signals that often go unnoticed by the average investor. The recent 15% decline in Ethereum (ETH) might look like a cause for concern at first glance, but a deeper dive into on-chain data reveals a different story.

In the last week, Ethereum (ETH) has dropped by approximately 15%. Yet, recent on-chain data indicates that this drop in price is simply reflecting the wider sell-off within the crypto market. The overall positive sentiment towards Ethereum continues to be quite strong.

According to this examination, there are two significant blockchain indicators suggesting that we might see a surge in value, potentially reaching the $4,000 price region soon.

Ethereum Sees Bullish Momentum Despite Price Fall

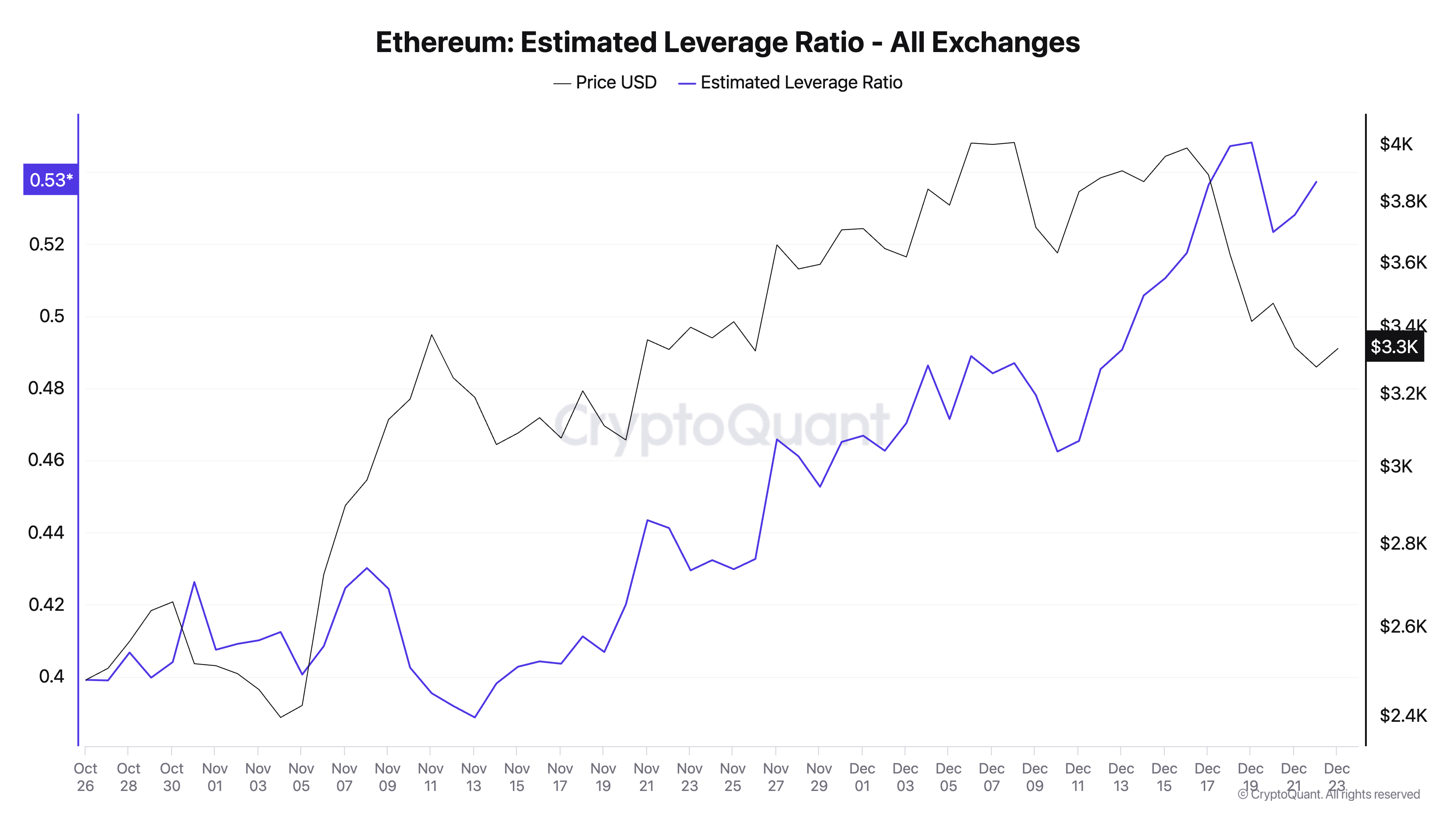

Initially, the increasing Estimated Leverage Ratio (ELR) on Ethereum suggests that investors are still keen on taking risks, which could potentially lead to a rise in its price. As reported by CryptoQuant, the ELR currently stands at 0.53.

The Excessive Leverage Ratio (ELR) of an asset indicates the typical degree of leverage employed by its traders when making transactions on a cryptocurrency trading platform. This value is determined by dividing the total outstanding contracts, referred to as open interest, by the exchange’s reserves specifically designated for that particular digital currency.

