In the grand theater of finance, Ethereum has taken center stage. Unfortunately, it’s a tragedy, not a comedy. Over the past 20 days, it’s lost 10% of its value quicker than Rincewind fleeing trouble, currently sitting at $2,021—though you’d swear it’s trying hard to hit rock bottom for artistic reasons.

The prolonged price dip has turned investor confidence into something resembling an Ankh-Morpork street salad—unpleasantly limp. Spot ETH exchange-traded funds (ETFs), ever the dramatic courtiers in this tale, have been bleeding capital like they’ve enrolled in a very aggressive blood donation campaign since March began.

Investor Confidence in ETH: About As Steady As A Drunken Brawl

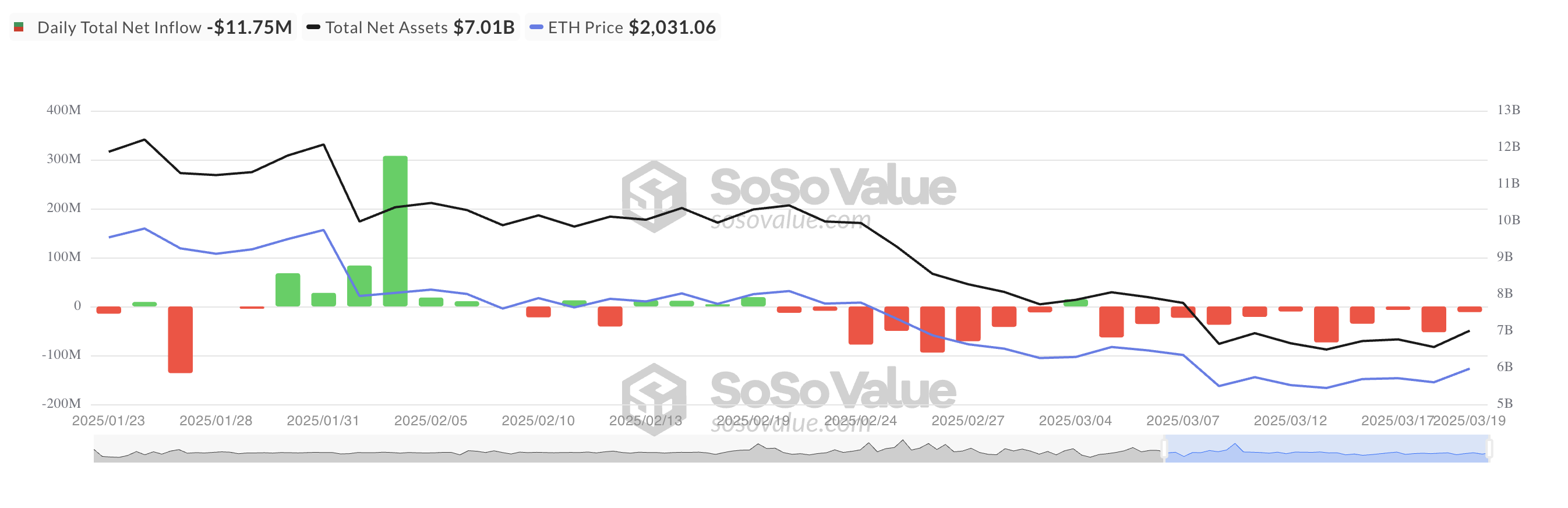

According to on-chain data from SosoValue (a name which really inspires trust, doesn’t it?), spot ETH ETFs have managed to do something truly impressive: record 11 consecutive days of outflows. That’s right, folks, over $370 million has been collectively yeeted by investors towards safer pastures—or possibly into a bottomless pit they find slightly more predictable.

With bearish sentiment driving this exodus, there’s been only one day of inflows during the entire month. The total net asset value of all US spot ETFs now stands at $7.01 billion, a figure which seems about as sturdy as a house of cards at a critical Dwarfish tap-dancing event. Year-to-date, this reflects a cheerful 44% nosedive.

Spot ETH ETF outflows occur when investors withdraw funds faster than a wizard can lose his hat, signalling a crisis in faith as big as Vetinari’s trust issues with committees. Unwavering pessimism coupled with impatient selling pressure hasn’t helped ETH sidestep its pricing woes, either.

//beincrypto.com/wp-content/uploads/2025/03/Ethereum-ETH-10.01.43-20-Mar-2025.png”/>

This drop in open interest is basically the market saying, “No thanks, we’ll just close the positions and hop off this wagon for now.” Traders are clearly uncertain, hesitant, and probably wondering whether using their ETH holdings as bookmarks might at least bring some utility to the table.

With diminishing market participation, ETH’s waning momentum feels less like a challenge of resilience and more like a metaphor for awkward floundering. Investors appear perpetually squinting at the horizon and whispering, “Direction, anyone? Please?”

ETH: A Glimmer Of Recovery Or Dramatic Curtain Call?

But wait! In typical soap opera style, Ethereum has found a plot twist. Last week’s broader market recovery stomped onto the stage with flashing lights and dramatic music, dragging ETH into its grasp. The MACD (Moving Average Convergence Divergence) indicator says “golden cross,” and traders say, “Maybe it’s time to poke the thing with a stick again.” For anyone unfamiliar, a golden cross suggests the sort of bullish pressure that could outshine even Lord Vetinari’s sense of power.

That little blue MACD line sitting above the orange signal line on the chart? It’s basically ETH whispering, “I might not be so bad after all, okay?” If momentum picks up steam, maybe—just maybe—ETH could climb to $2,224 like a climber who remembered they packed rope after all.

On the other hand, if ETH decides to double down on its current performance (or lack thereof), we could see it hitting $1,924 faster than you can tell Nanny Ogg to stop singing “The Hedgehog Song.” Will it rise, or will it fall? Only time and the whims of market forces—and perhaps a puckish deity or two—can provide an answer.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-03-20 17:09