The rising trend of ETH’s Exchange Leveraged Ratio (ELR) suggests that traders are becoming more daring in their investment decisions. This could mean that a significant number of investors are hopeful about the coin’s future price increase and are prepared to boost their investments to maximize potential profits.

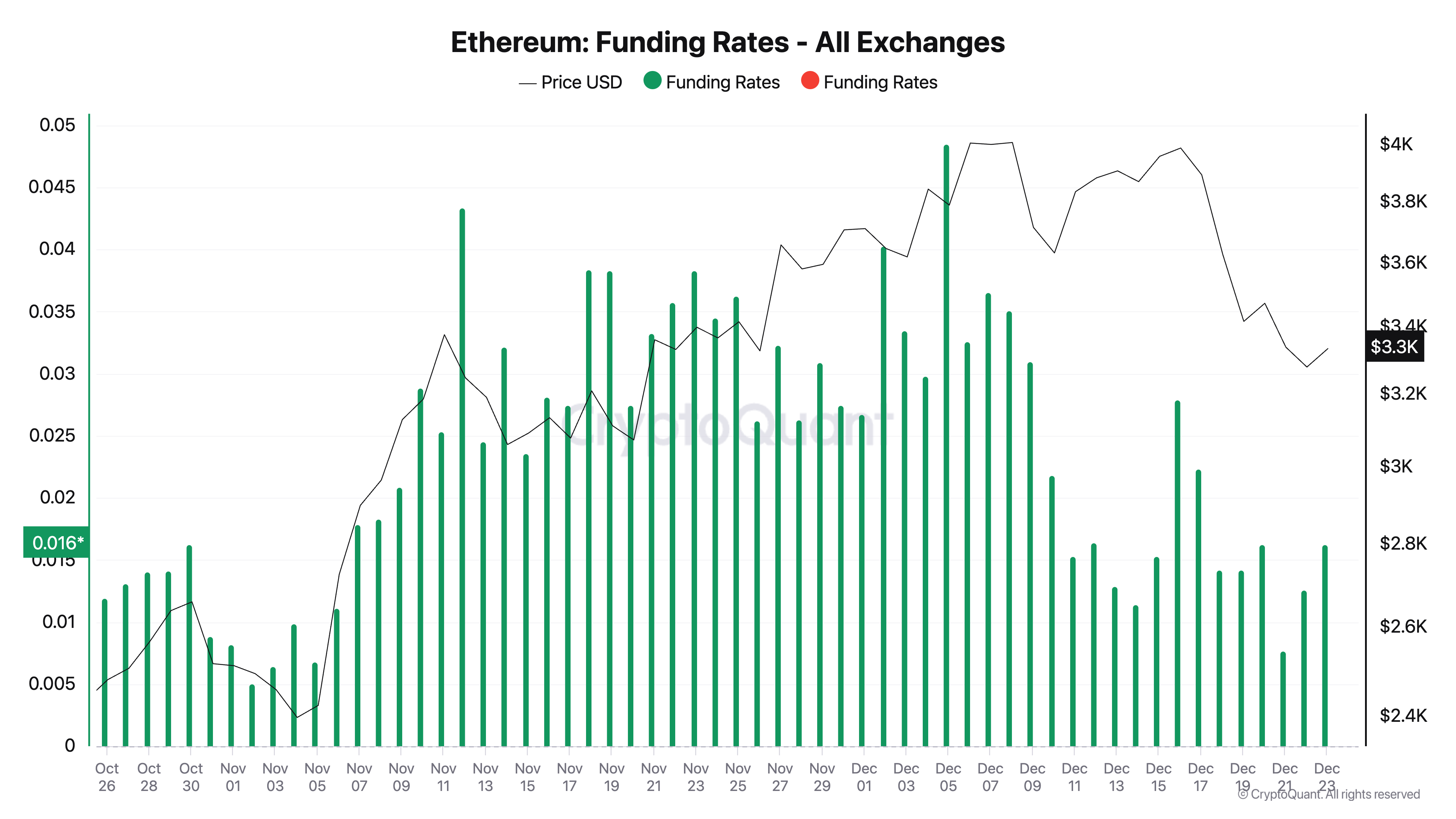

Additionally, the current positive funding rate for Ethereum on exchanges suggests that its price could potentially bounce back soon. According to CryptoQuant, this rate is currently at 0.016, indicating a bullish outlook towards Ethereum despite recent price drops. The overall sentiment across cryptocurrency platforms remains positive.

An asset’s funding rate is a periodic fee exchanged between long and short traders in its futures market. It ensures the perpetual futures price aligns with the spot price. When it is positive, long traders are paying shorts, indicating bullish sentiment and expectations of price increases.

ETH Price Prediction: Will $4,000 Be the Next Stop?

As a crypto investor, I’m seeing ETH trading at around $3,344 right now. If the bullish trend continues and buying activity increases, ETH’s price might break through the resistance at $3,439. A successful breach at this level could propel the coin towards $3,733, potentially allowing it to surpass the psychological barrier of $4,000.

Should the current downward trend continue, there’s a possibility that Ethereum’s value might decline to approximately $3,232, which would contradict the current bullish prediction.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2024-12-23 21:01